Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

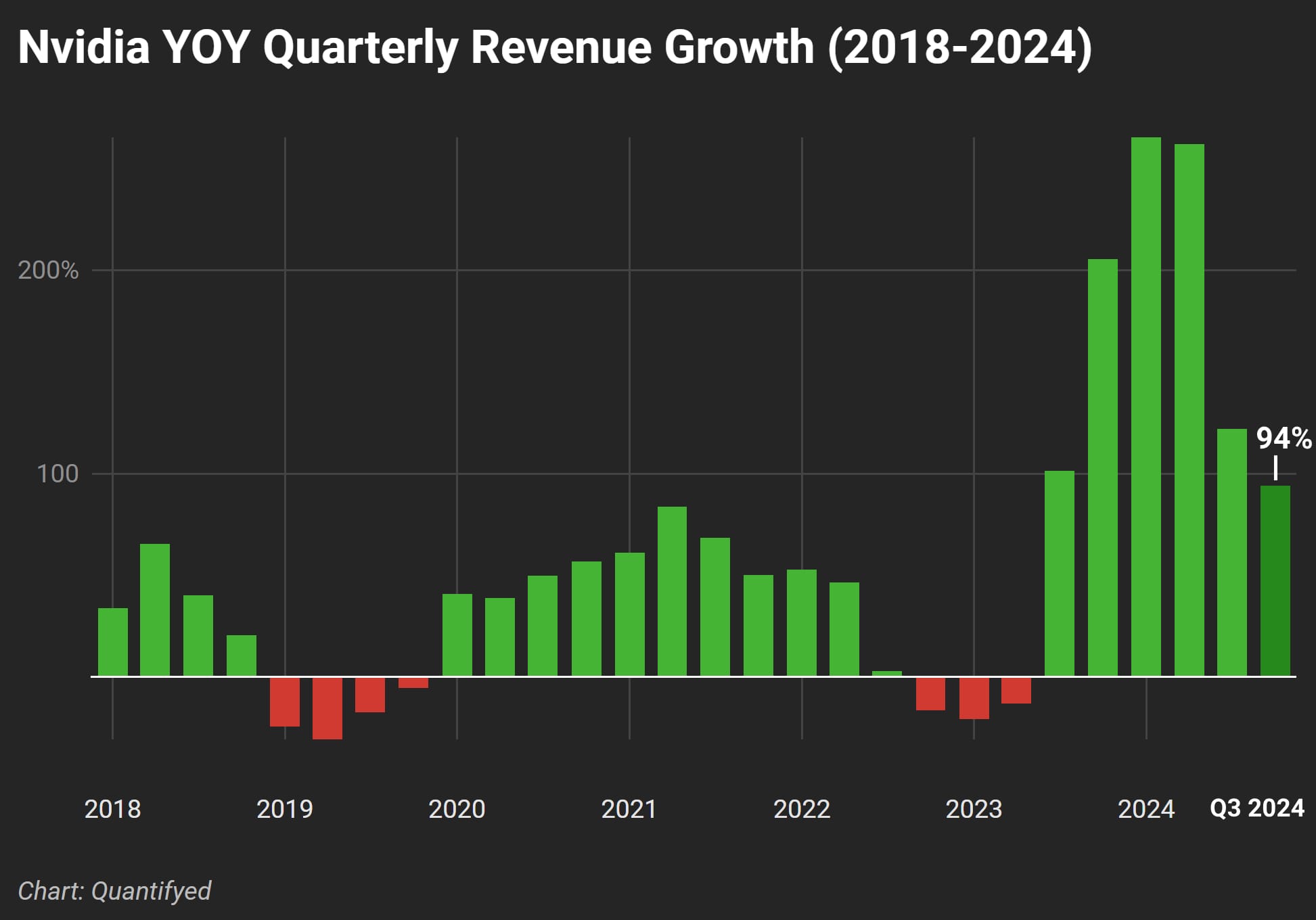

Nvidia just posted another big earnings report, beating estimates for both revenue and profit. Q3 revenue hit $35.08 billion, up 94% from last year, and earnings per share landed at $0.81. But even these strong results couldn’t stop the stock from falling 2% after hours. Let’s look at what happened:

Big Growth, Slowing Down

Nvidia’s revenue is still growing fast, but not as fast as earlier this year. The company’s 94% growth this quarter is lower than the triple-digit increases of the past three quarters (122%, 262%, and 265%)

Here’s how Nvidia’s growth looks over time:

Demand for AI hardware is still strong, but Nvidia is now so big that this kind of growth can’t last forever.

