Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Why are your insurance premiums skyrocketing, and what can you do about it? Spoiler: Not much. But here’s why.

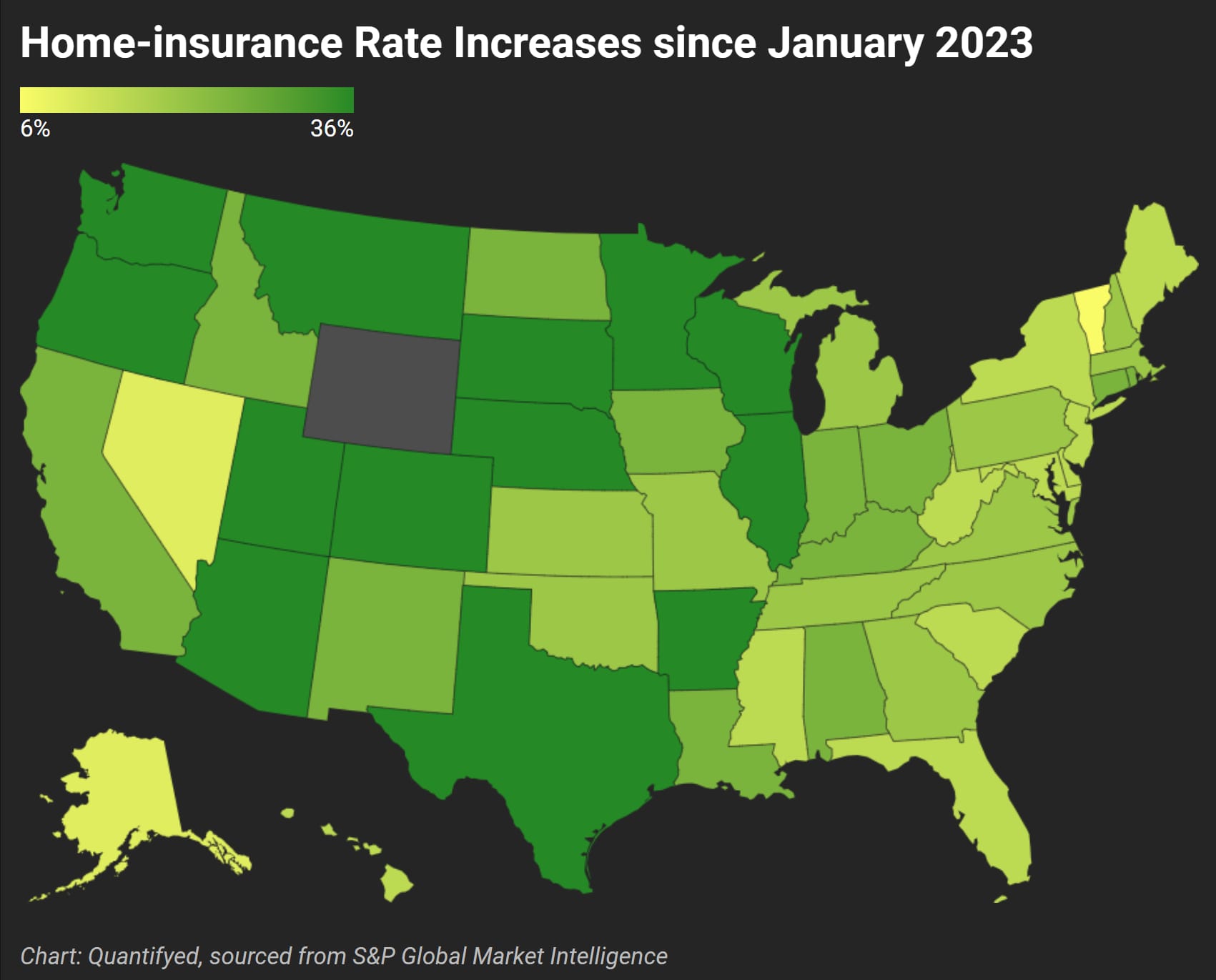

Home insurers are pushing for big rate increases and weakened consumer protections, and it seems they're getting what they ask for.

State regulators across the US appear to be submitting to industry demands due to fears that insurers will pack up and exit their state, leaving residents with fewer coverage options.

