Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

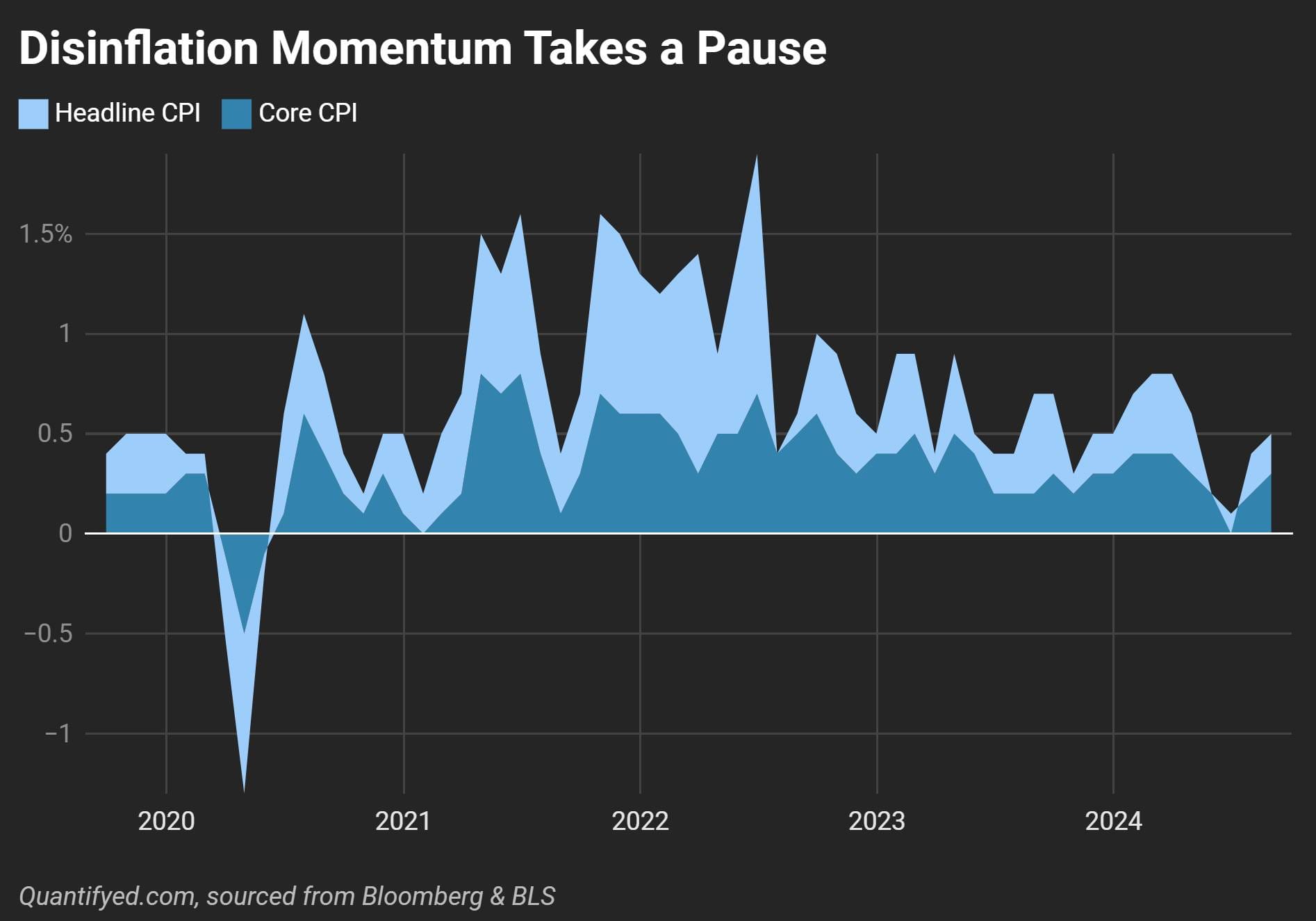

Core inflation is still climbing, and the Fed can't cut rates just yet. Find out why rising shelter costs are keeping inflation high.

So, inflation numbers dropped yesterday, and guess what? Your rent still isn’t getting any cheaper. While the headlines are celebrating, core inflation—aka the stuff that actually affects your daily life—isn’t cooling fast enough.

While headline inflation grabs attention, the Fed's bigger problem is core inflation, driven largely by housing costs.

