Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

The S&P 500 Value Index just dropped 3.7%, marking its longest losing streak on record. Meanwhile, Bitcoin smashed past the $100,000 mark, and the Nasdaq climbed to 20,000.

To me, it seems that value stocks have been left in the dust, and investors chasing bigger gains in growth and crypto. Is this the end for value investing—or just another cycle? Let’s look at the numbers.

The Fall of Value Stocks

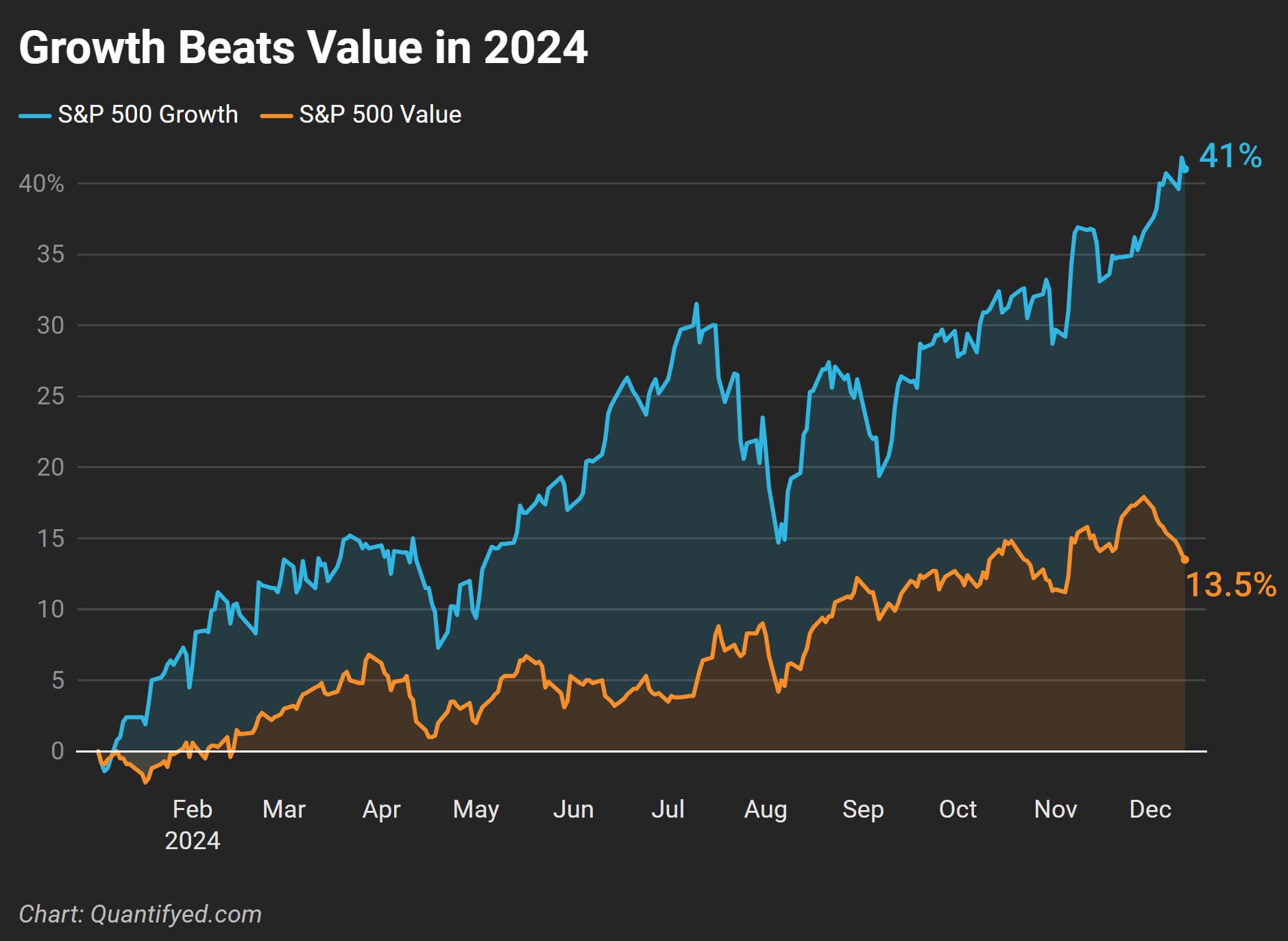

Value stocks are struggling to keep up. While the S&P 500 Growth Index has gained 41% YTD, the Value Index is up just 13.5%.

Healthcare and financial stocks have been major drags on performance, too.

Growth and Crypto Take the Lead

The market’s winners are clear—and value isn’t in them.

