Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

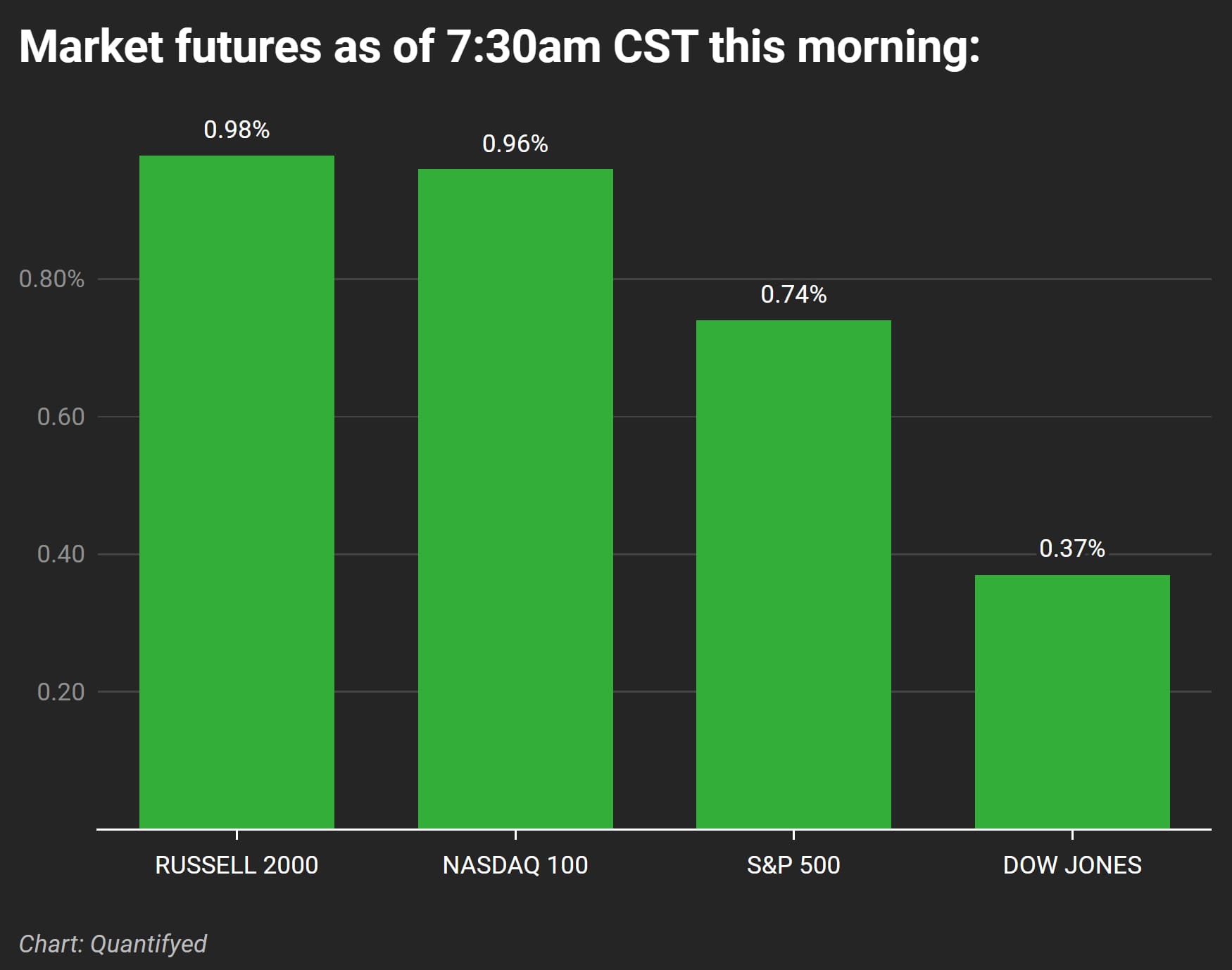

Tech stocks are lifting markets today. Nasdaq futures are up 0.96%, driven by excitement over Microsoft’s massive $80 billion AI spending plan.

