Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Two tech giants, two different stories: Tesla struggles with declining sales while Google gets surging cloud revenue. If you think your week was rough, imagine missing Wall Street estimates like Tesla did.

Tesla's Earnings Report

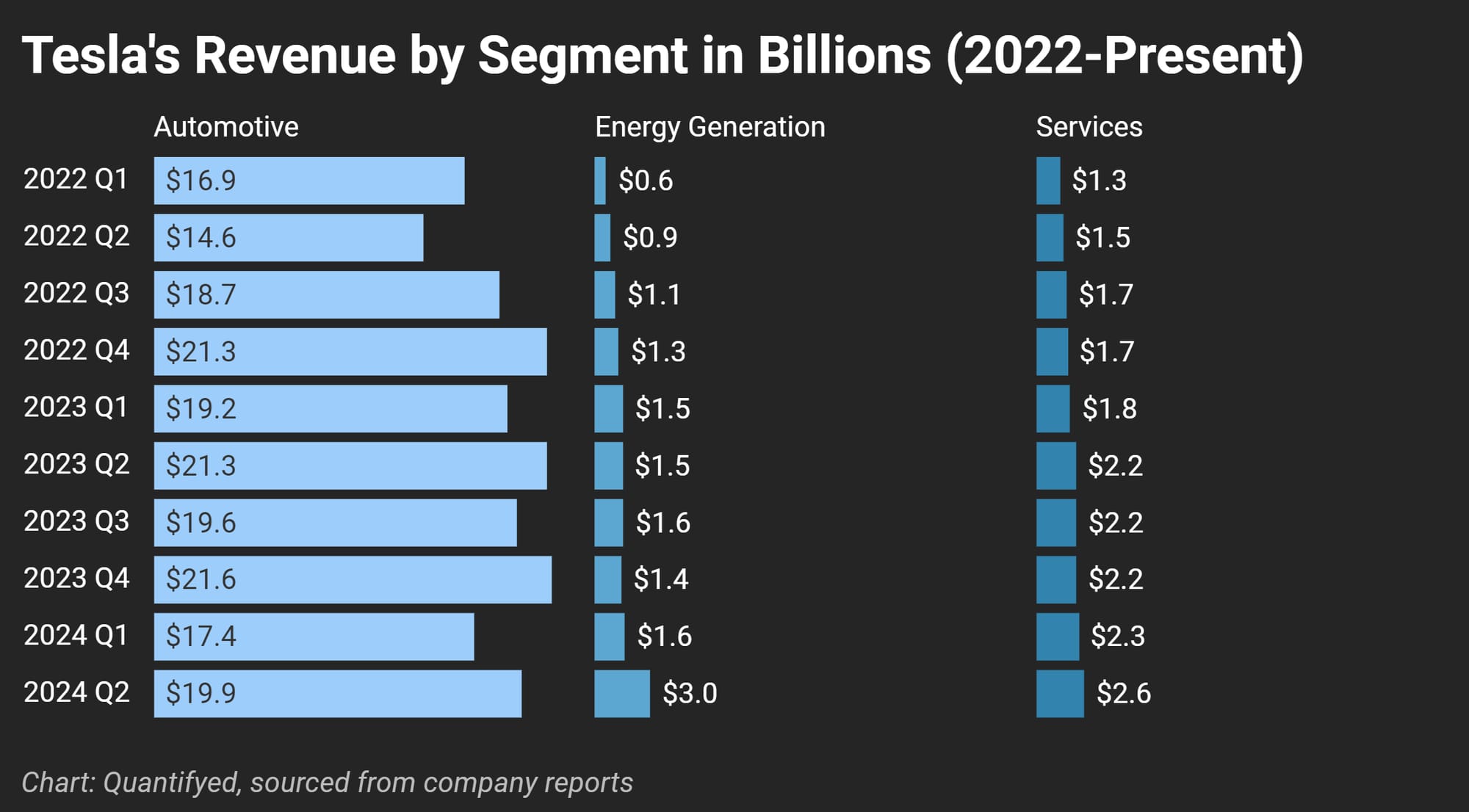

Tesla reported a 7% drop in auto revenue, decreasing to $19.9 billion from $21.27 billion the previous year. Earnings per share fell short of estimates, coming in at 52 cents versus the 62 cents expected (16% miss). However, total revenue was slightly up at $25.5 billion compared to the expected $24.77 billion, thanks in part to regulatory credits.

Below is a chart of Tesla’s revenue by segment since 2022. You can see Tesla's main source of revenue, their auto sales, has slowed in recent quarters 👇

Impact of Regulatory Credits: Regulatory credits was Tesla's life support during this quarter, contributing $890 million worth of auto revenue— more than triple the figure from the same time last year. Without these credits, Tesla's growth could have painted a far bleaker trend.

Robotaxi Hype: One of the focal points for Tesla's future has been their development of robotaxis. During the earnings call, Elon Musk announced a robotaxi event scheduled for October 10th, which was originally planned for August 8th (they must not be prepared?)

