Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

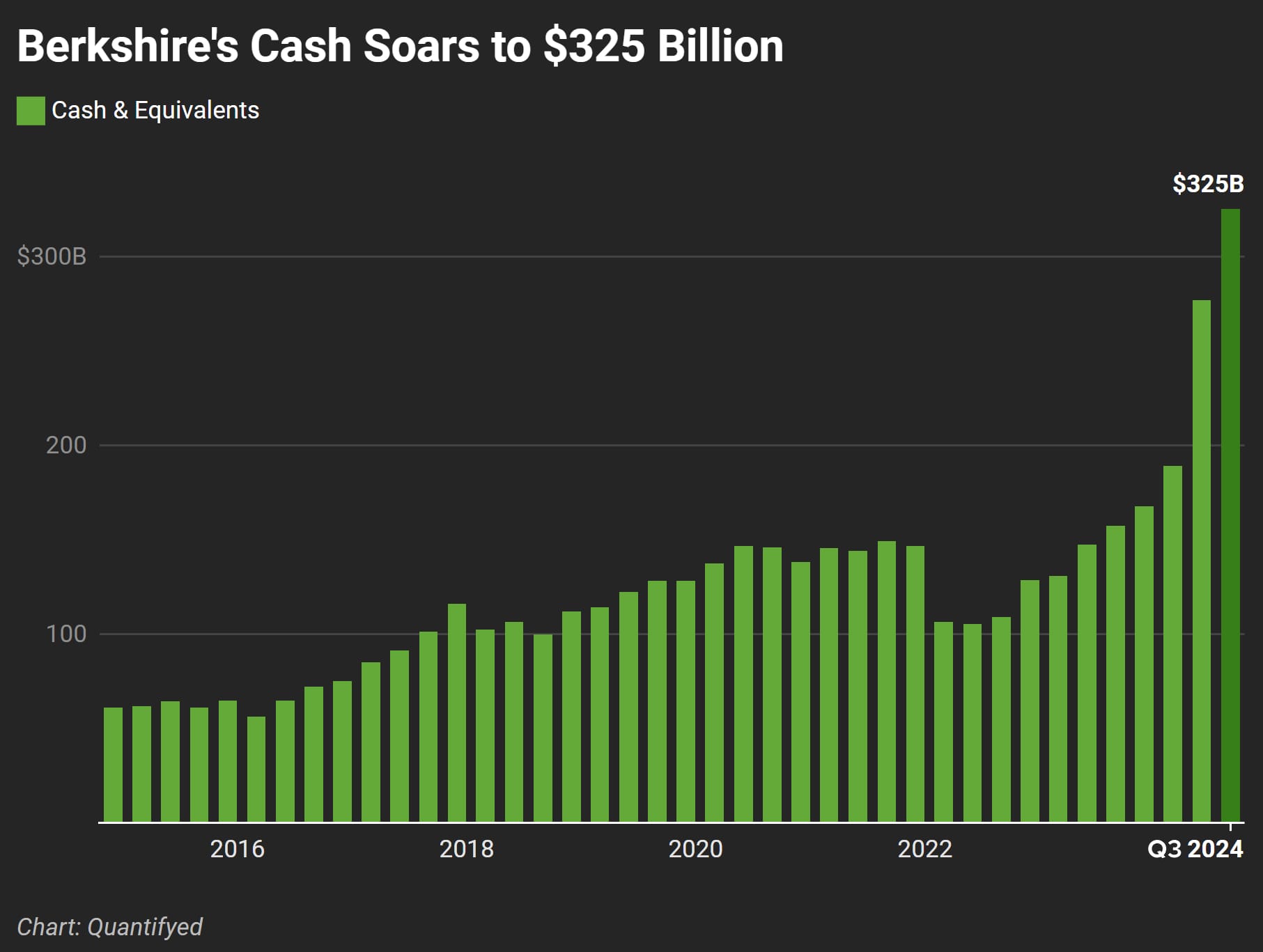

Just when you thought Warren Buffett couldn’t pile up more cash, he’s got a new record: $325 billion. Meanwhile, I'm over here figuring out how to stretch my paycheck.

Berkshire Hathaway’s cash reserves hit insane levels in Q3 2024. What’s he waiting for? A once-in-a-lifetime deal? Or maybe he just likes watching his cash grow. Let’s dig into how he built this “money mountain” and what it could mean for Berkshire’s next moves.

Building the Cash Mountain

Buffett’s cash pile didn’t happen by accident. A big part of it? Trimming Berkshire’s Apple stake.

- Apple Moves: Back in 2016, Buffett jumped in when Apple was trading at $25 a share. Fast-forward, and he’s been selling some of that stake, bringing Berkshire’s Apple holdings down to $70 billion from a peak of $178 billion. That’s a lot of cash freed up.

