Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

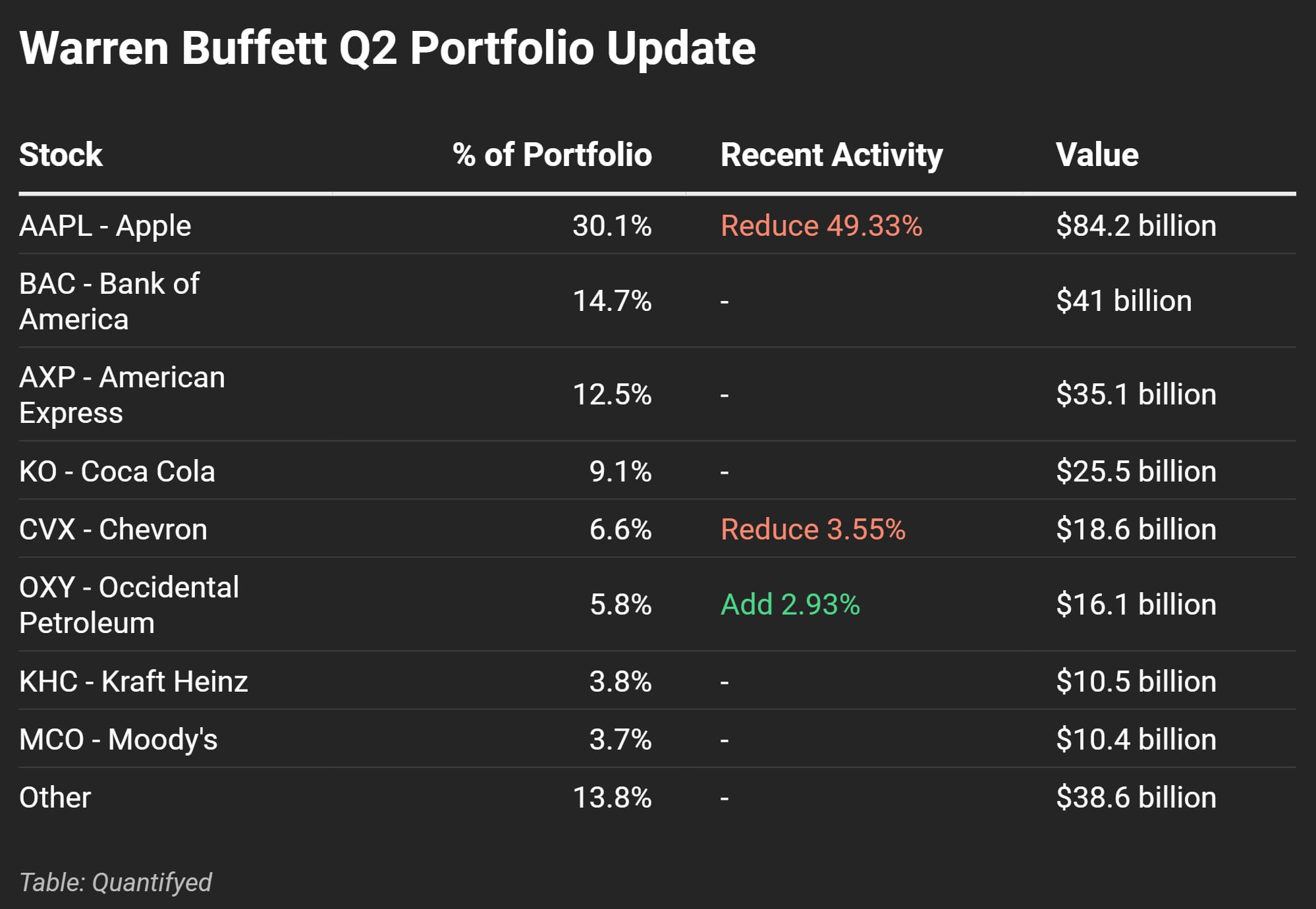

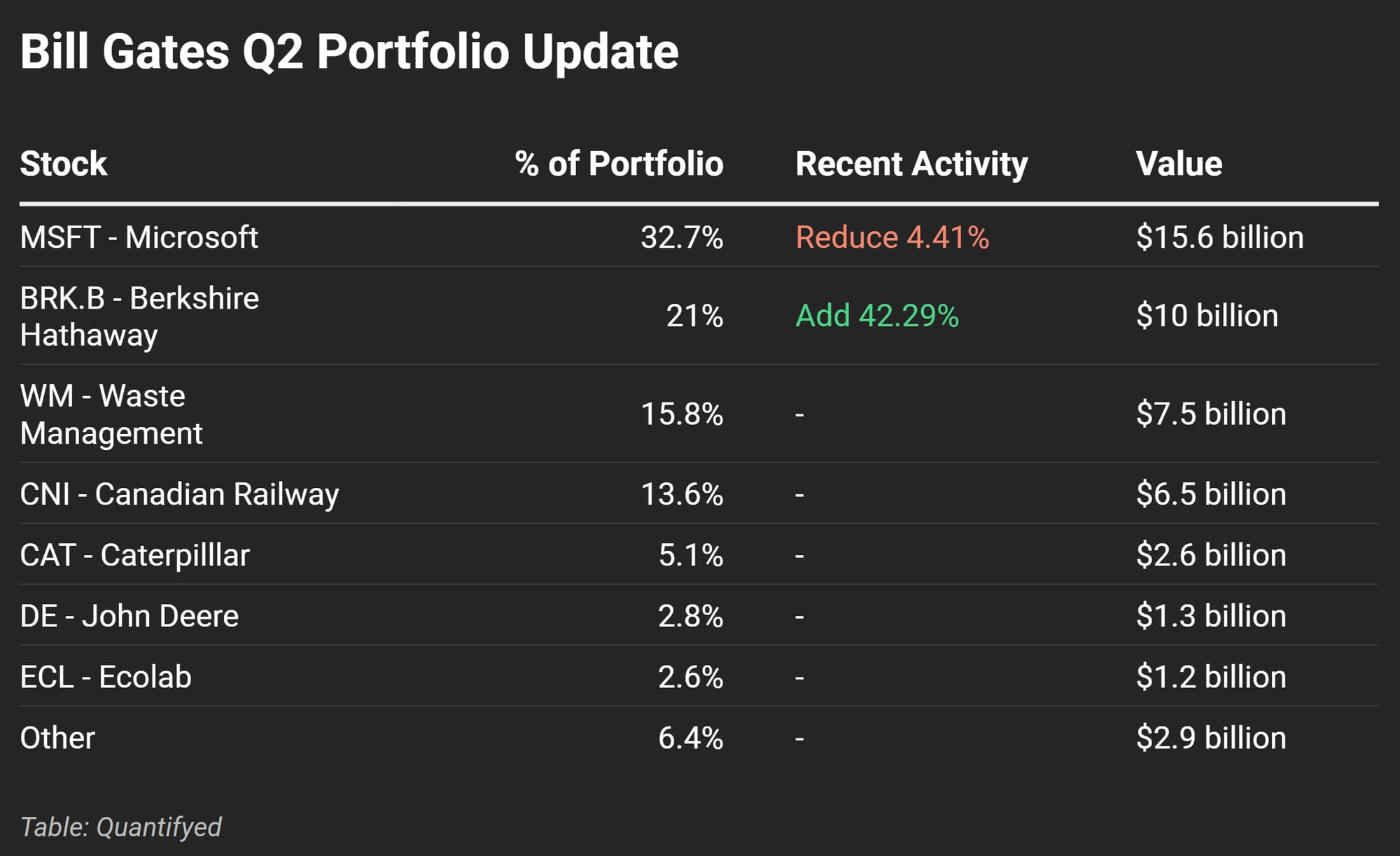

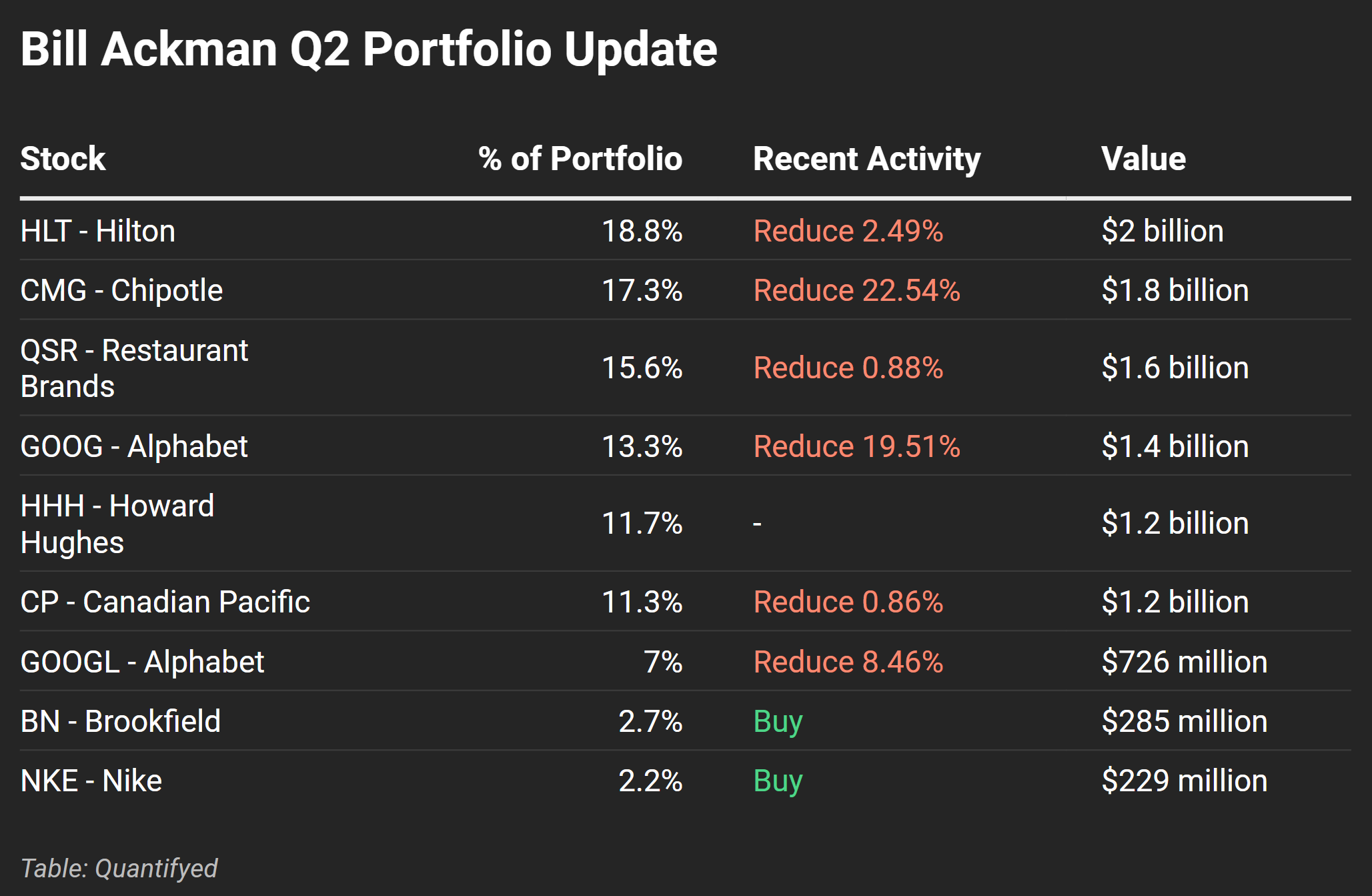

When it comes to investing, tracking what the big names are doing can give us some solid insights. Recently, Warren Buffett, Bill Gates, and Bill Ackman made some huge moves in their portfolios. Let’s break down what each of these super investors have been up to and what it might mean.

Warren Buffett made some big changes this time. He cut down his Apple ($AAPL) stake by 49.33%, which is surprising since it was a huge part of his portfolio. But he added 2.93% more to Occidental Petroleum ($OXY), showing he's still confident in the energy sector. It looks like he's being cautious with tech and putting more faith in energy.

Bill Gates also trimmed his Microsoft ($MSFT) holding by 4.41%, though it’s still his biggest investment. The big move? He nearly doubled his stake (42.29% more) in Berkshire Hathaway. It seems like Gates is leaning into Buffett’s company for stability and long-term gains, especially with today's market frenzy.

Last (but not least) the one and only Bill Ackman. He's gained popularity on Twitter for his comments on the Gaza war and the upcoming US election.

Meanwhile, Ackman's been busy selling off his top holdings. He cut Chipotle ($CMG) by 22.54% and Alphabet (GOOGL) by 19.51%. His moves could be about locking in profits or shifting gears, since both stocks have had an incredible year in the stock market, so far.

On the flip side, he bought into Nike, which could show he’s betting on future consumer spending growth. Ackman’s strategy seems to be a mix of cashing out on wins and chasing new opportunities—different than Bill Gates and Warren Buffett's strategies.

What investor piqued your interest? Our stock market is reaching new all time highs and insiders are moving investments like no tomorrow.