Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

The Fed is about to make its next move, and it could either save the economy or push it over the edge. With so much at stake, how big will the Fed’s first interest rate cut be?

The Fed is about to make its next move, and it could either save the economy or push it over the edge. With so much at stake, how big will the Fed’s first interest rate cut be?

Spoiler alert: we don’t know. But what we do know is that investors are split, and economists are debating.

How Much Will the Fed Cut Interest Rates in September?

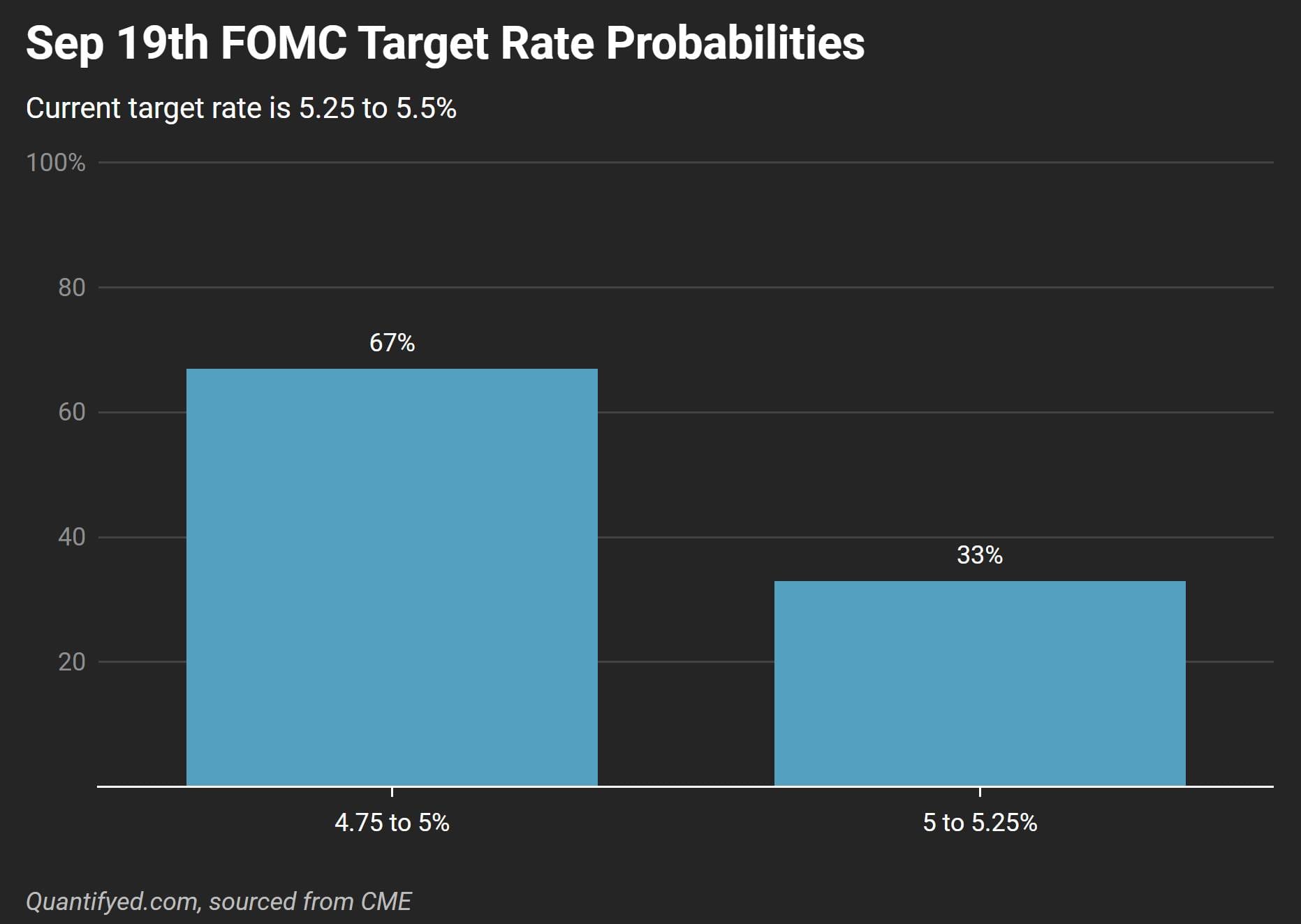

The question on everyone’s mind: how much will the Fed cut rates this month? For the first time in a while, markets are torn between two options—a smaller 0.25% cut or a larger 0.5% cut.

What surprised me the most about these estimates is that the market isn’t as certain as usual. Currently, the odds stand at 33% for a 0.25% cut and 67% for a 0.5% cut. If the Fed pulls a surprise move, it could create uncertainty for investors who’ve placed their bets on one of these scenarios.

