Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Warren Buffett has been on a buying spree, snapping up shares of Occidental Petroleum like it's going out of style. But why is one of the world’s legendary investors betting on oil when everyone else seems to be yapping about renewable energy?

The Permian Basin Play

First off, let's talk geography. Occidental Petroleum is a major player in the Permian Basin, one of the richest oil fields in the US, and guess what? Buffett loves a good, reliable cash flow! The Permian Basin's oil production is like a pot of gold.

Did you know that the Permian Basin is the largest and most productive in the world? To put it in perspective, the Permian Basin produces more oil than entire countries.

ALSO, the reserves in the Permian are huge. Estimates suggest that the Permian holds about 60 to 70 billion barrels of resources. That’s a lot of oil, and I can already hear the eagles flying in 🦅🦅🦅

Buffett’s Big Bet on Black Gold

So, we've established that the Permian Basin is an oil powerhouse. Now, I want to talk about the man of the hour—Warren Buffett. Why is he so obsessed with Occidental Petroleum?

First off, Buffett isn't known for throwing his money around without good reason. When he sees an opportunity, he goes in, and that's what he's doing with Occidental. In 2024 alone, Berkshire Hathaway bought over $246 million in stock.

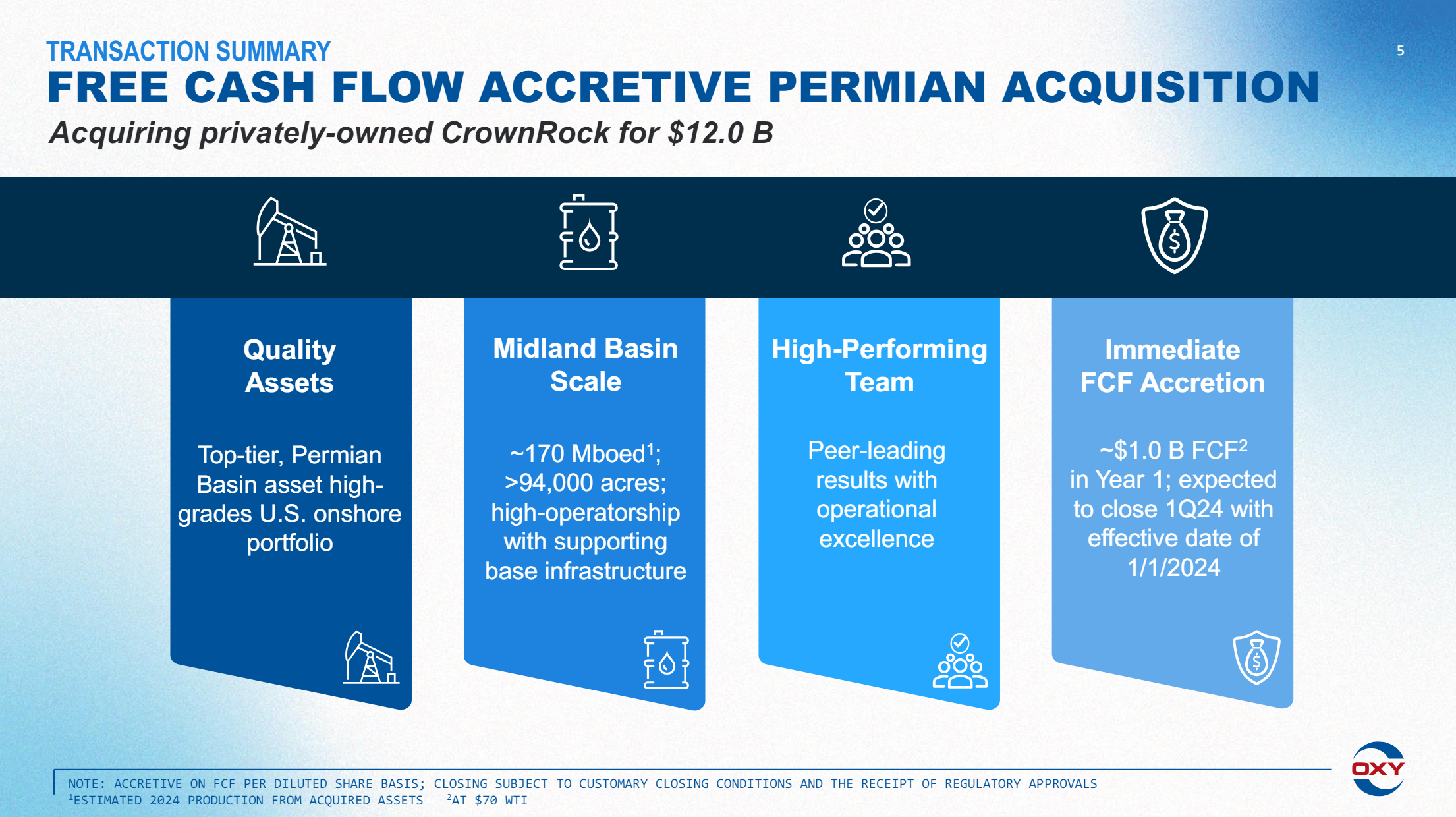

But why Occidental, and why now? Well, it’s not just about the Permian Basin’s current production. It’s about the future. Occidental’s acquisition of CrownRock, a major player in the Permian, positions them to capitalize on one of the richest oil reserves in the world.

Future Supply Shortages

Occidental’s CEO recently forecasted a potential oil supply shortage by the end of 2025. With demand expected to outpace supply, oil prices could soar, making investments in oil companies like Occidental incredibly lucrative, which is probably what intrigued Buffett.

Of course, no investment is without risk. The energy sector is volatile, with prices subject to geopolitical, regulatory, and market changes. And the ever-looming shift towards renewable energy... But here’s the thing—Buffett is all about calculated risks. He’s betting on the continued relevance of oil, at least for the foreseeable future, and he’s betting big.

For extra stats on the Permian Basin, read this infographic 👇