Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

Nvidia’s earnings have sparked an AI frenzy, driving record investments. But with soaring valuations, is this boom sustainable or a bubble set to burst?

Remember when we all thought AI was going to change the world last summer? Well, the generative AI wave has only gotten crazier.

Nvidia’s older Q2 earnings guide not only hit the mark but smashed right through it, sending the market into a frenzy over GPUs.

Before Nvidia’s bombshell, AI was already making waves with consumer launches like ChatGPT and image creation platforms like Midjourney.

These brought AI into everyday conversations. Nvidia’s results gave businesses hard proof that AI is a real money-making tool, capable of generating billions in revenue.

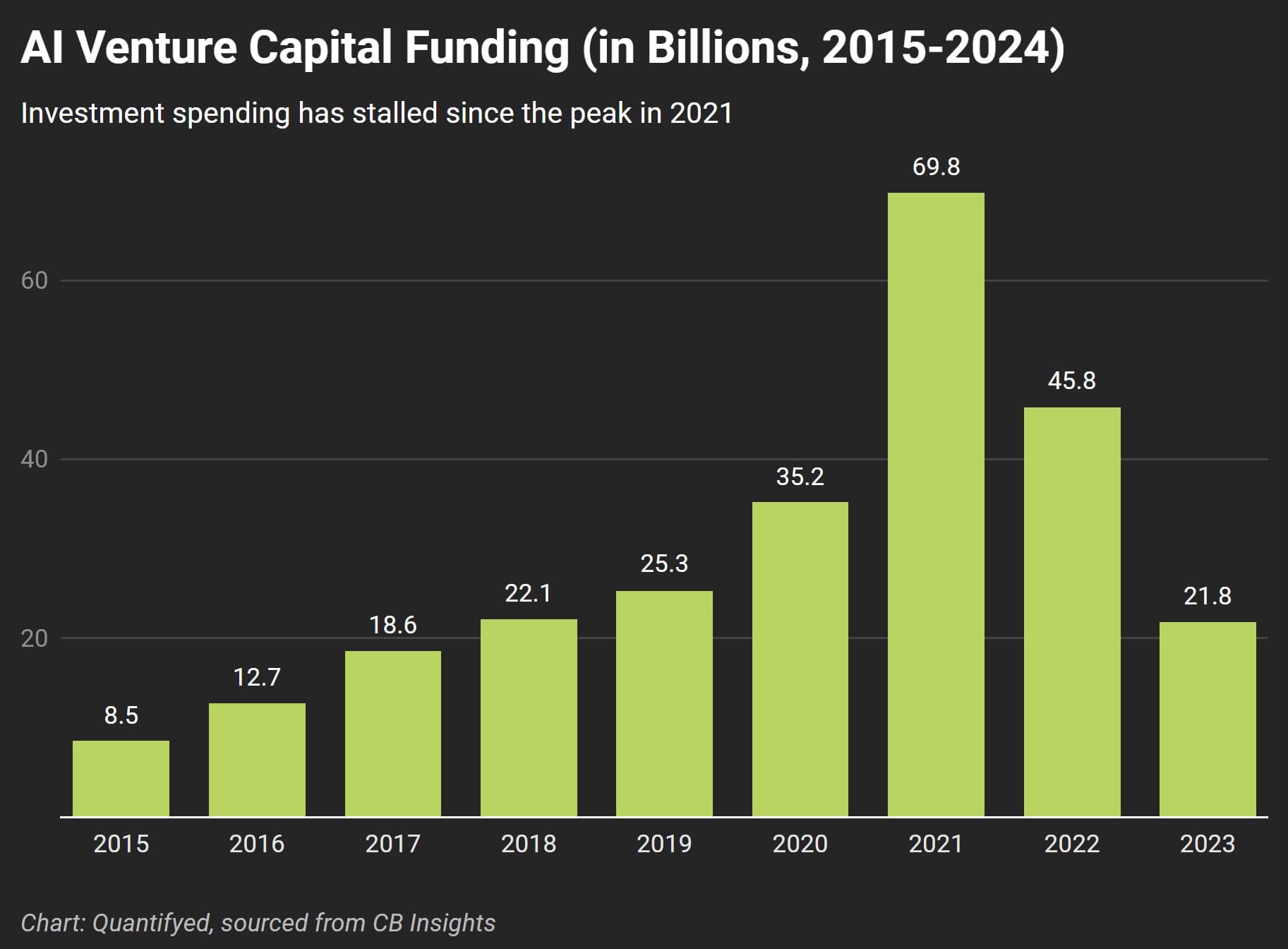

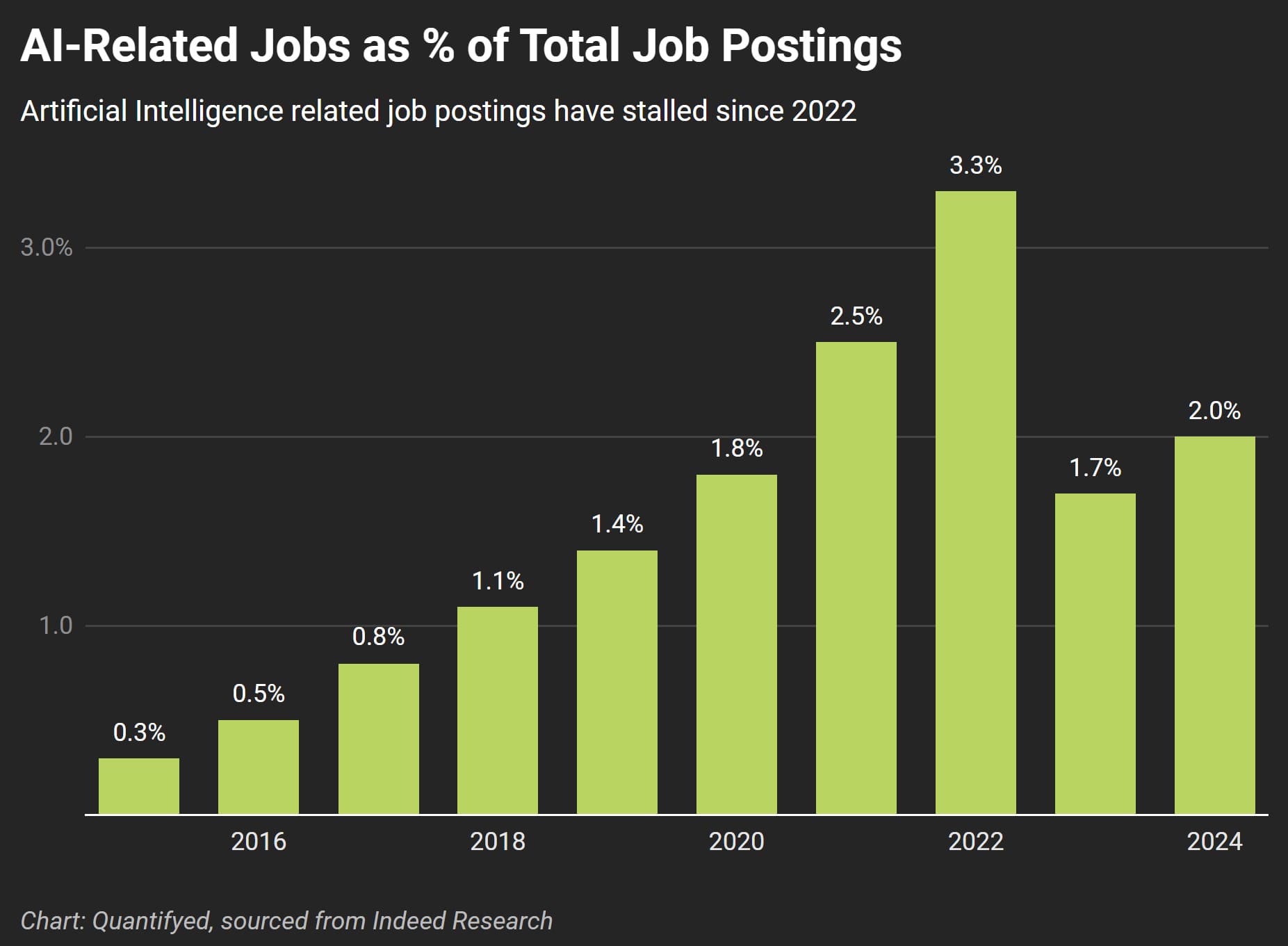

Now, investors are piling into AI like it's the next gold rush, driving record valuations. But there's a question we aren’t asking: What exactly are all these GPUs being used for? And more importantly, who is the customer’s customer?

