Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

I used to think I could outsmart the market by buying at rock-bottom and selling at the peak. I’d try to pinpoint those perfect days when stocks were at their lowest, and then cash out before the next downturn. But over time I learned that chasing those 'magic&

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today.

With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025.

Here’s what’s happening and what it means for markets:

How Will Tariffs Affect Markets?

Trump’s proposed tariffs would hit three key industries:

- Autos: An already tough sector dealing with supply chain issues.

- Semiconductors: A critical piece of tech manufacturing with deep reliance on Asian suppliers.

- Pharmaceuticals: Higher costs could trickle down to consumers.

Investors remember the 2018-2019 U.S. China trade war, which sent costs higher and shook markets. If these tariffs move forward, they could hit corporate earnings, drive inflation back up, and force the Fed to keep rates higher for longer.

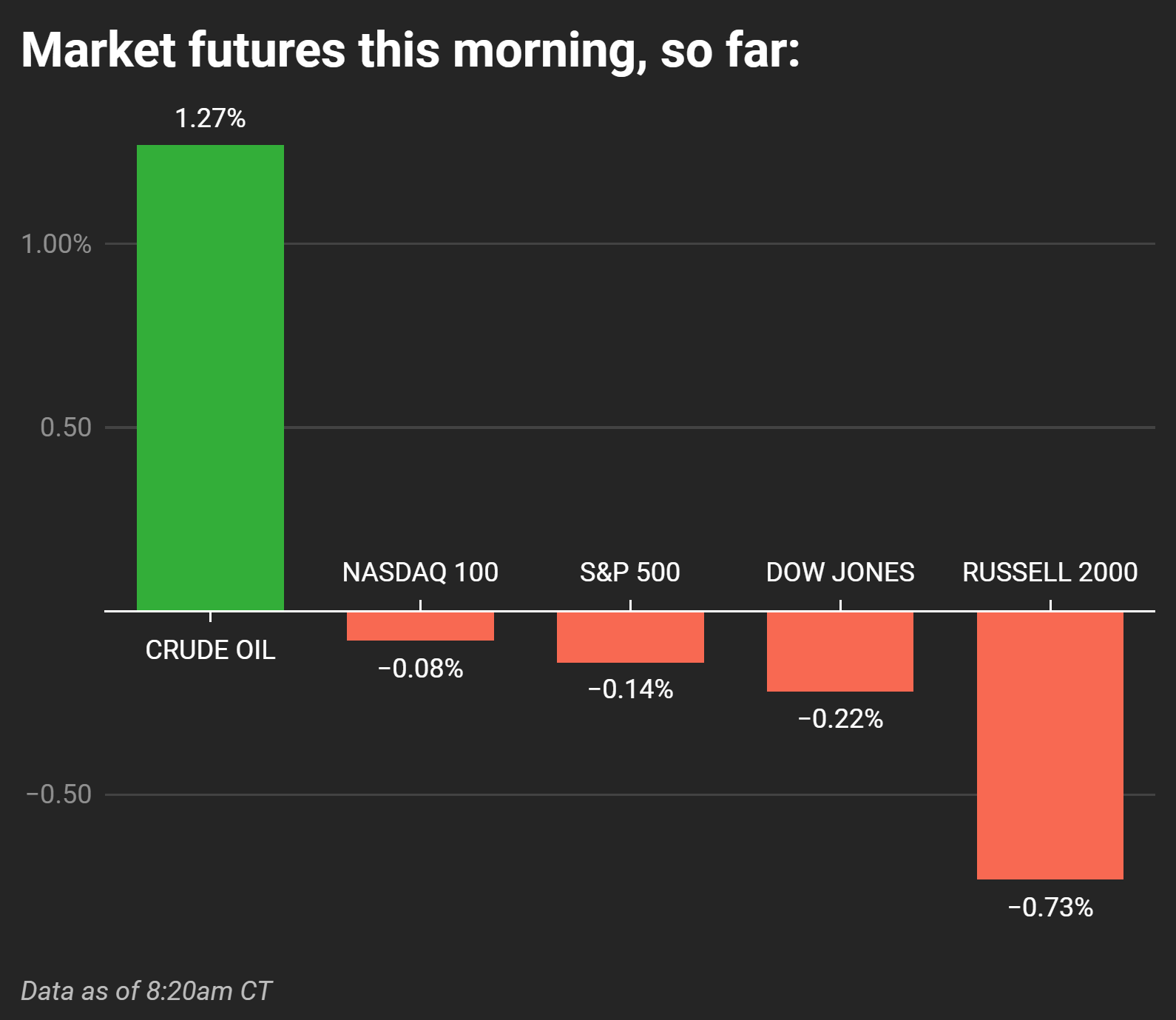

Futures Drop as Oil Surges

Investors didn’t take the news lightly. Stocks slipped across the board, while crude oil was one of the few assets in the green:

Here's how markets are moving this morning:

- S&P 500: -0.14%

- Dow Jones: -0.22%

- Nasdaq 100: -0.08%

- Russell 2000: -0.73% (biggest drop)

- Crude Oil: +1.27%

Other market moves:

- Bond yields climbed: 10-year Treasury yield inched higher, a sign of inflation concerns

- The dollar strengthened: Risk-off sentiment is pushing investors to have more liquidity

- Bitcoin rose: Up over 1%, possibly as traders hedge against traditional markets

What This Means for Markets

The Fed’s meeting minutes come out soon, and traders are looking for any hint of rate cuts. But if tariffs push inflation higher, the Fed might have to keep rates steady for longer than expected.

At the same time, oil is also up 1.27% this morning, which could mean traders are worried about supply issues or geopolitical risks. On top that, Ukraine-Russia talks and Germany’s upcoming election are adding more uncertainty to the mix.