Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

So, here we are again—another week where the market either flies or crashes, depending on a few numbers.

We’ve got a jobs report that might tell us something new (or not), Tesla flexing its delivery muscles, and Nike hoping we all forget about their slipping revenue. Let's break it down🕺

Will the Jobs Report Show a Slowdown?

First up: the jobs report—it's arriving on Friday, and all eyes are on it. It's not just about how many jobs were added—it's about what these numbers tell us regarding the broader economic health. Despite inflation showing signs of cooling, the employment data will be important if the Fed keeps cutting rates.

Consensus estimates suggest 130,000 nonfarm payroll jobs were added, with the unemployment rate expected to hold steady at 4.2%. The market is navigating a delicate balance, and how this report lands could have major implications on the trajectory for the rest of the year.

Any sign that the labor market is either losing steam or rebounding too strongly could hugely affect investor sentiment.

But enough about the labor market. Let’s talk about Tesla, the chaotic company reporting earnings soon 👇

Can Tesla Keep Up the Pace?

Tesla has quietly been on a rally, with stock prices up 24% over the past month. However, this week, the real focus now shifts to the actual delivery numbers to see if this growth narrative can hold.

Analysts estimate that Tesla delivered around 462,000 cars in the third quarter, representing a 6% increase from the same period last year.

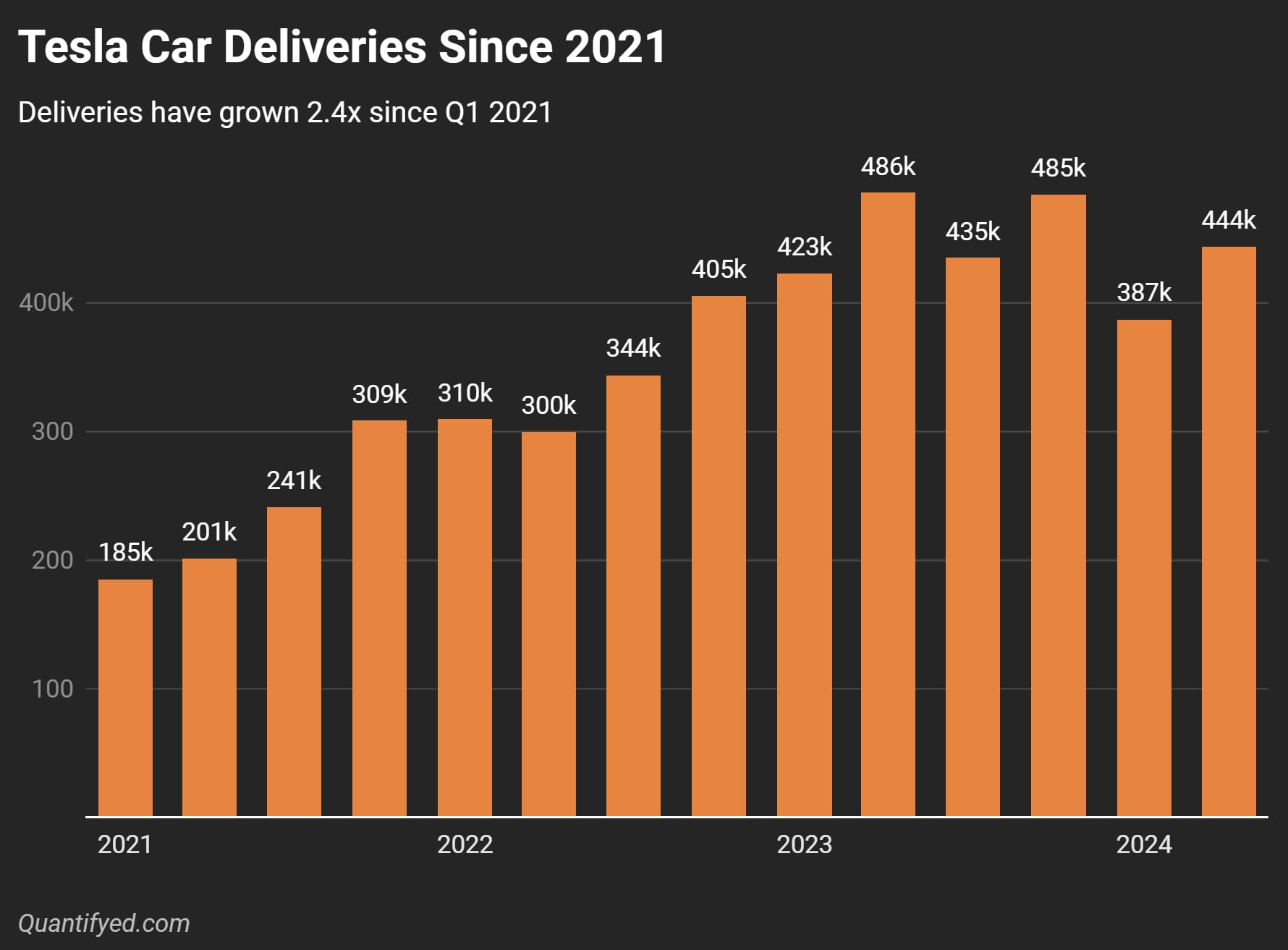

Below is a chart we made of Tesla’s car deliveries since the Q1 2021. As you can see, deliveries have been steadily climbing. Tesla has no doubt in our minds been able to scale production, even as other car companies struggled with supply chain issues and production bottlenecks.

