Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

The latest data is hinting that our economy is cooling, pointing to a slowdown that could influence the Federal Reserve's next move on interest rates.

There's a LOT to unpack. Let's start off with the labor market. Jobless claims have inched up, signaling a gradual cooling. Initial claims for state unemployment benefits rose by 4,000 to 232,000 for the week ending August 17. While this increase might seem minor, it’s part of a broader trend of a softening labor market.

But before you start worrying, I should also note that layoffs are historically low right now. Companies are mostly scaling back on hiring rather than cutting jobs outright.

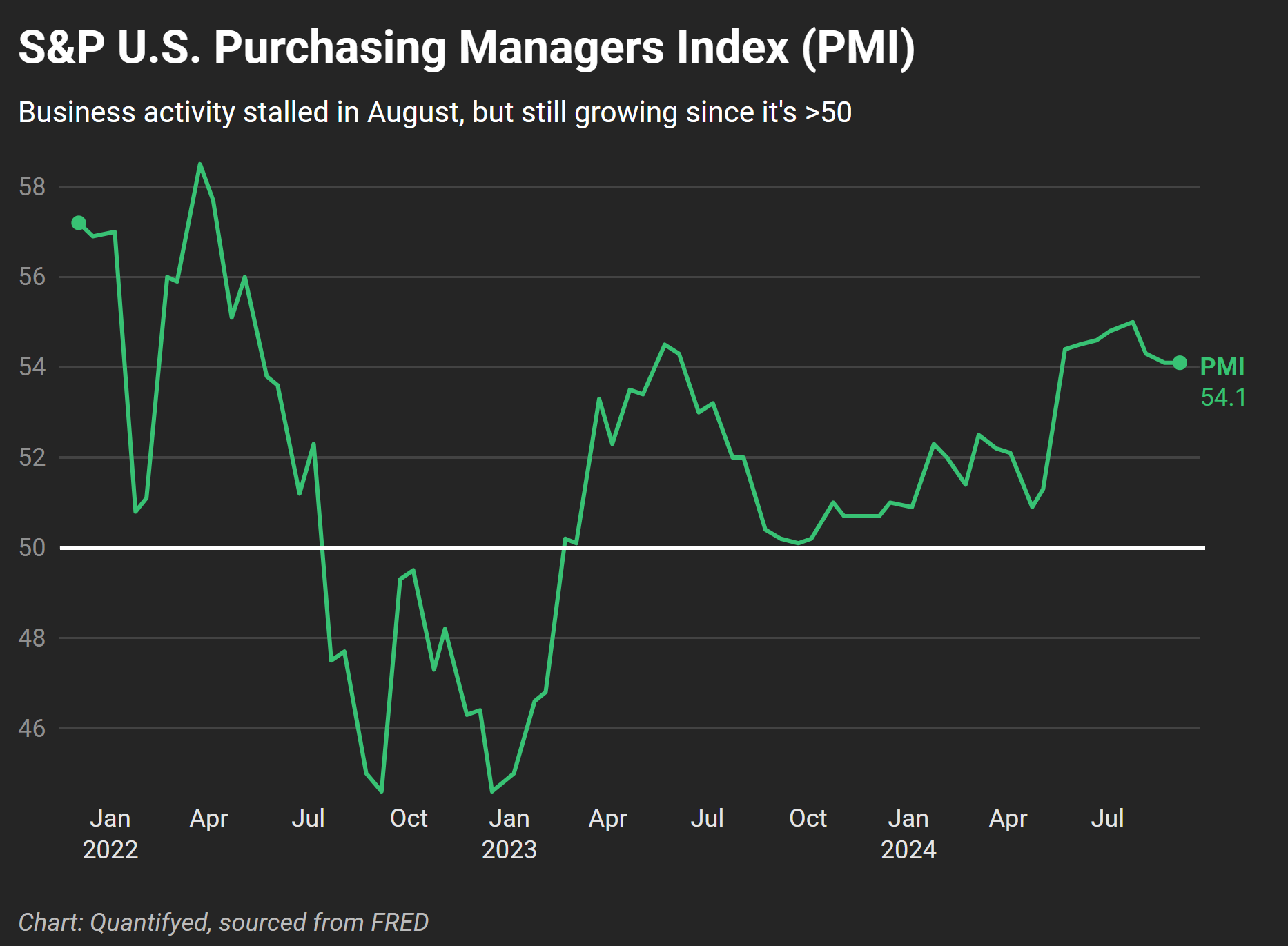

Meanwhile, business activity is slowing, even though the economy continues to grow! The S&P Global Composite PMI dropped slightly to 54.1 in August from 54.3 in July.

Does this signal trouble? Not necessarily—anything above 50 still shows growth. However, firms are finding it harder to increase prices as consumers begin pushing back, which is contributing to slower inflation.

In the housing market, we're seeing a rebound. Existing home sales rose 1.3% in July to a seasonally adjusted annual rate of 3.95 million units (beating expectations).

That said, home resales are still down 2.5% compared to a year ago. The median home price jumped 4.2% to $422,600, with inventory levels rising slightly by 0.8% to 1.33 million units.

With all this data in mind, it’s no wonder that the Federal Reserve is expected to cut interest rates at its next meeting. But with the economy showing signs of slowing down, is a cautious rate cut the best move? The Fed might do a 25-basis-point cut to keep the economy on track.

All in all, the U.S. economy is cooling. Jobless claims are up slightly, business activity is slowing, and the housing market is showing mixed signals. All these factors could point to an interest rate cut by the Fed.