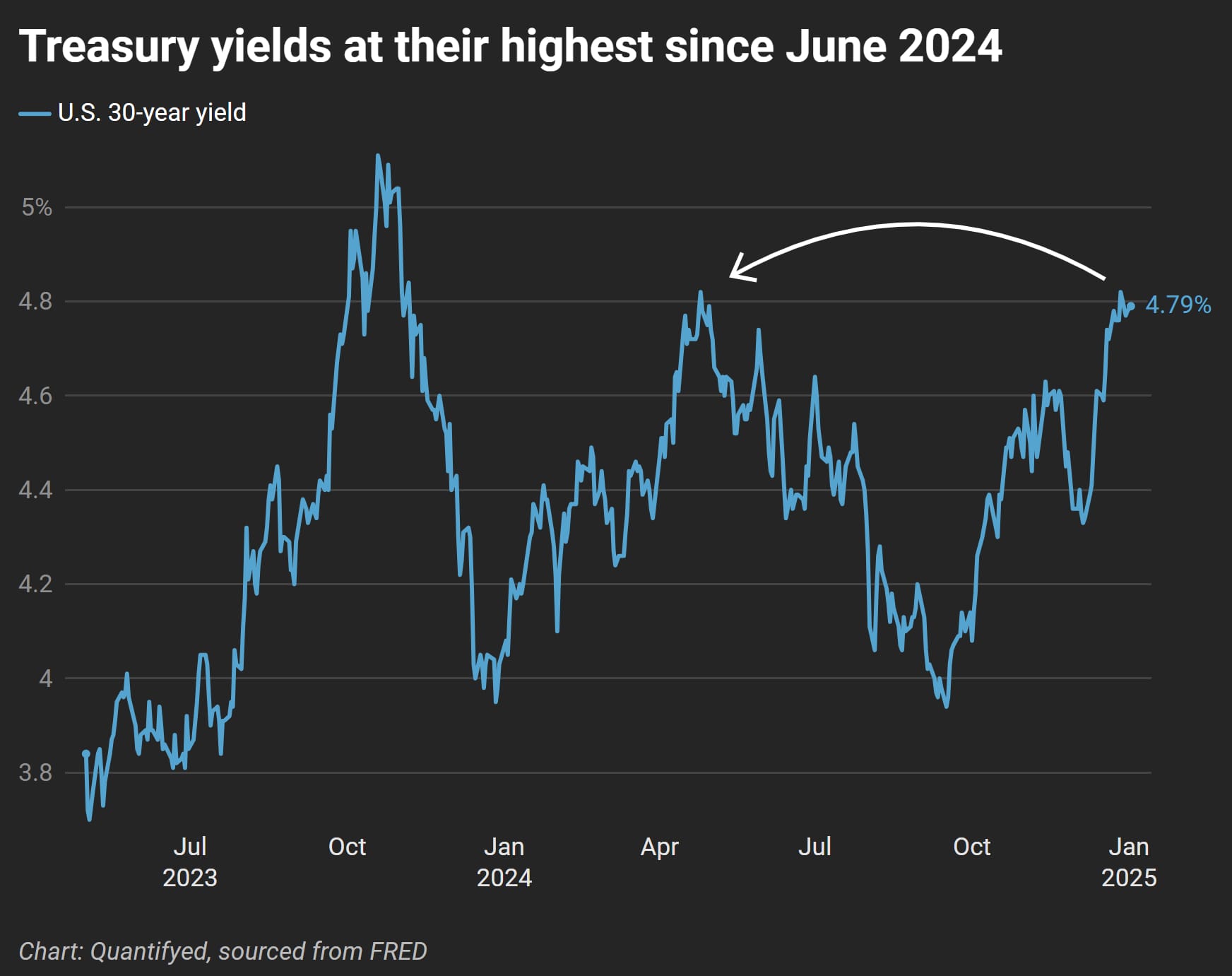

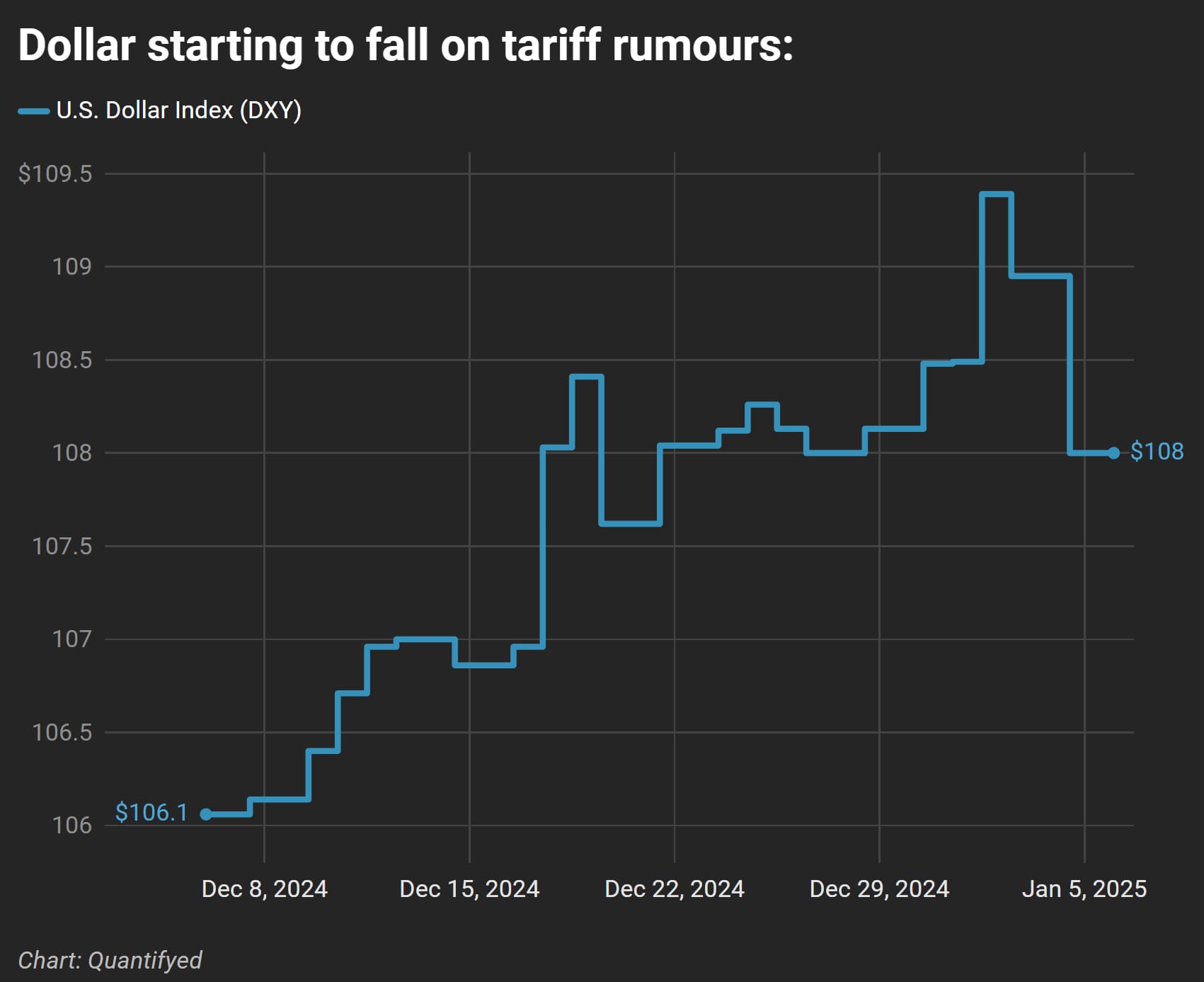

Treasury yields are climbing, hitting levels we haven’t seen since 2023, and the dollar is slipping for the second day in a row.

Let’s break it down.

Tech Stocks Boost Markets

Tech is back in the spotlight. Microsoft’s announcement of $80 billion in AI investments for 2025 is boosting the sector. Nvidia and AMD are also up more than 2% in premarket trading, helping push Nasdaq futures to a 0.96% gain. S&P 500 futures are following with a 0.74% rise, after last week’s losing streak.

Treasury Yields Hit New Highs

Treasury yields are climbing again!

The 30-year yield reached 4.79%, its highest level since June 2024, likely a sign we're expecting future inflation.

Higher yields could put pressure on sectors like housing and utilities that are sensitive to rate changes.

The Dollar Slips

The dollar is also down 0.8% after news that Trump’s administration may soften its stance on tariffs.

This marks its 2nd-straight day of losses:

What Else Is Happening?

Here’s what else is happening this morning:

Economic data: Factory orders and PMI reports are due later today, with more updates on jobs coming later this week.

Commodities: Gold is down after Goldman Sachs pushed its $3,000/oz target to 2026, and Brent crude slipped slightly as supply worries eased.

Key Market Data:

- Stocks:

- Russell 2000: +0.98%

- Nasdaq 100: +0.96%

- S&P 500: +0.74%

- Dow Jones: +0.37%

- Bonds:

- 30-year Treasury yield: 4.79%

- 10-year Treasury yield: 4.62%