Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

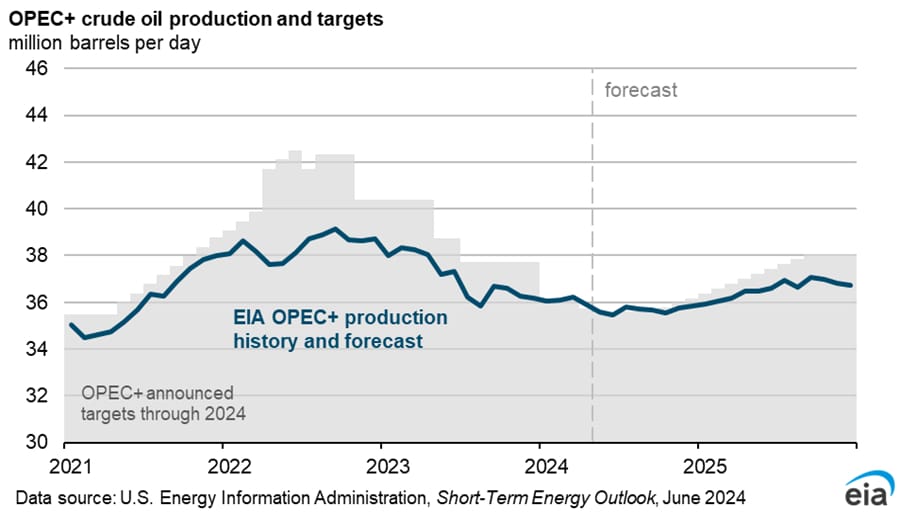

Current trends and expert opinions see a supply shortage in 2025. Despite our efforts to balance production with global demand, several factors are aligning to create a perfect storm for the oil market. I'll dive into why this is happening and what it means for the future.

Increasing Demand vs. Supply Constraints

According to the CEO of Occidental, a major US oil-player, the oil market is facing significant supply shortages. The root of this issue lies in the growing global demand for oil, which is expected to outpace supply. As Occidental’s CEO noted, the industry is facing one of its most challenging periods in recent history.

Here's a few stats that support this oil shortage thesis:

Effects of Advances in Technology

Interestingly, technology within the oil industry could play a role in mitigating our shortage. AI and machine learning are being adopted across the industry to improve efficiency and predict maintenance, but their impact on overall production capacity is pretty miniscule.

For instance, predictive maintenance using AI can hugely reduce downtime and improve operations, but it doesn't substantially increase production capacity.

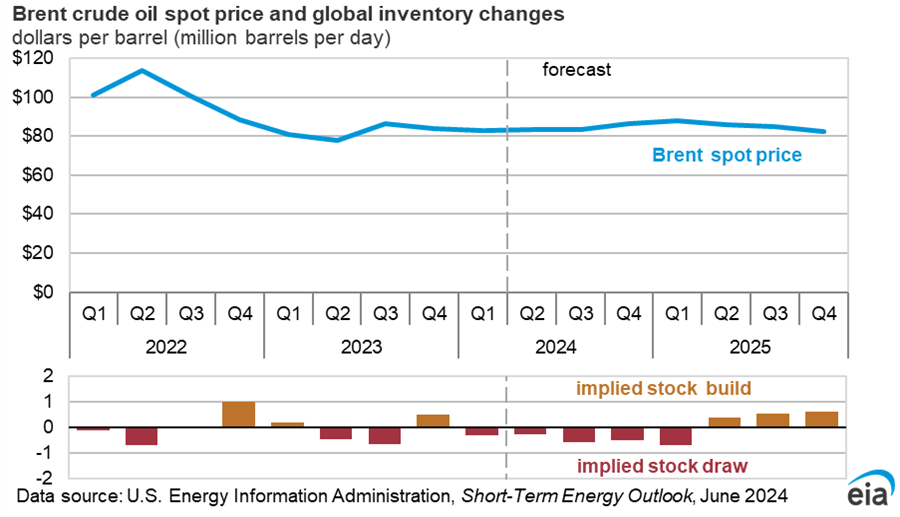

Also interesting, The Energy Information Administration (EIA) gave us a sobering outlook for the oil market. They forecast that Brent crude prices will remain relatively stable in the short term but are likely to spike as supply constraints become more pronounced towards 2025.

What happens if the supply shortage becomes more severe than expected? This scenario isn't just a possibility—it's a growing concern. If oil companies continue to underinvest and geopolitical tensions remain high, the impact could be even more dramatic. We might see oil prices skyrocketing, causing ripple effects across global economies and possibly leading to an energy crisis.

The takeaway? Our oil market could see a supply shortage by the end of 2025.

For investors or consumers, staying informed about this trend is crucial. The time to act is now. Is it time to diversify your energy portfolio? Maybe. Regardless, I'll keep you posted on this trend! Subscribe to our newsletter to get exclusive reports sent straight to our inbox, weekly. For free. 👇