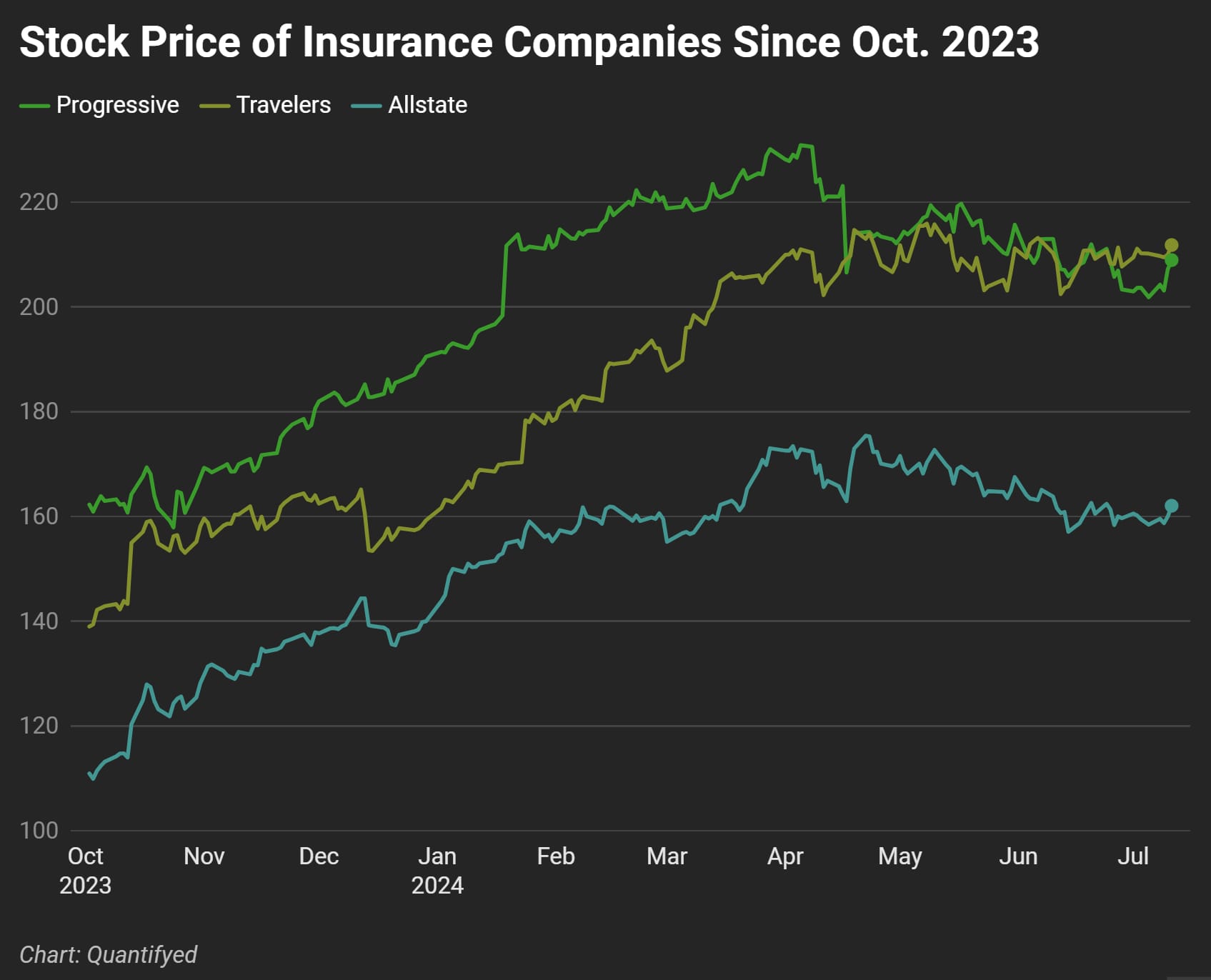

The pain for home and auto insurance customers is quickly becoming investors' gain. Insurance giants' shares and profits are hitting records, thanks in part to those steep rate hikes recently.

Check out this chart showing the price performance of Progressive, Allstate, and Travelers since October 2023 👇

So, why are these insurance companies making such high profits? The industrywide push to raise prices follows a long run of underwriting losses after the pandemic. In hindsight, customers got a great deal for most of the period after the Covid lockdown ended.

During the pandemic, auto insurers raked in outsized profits as people stayed at home and got in fewer car crashes.

Since then, the 10 companies—Allstate, American Family Insurance, Farmers Insurance, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA—have each won regulatory approval to boost auto-insurance rates by more than 20%, according to an S&P report this month.

In 16 states, the two-year increase topped 30%, including jumps of 45.5% in Texas and 39% in Ohio.

This means your wallet is getting hit harder, while investors laugh all the way to the bank!

Why are state regulators allowing such large rate increases? One factor is the recent willingness of regulators to allow these increases.

Insurers are bullying states. The companies are basically saying to state regulators, 'We can wreak havoc on your economy if you don’t play ball with us.' Crazy, right?

During the pandemic, insurance companies made huge profits because people drove less, with fewer accidents. However, as the world returned to normal, the insurers dealt with losses from paying out more claims, causing them to increase rates again.

For us consumers, this means fewer coverage options and higher premiums. With the steep rate hikes, consumers are bearing the financial burden. Wonderful, isn't it?

How long do you think this trend will continue? Perhaps until interest rates cut back we'll see pressure ease from insurance companies in the future.