Fed Chair Jerome Powell hasn’t exactly been crystal clear either. While acknowledging that rate cuts are necessary, he left plenty of wiggle room by saying, “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data" at his latest speech.

What does this mean for you? If the Fed opts for the smaller cut, we’re in for a slow and cautious easing process. If they go big with the 0.5% cut, it might signal concerns about the economy.

How Low Could Interest Rates Go?

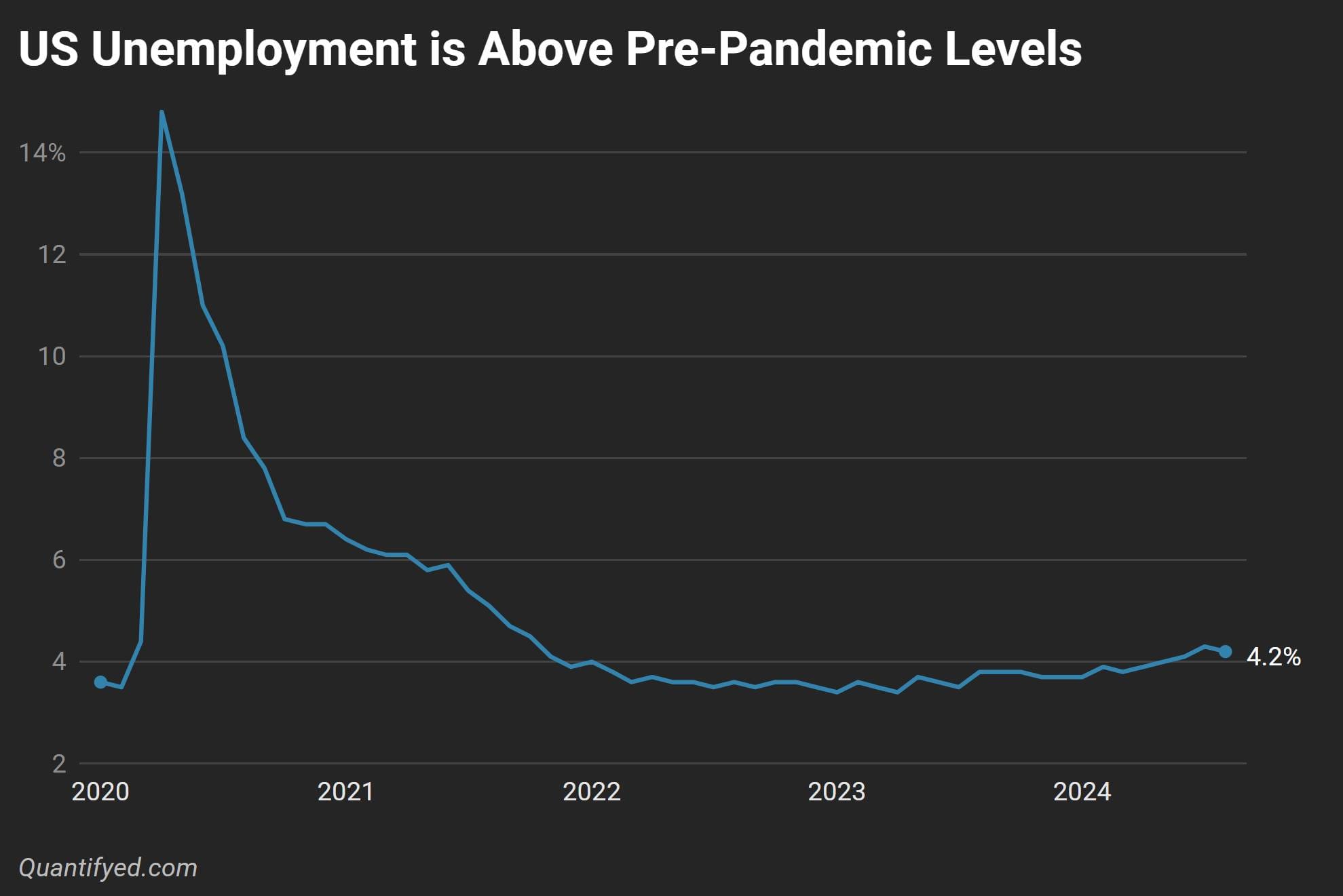

How low rates go largely depend on how the U.S. economy evolves. If unemployment keeps rising or the economy starts to wobble, we'll see more rate cuts down the road.

As it stands, the unemployment rate is sitting at 4.2%, already higher than pre-pandemic levels. The Fed could be facing a tipping point: cut rates too little, and job losses could accelerate; cut too much, and risk reigniting inflation.

Is the Fed Behind the Curve?

