Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

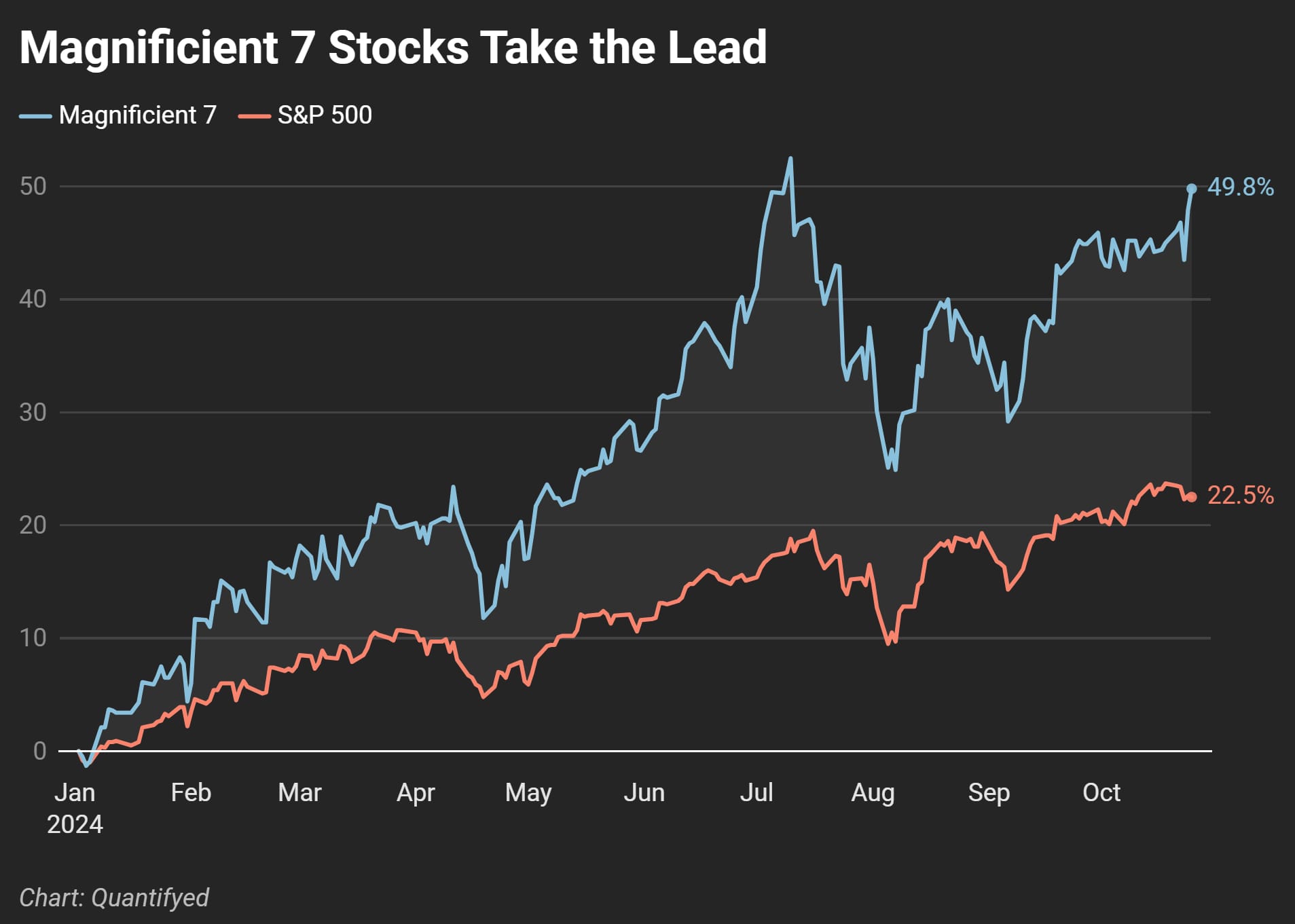

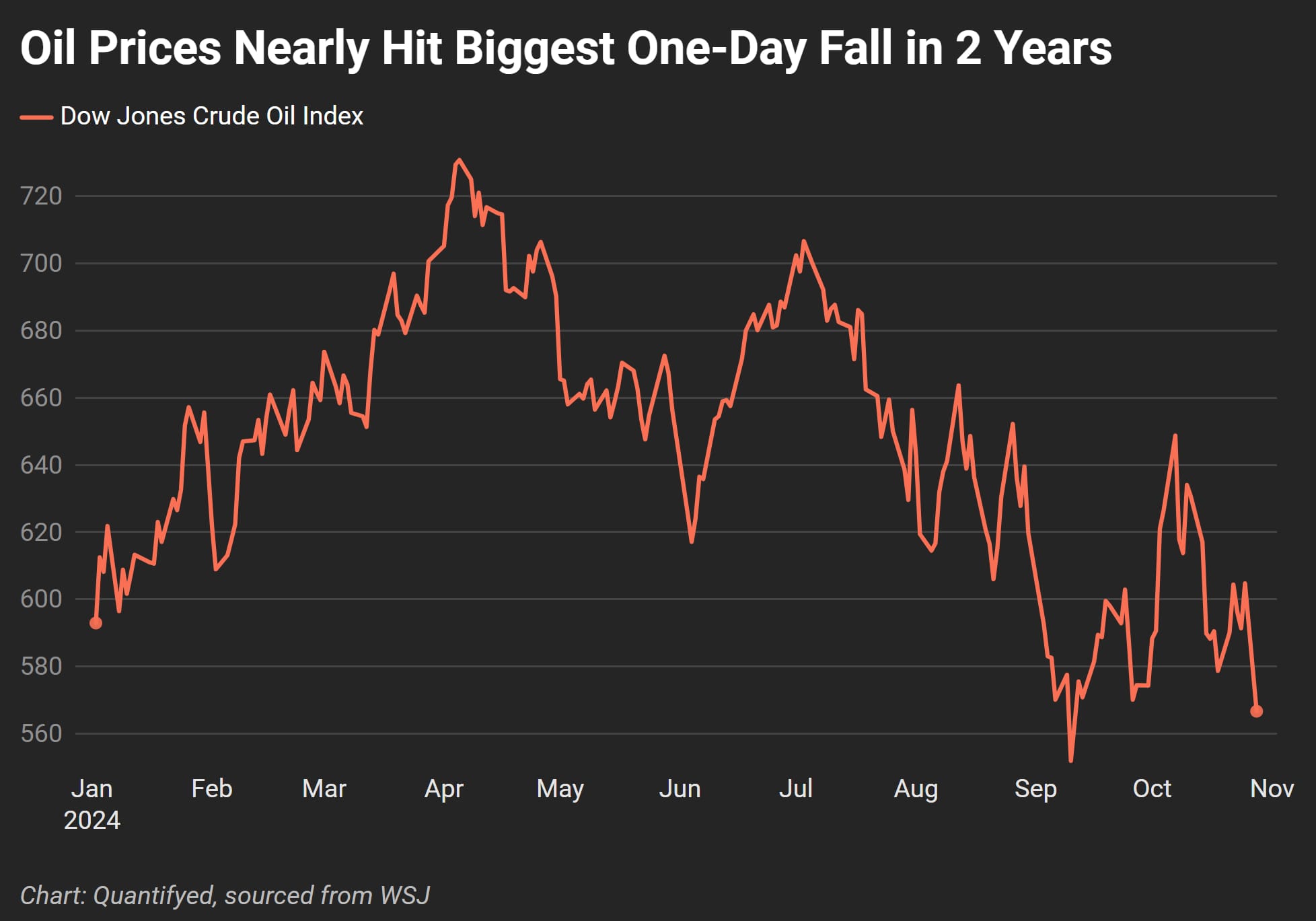

Big Tech stocks are climbing to new highs, while oil prices are taking a hit. With tech giants driving the Nasdaq’s recovery and oil prices dropping due to recent geopolitical events, investors have plenty to watch as earnings season continues. Here’s a look at what’s happening and why it matters.

Tech Stocks Surge

The Magnificient 7 (Nvidia, Apple, Meta, Amazon, Microsoft, Alphabet, and Tesla) gained momentum, with tech stocks up 49.8% this year. These companies have been outpacing the broader S&P 500, which is up only 22.5%.

The Mag7 have repeatedly stayed ahead of the S&P 500. While the rest of the market grows at a slower rate, these tech companies are driving the market's recovery. With earnings reports coming up, analysts expect higher-than-average growth from Big Tech, which could add further momentum to the index if results meet expectations.

Oil Takes a Hit

In contrast to tech’s climb, oil prices have been sliding. Israel’s recent strikes on Iran avoided direct impacts on oil infrastructure, but the geopolitical tension still led to a 5.7% drop in oil prices. This is almost one of the biggest one-day falls in oil in nearly two years, with prices dipping to around $580 on the Dow Jones Crude Oil Index.

Lower oil prices are expected to benefit sectors like airlines and transportation, which rely on cheaper fuel, while energy stocks may face additional pressure. For investors, just know that oil prices can change quickly from geopolitical tensions.

Tech stocks rising and falling oil prices aren't the only thing investors are watching! Let's not forget about next week's US election. Also, the Federal Reserve's policies could further influence market sentiment.

If big tech reports strong earnings, it'll provide a lift to the market overall. However, oil’s recent volatility reminds us of continued global uncertainty that could impact markets.

A few Key Takeaways:

- Mag7 tech stocks are driving the market's recovery, outpacing the rest of the market with a 49.8% gain this year.

- Oil prices dropped this morning by 5.7% due to geopolitical events, benefiting some sectors while putting pressure on energy stocks.

- Investors are focusing on tech’s earnings this week, but are cautious about global & economic risks that could affect markets.