The key question is: can Tesla sustain this growth and keep reassuring investors, or are there potential cracks in their business? We'll have to wait and see.

Will Nike Bounce Back?

Nike is back in the spotlight since it reports earnings tomorrow. Nike is at a crossroads: a new CEO just joined and they've got slow revenues. Investors want to know if this week is the beginning of a turnaround or just another crappy quarter.

Expected revenue for Nike’s fiscal Q1 is $11.65 billion, with earnings per share anticipated at $0.52—both representing year-over-year declines. Analysts, like those from Citi, are expecting a lowered outlook due to weaker macroeconomic conditions in China and a brand reset.

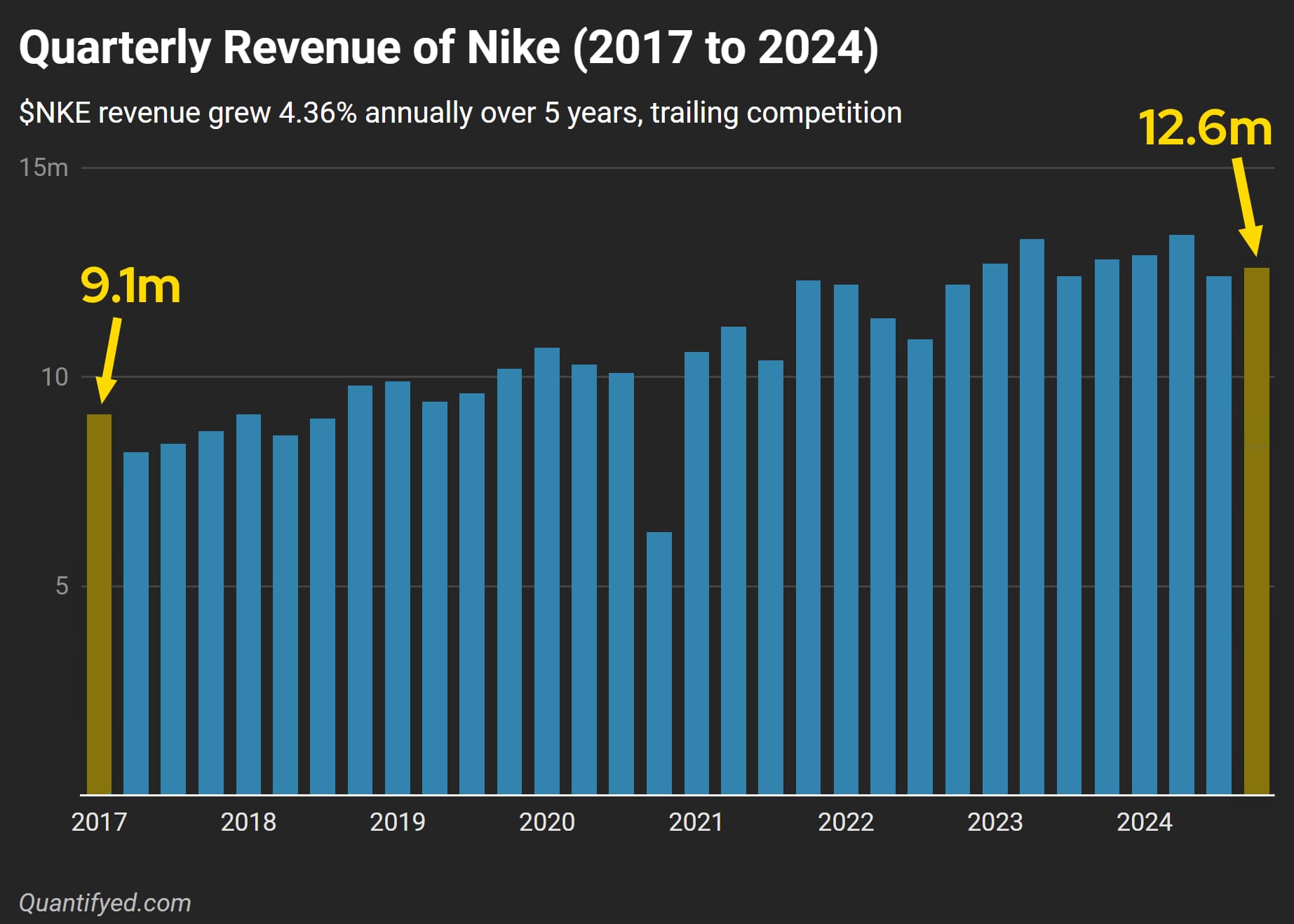

To better understand Nike’s position, here’s a look at Nike's quarterly revenue from 2017 to 2024. In the last 5 years, Nike's had an annual growth of 4.36% (which is super slow).

The five-year revenue trend tells us an important takeaway: despite steady growth, the hurdles of competition, changing consumer preferences, and global market challenges are tough.

Nike's next earnings report could show how much they've worked to regain their market share and competitive edge.