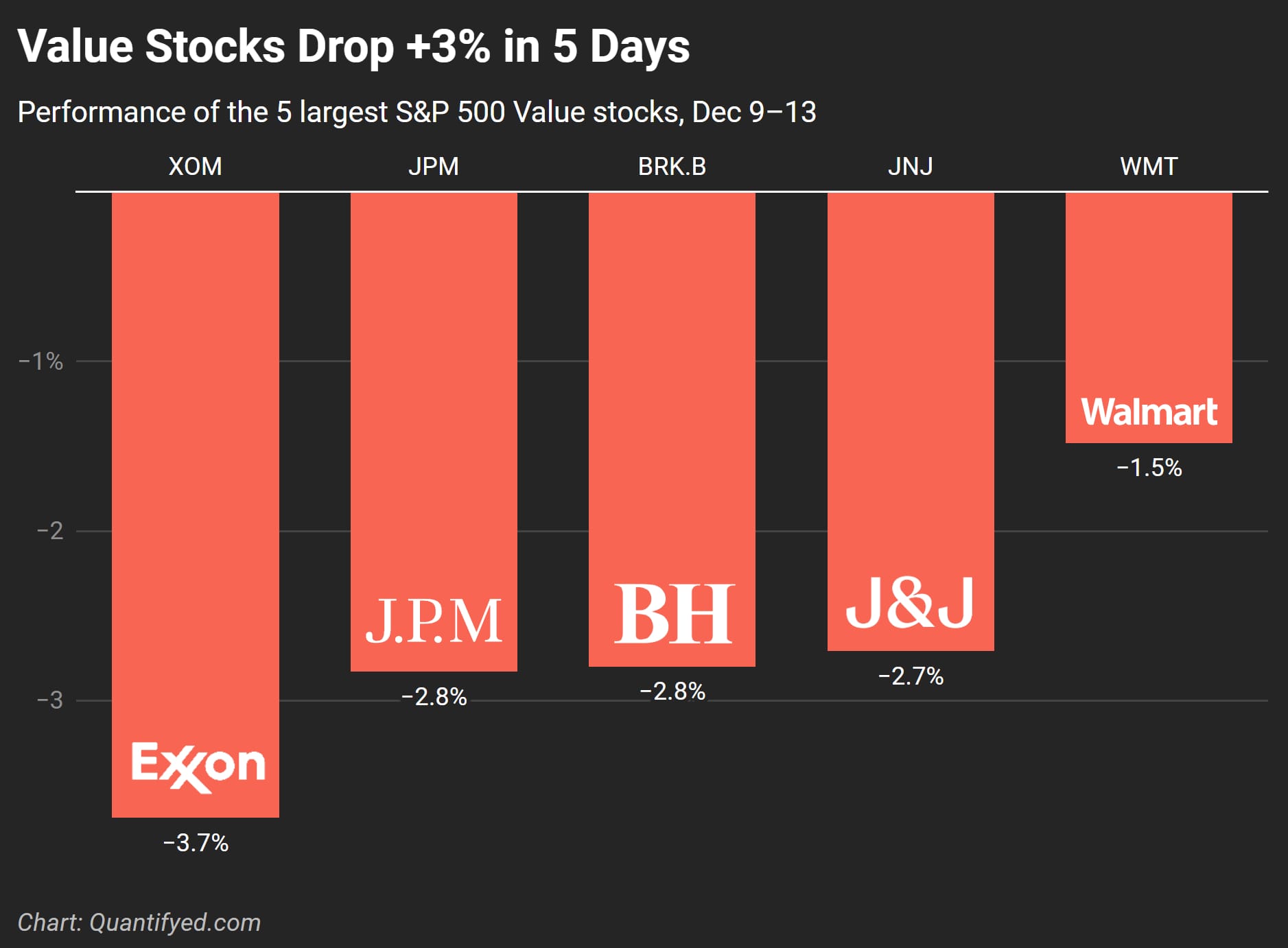

Here's the five largest S&P 500 Value stocks performance from Dec 9-13:

- Exxon (-3.7%)

- JPMorgan (-2.8%)

- Berkshire Hathaway (-2.8%)

- Johnson & Johnson (-2.7%)

- and Walmart (-1.5%)

Each of these have all posted losses in the past five days. Even traditionally defensive stocks like Walmart are failing.

Meanwhile, tech giants are crushing it:

- Big tech now accounts for 35.77% of the S&P 500’s market cap, the highest level in 20 years, per CNBC.

- Tech leaders like Tesla, Meta, and Amazon are driving the Nasdaq higher, while Broadcom, a semiconductor builder, is closing in on a $1 trillion valuation.