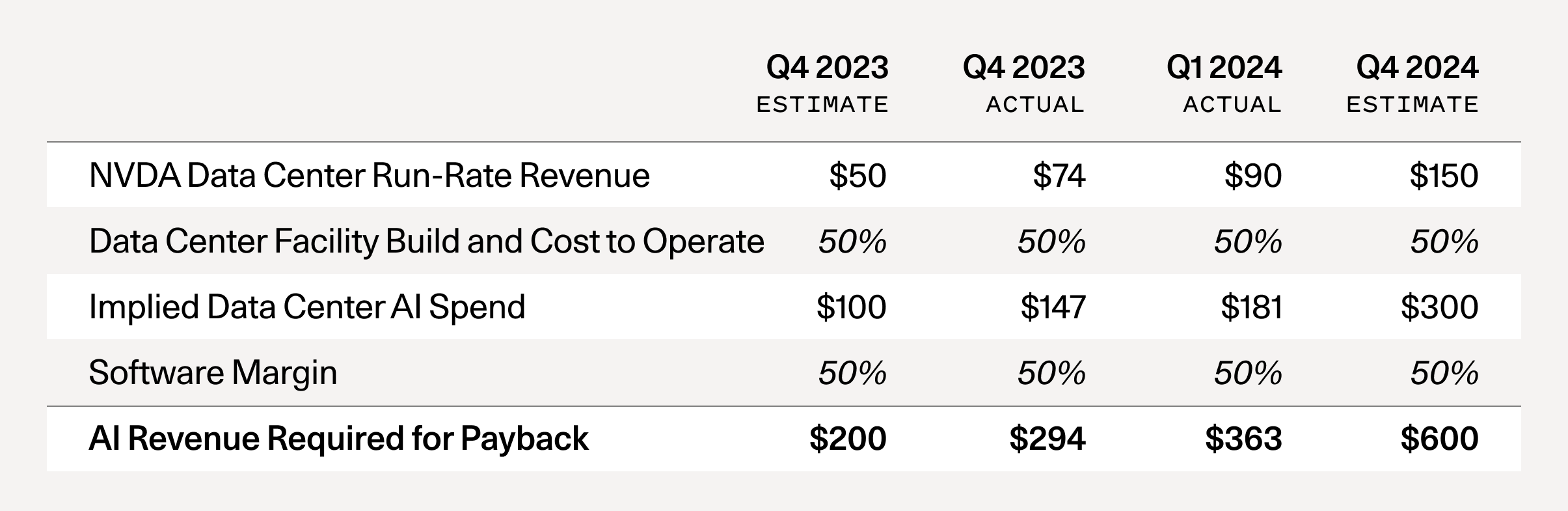

The burning question here is: How much value needs to be generated for this rapid investment to pay off?

To put it simply, take Nvidia’s run-rate revenue forecast and multiply it by 2x to reflect the total cost of AI data centers (GPUs are only half the total cost, the other half includes energy, buildings, etc.). Then, double it again to reflect a 50% gross margin for the end-user of the GPU (like startups or businesses using Azure or AWS).

What’s Changed Recently?

- Supply Shortage Subsided: Late 2023 was peak GPU supply crisis. Startups were desperately calling Venture Capital firms for money to buy GPUs. Now, it’s much easier to get them with quick lead times.

- Growing GPU Stockpiles: Nvidia reported that about half of its data center revenue came from big cloud providers. Microsoft alone likely represented about 22% of Nvidia’s Q4 revenue.

- The $600B Question: Even with generous assumptions for big tech’s AI revenue, there’s a massive gap to fill each year to justify current CapEx levels.

- Nvidia’s B100 Chip: Nvidia’s new B100 chip promises 2.5x better performance for only 25% more cost. This will likely lead to another surge in demand, causing a temporary supply shortage.

One argument you'll hear often is that “GPU CapEx is like building railroads” – the infrastructure is being built, and the value will come. While I agree with this to some extent, there are critical differences:

- Lack of Pricing Power: Unlike railroads, GPU data centers have much less pricing power. New entrants keep flooding the market, and prices are being driven down to marginal cost.

- Depreciation: Semiconductors RAPIDLY depreciate. Nvidia will keep releasing better chips like the B100, devaluing previous generations quickly.

The AI hype is reaching new highs, but the road ahead is long.

Founders focused on delivering real value to end users will capture the most value from this overbuilt infrastructure.

AI has the potential to be a generation-defining technology wave, and companies like Nvidia deserve credit for enabling this transition.

So, let's not get carried away by the delusion that AGI is coming tomorrow or that we need to stockpile GPUs.