Google's Earnings Report

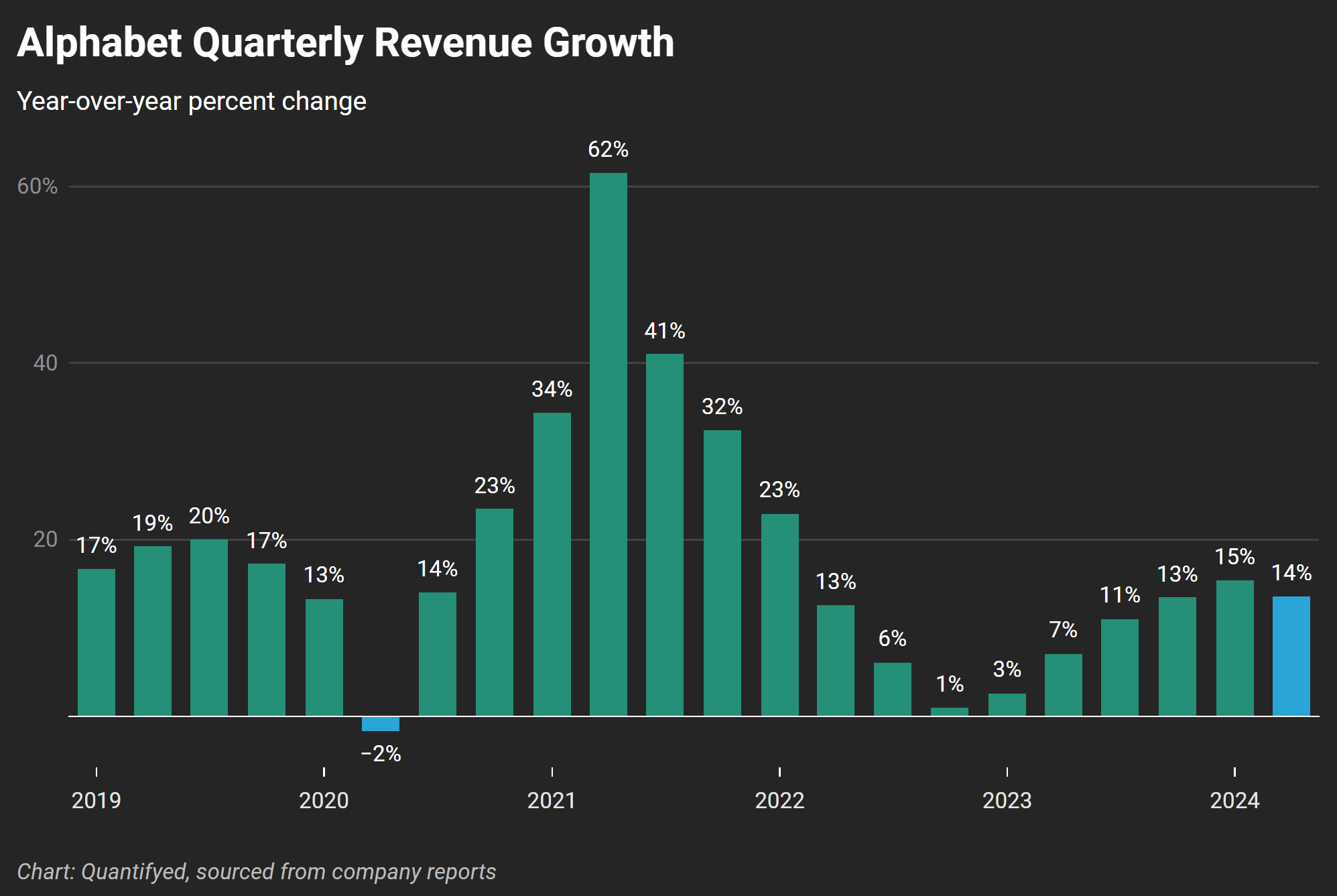

Now, onto Google (aka Alphabet). They gave us an incredible earnings report, driven by search and cloud services.

Google's revenue was up 14% year over year, driven by significant gains in digital advertising sales and cloud computing services. Cloud revenue, in particular, broke $10 billion in quarterly revenues with $1 billion in operating profits for the first time.

Advertising and Cloud: Alphabet reported ad revenue of $64.62 billion, up from $58.14 billion last year, demonstrating that Google's advertising business continues to thrive despite inflation and interest rates dampening marketing budgets.

Earnings per share were slightly above expectations at $1.89 versus the $1.84 expected, and total revenue stood at $84.74 billion against the expected $84.19 billion.

YouTube and Waymo: YouTube ad revenue came in at $8.66 billion, slightly below the estimated $8.93 billion, likely due to increased competition from heavyweights like TikTok.

Meanwhile, Waymo, Alphabet’s robotaxi competitor to Tesla, brought in $365 million in revenue, up from $285 million a year ago. Alphabet also announced a new $5 billion investment in Waymo, solidifying our odds at seeing more robotaxis in the future.

Tesla's earnings report gives us an insight about the challenges their company is facing, with slowing auto sales and an uncertain future with robotaxis. In contrast, Google's impressive revenue growth, driven by advertising and cloud services, underscores its strong market position and strategic investments.

How do you think Tesla’s robotaxi venture will fare against Google’s Waymo?