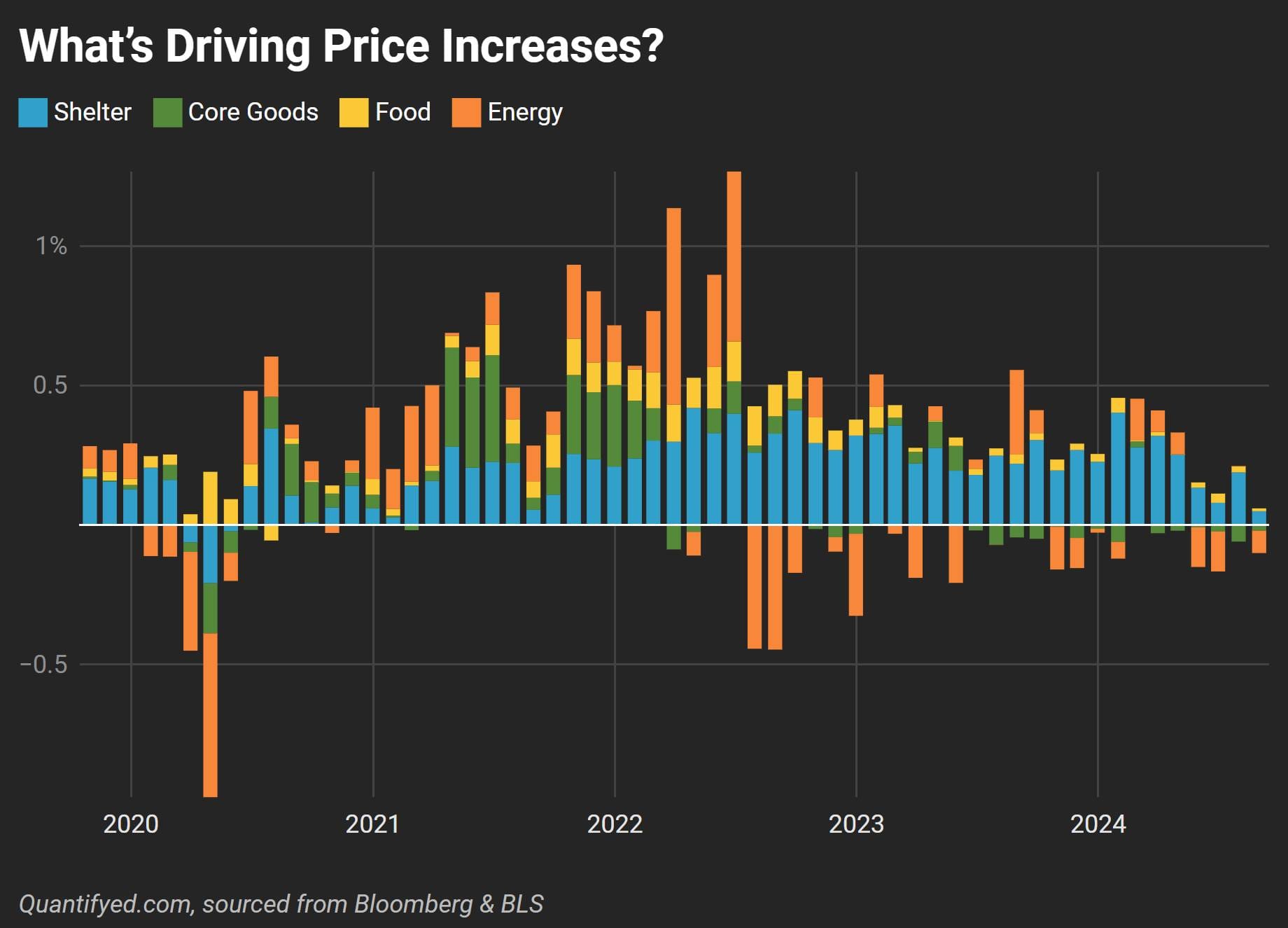

What’s Really Driving Inflation? Well, core inflation increased by 0.3% in August 2024, following a 0.2% rise in July. Over the past year, core inflation has increased 3.2%, driven mainly by rising shelter costs. Shelter jumped 0.5% in August.

This chart shows how shelter costs have been a large driver of core inflation. Food prices were stable (0.1% increase in August), and energy prices fell (-0.8% month-over-month).

Despite a 2.5% year-over-year increase in headline inflation, the core inflation rate of 3.2% is preventing the Fed from cutting rates. Cutting rates too soon could reignite inflation, especially with shelter costs still climbing.

For consumers, borrowing costs, including mortgage rates, will remain high. With shelter costs rising 0.5% month-over-month and continuing to be the largest component of core CPI, rent and housing costs are unlikely to ease soon.

Homebuyers and renters could expect these elevated costs to persist. Meanwhile, energy prices are offering some relief, with gasoline prices down 0.6% and overall energy prices down 4.0% year-over-year, but the overall cost of living remains elevated due to shelter inflation.

The latest August 2024 CPI report shows that while headline inflation is improving, core inflation—driven primarily by shelter—remains a challenge. The Federal Reserve is unlikely to lower interest rates until shelter costs come down significantly. Consumers should prepare for continued high costs in housing and borrowing.