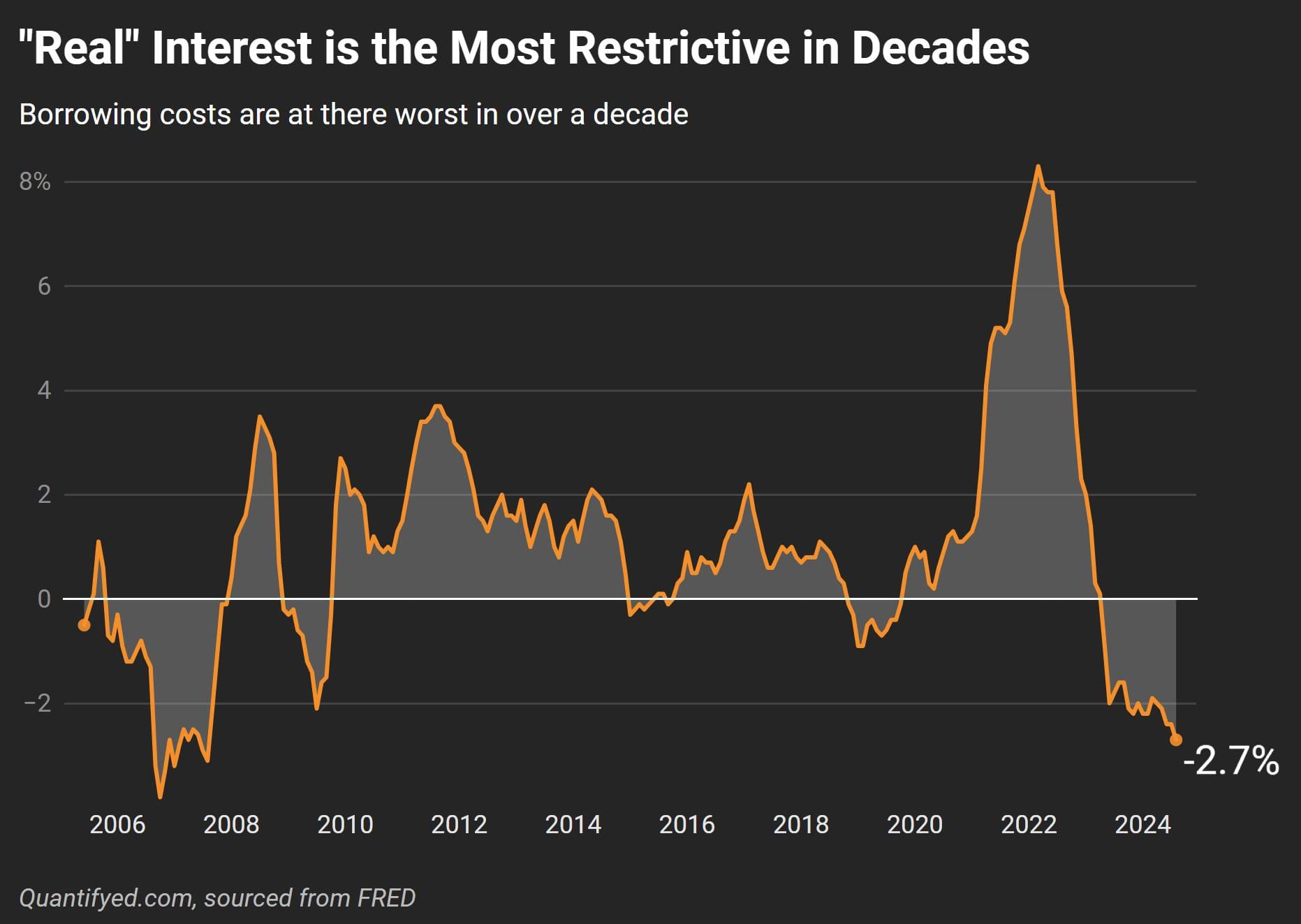

Now, let’s address the elephant in the room: Is the Fed already behind the curve? The short answer: maybe. Rate cuts, at this point, aren’t about stimulating the economy; they’re about easing the pressure the Fed’s policies have been putting on it.

While data shows the economy slowing down, it’s not crashing. Job growth has cooled a lot, with the three-month moving average dipping to 116,000 jobs—the lowest since the pandemic lockdowns. Despite this, layoffs remain historically low, and fewer people are quitting their jobs.

The most concerning factor? Real interest rates—which subtract inflation from the Fed’s key interest rate—are the most restrictive they’ve been since the 2008 financial crisis. Keeping rates at these levels could push the economy into a deeper slowdown.

At the core of all this debate is the Fed’s balancing act. Historically, they’ve been slow to raise rates and quick to cut them when the economy starts to show cracks. This time, it’s different. The Fed took the elevator up with rapid rate hikes in 2022, and now, they’re taking the stairs down with much slower, methodical rate cuts.

The Fed is walking a tight rope—cut too little, and they could trigger a recession; cut too much, and they risk unleashing inflation.