Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

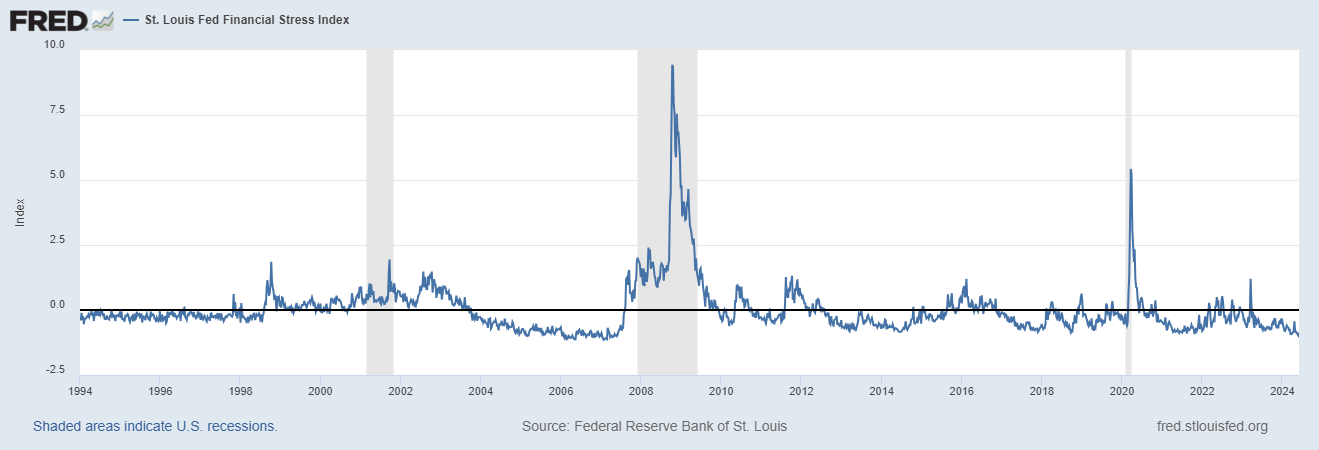

The U.S. yield curve inversion, lasting since October 2022, is the longest on record. Historically, such inversions signal recessions by through credit contractions. We'll cover conflicting data on whether or not we'll have a recession.

The greatest fear an investor can have is losing all their gains on an investment from a recession... But hold your horses!

Despite our ongoing inversion (and the longest on record too.. 😳), some current economic data doesn't point to an imminent recession. Historically, yield curve inversions have been accurate predictors, but this time, several factors are mitigating the risk:

A Weird Pattern in US Bank Interest Income

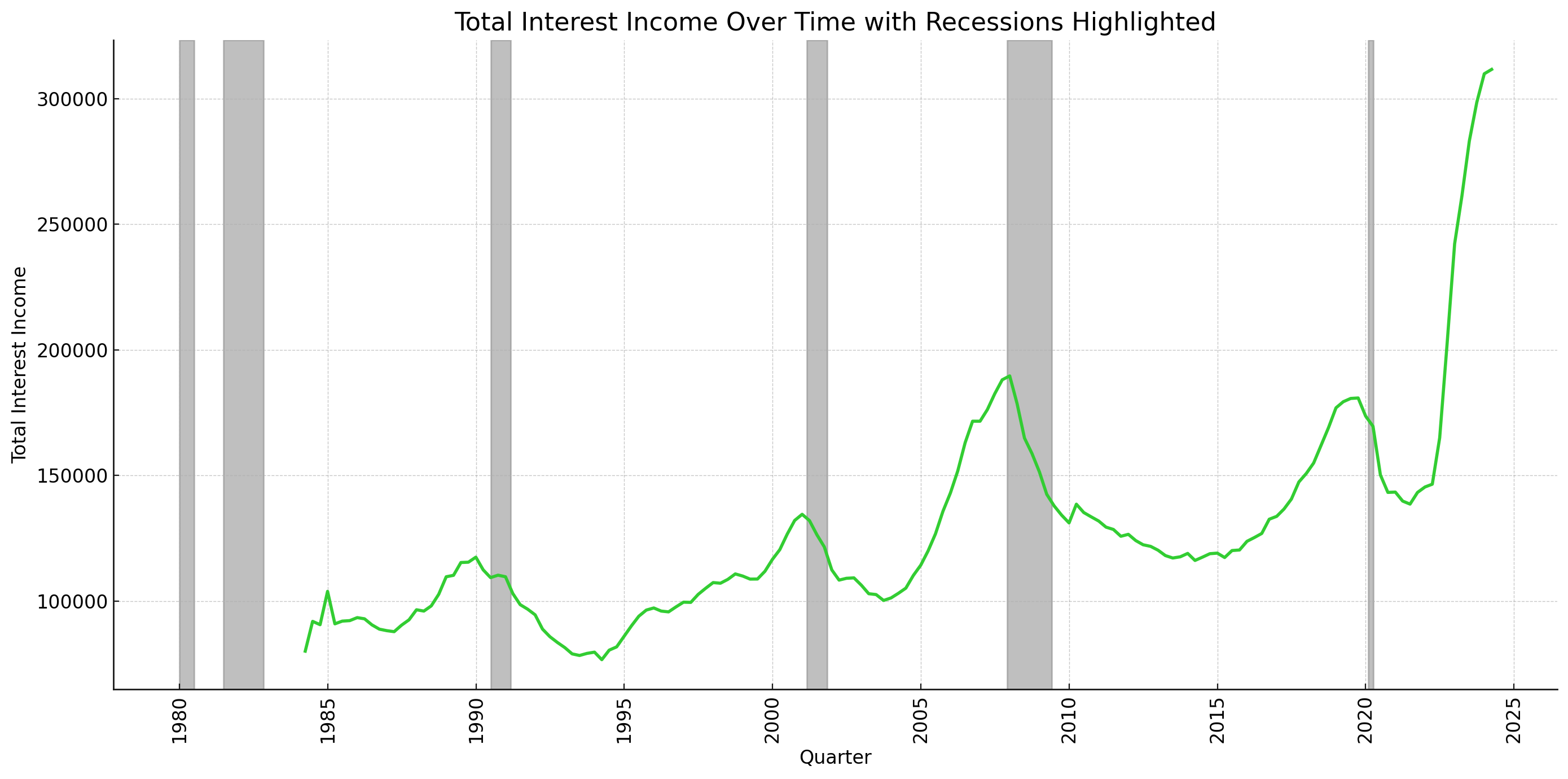

Also interesting and important to mention, if we look at the historical data, you can see that preceding most recessions, bank interest income inflated super quickly, and then we entered a recession. See below 👇

Pretty crazy right!? The spikes in total interest income often tie with the onset of recessions. While this observation might seem contradictory to the earlier points, it's important to know that each recession is different. While historical patterns are insightful, they are not predictive.

Impact of Anticipation and Misperceptions

The widespread discussion of the inversion has heightened recession expectations, leading businesses to cut excess preemptively. This proactive approach has reduced the severity of potential economic downturns.

Our yield curve inversion is an important signal, but some of our data suggests that its effects could be less severe. The combination of continued bank lending, resilient corporate earnings, and low inflationary pressure provides a counterbalance to our traditional expectations.

Regardless– staying informed is crucial. You should continue to monitor these indicators and adjust their strategies accordingly, or subscribe to our newsletter and have us do it for you!