Crypto has also taken off, stealing capital from traditional investments:

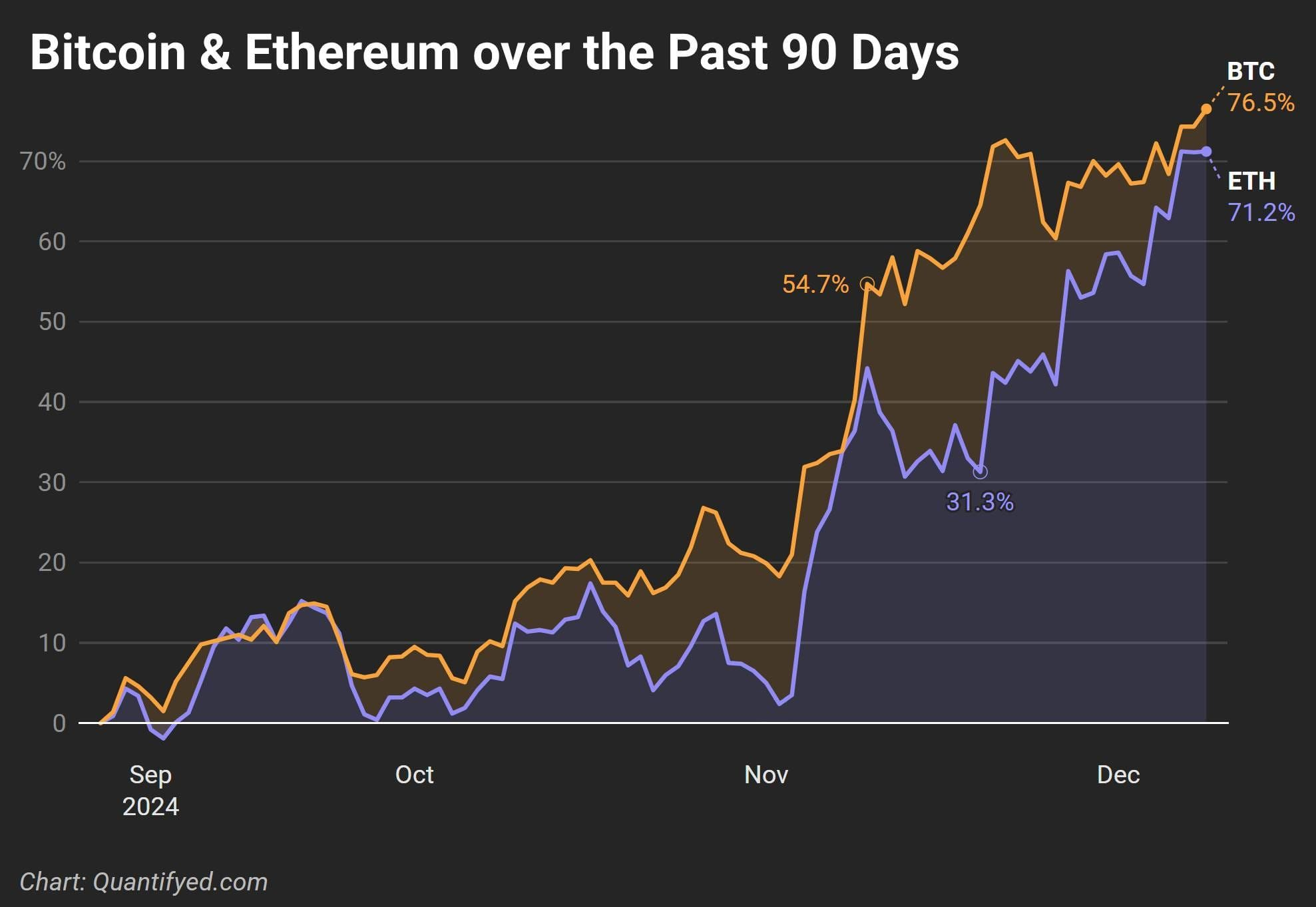

- Bitcoin is up +76.5%, while Ethereum has climbed +71.2% over the past 90 days.

- Institutional interest is helping push Bitcoin past the $100k mark

I'll say this though: value investing isn’t dead, but it’s out of style.

Value stocks often rebound after market corrections or tech booms due to their resilience during economic uncertainty (think periods after 2001 and 2022)

Here's some takeaways:

- Value stocks are struggling, up just 13.5% YTD

- Crypto is leading the pack, with Bitcoin and Ethereum up +70%

- Value investing isn’t dead, and it often bounces back in cycles