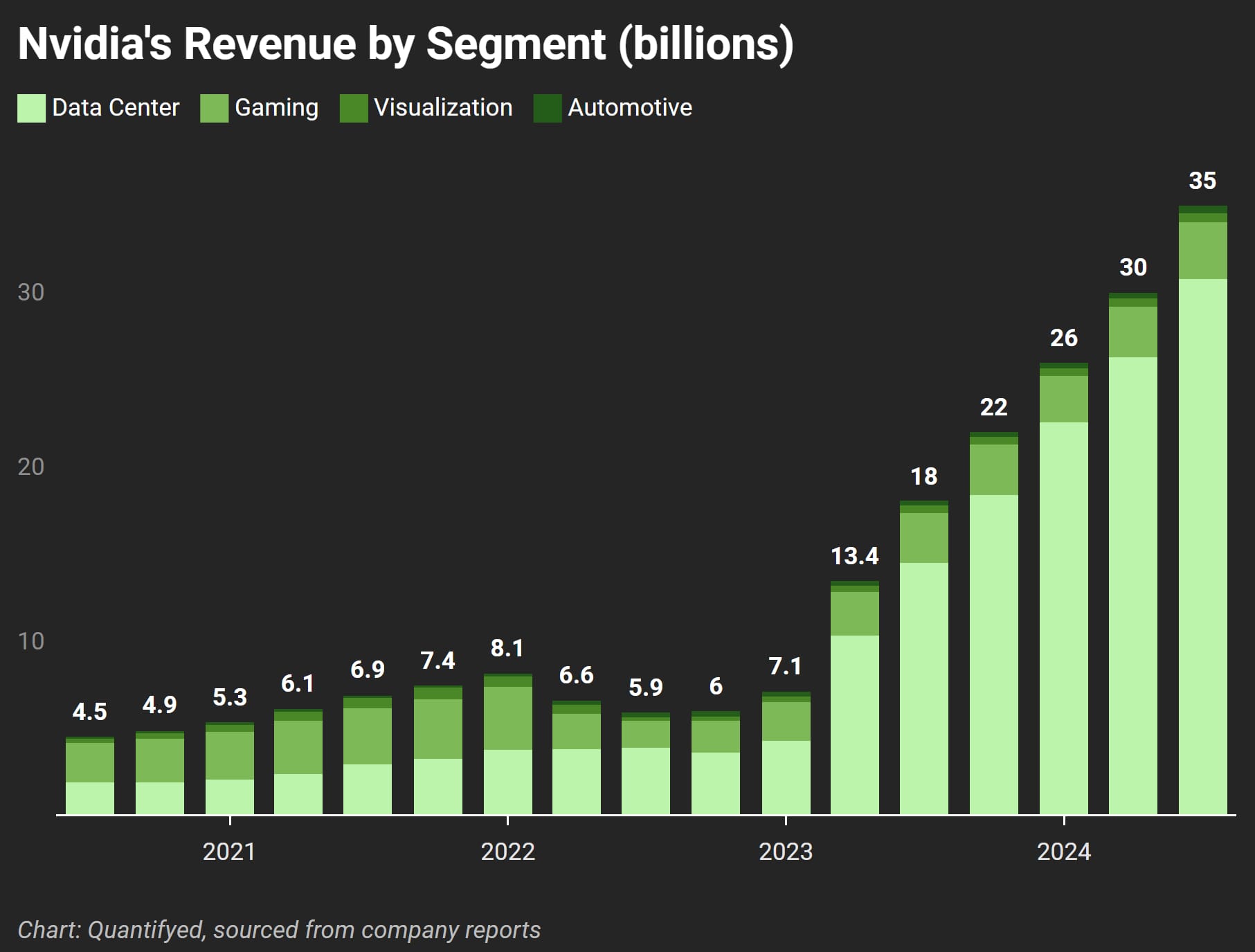

Data Center Revenue Leads

Nvidia’s data center business brought in $30.8 billion this quarter—112% more than last year. That’s where most of Nvidia’s money comes from, as companies like Microsoft and OpenAI buy its chips to power AI systems.

Other parts of the business, like gaming and automotive, grew too, but nothing comes close to data centers. Nvidia says demand for its new Blackwell chips is “insane,” and customers are already buying them. How long will it last?

The Blackwell Factor

Nvidia’s new Blackwell chips are now shipping, with 13,000 units sent to big customers this quarter. Nvidia expects these chips to bring in “several billion dollars” in revenue next quarter, but demand is so high that supply will stay tight for a while. Even so, Nvidia expects $37.5 billion in Q4 revenue, up 70% from last year.

Why Shares Fell

Even though Nvidia beat expectations, investors worry about slowing growth and chip supply issues. When a stock has tripled in a year, strong results sometimes just aren’t enough.

Key Takeaways

- Nvidia’s Q3 revenue reached $35.08 billion, up 94% from last year, but slower than other quarters.

- Data center revenue hit $30.8 billion, making up most of the company’s total.

- Blackwell chips are now shipping, and demand could outpace supply for a while.

- Nvidia expects $37.5 billion in Q4 revenue, but growth concerns sent shares down 2%.

Is Nvidia in a bubble? I answer that question here.