- Cash Growth: That Apple sale rocketed Berkshire’s cash to record highs.

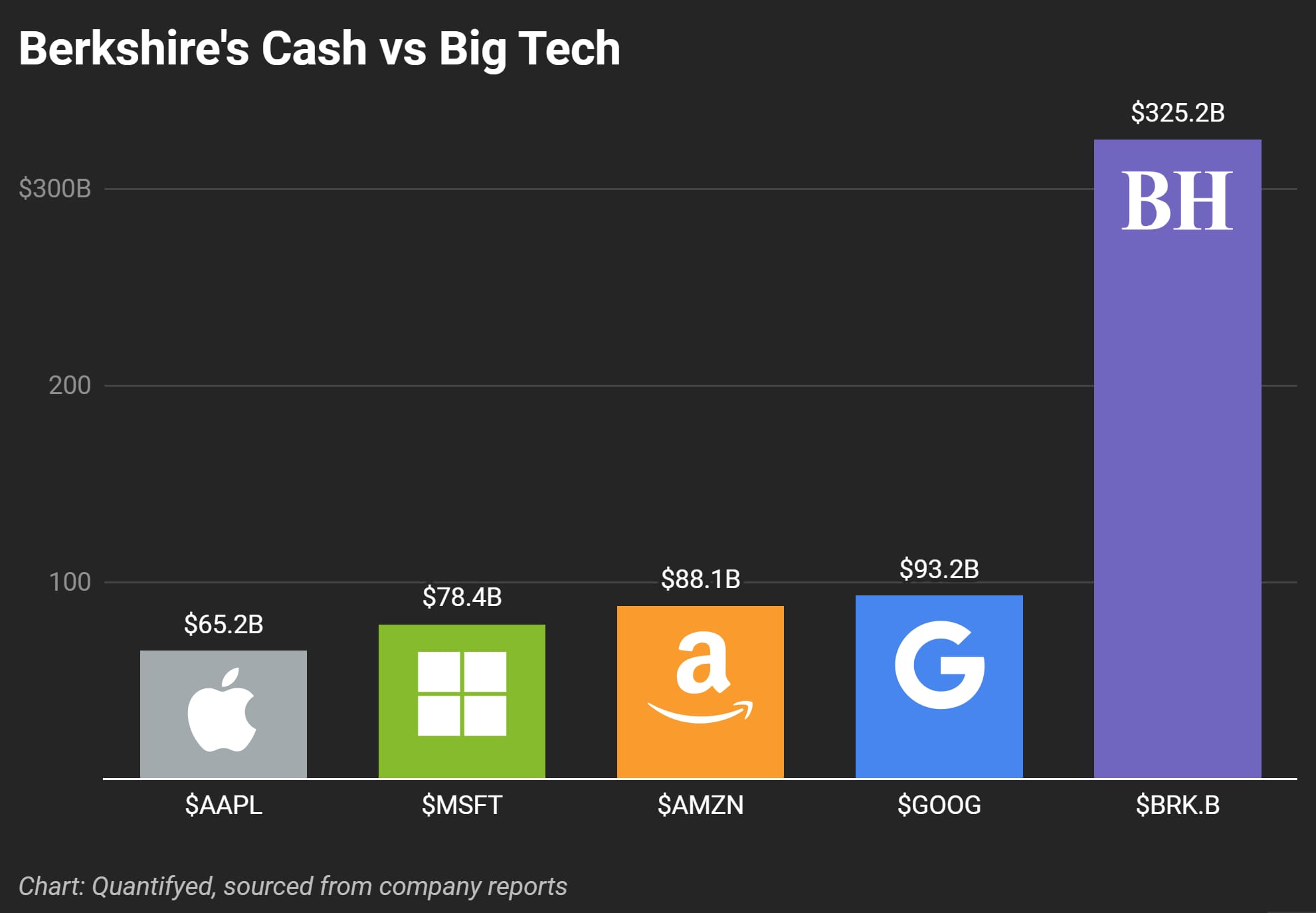

Berkshire vs. Big Tech

Sure, tech giants have a lot of cash. But Berkshire? They’re in a league of their own.

- Big Tech Comparisons: Apple holds $65.2 billion in cash. Microsoft? $78.4 billion. Even Amazon and Google with $88.1 billion and $93.2 billion look small next to Berkshire’s $325 billion. Buffett’s stockpiling cash like there’s no tomorrow.

- Why This Matters: This isn’t just a flex. It’s a strategy. Buffett isn’t jumping into overpriced markets. Instead, he’s biding his time, waiting for deals to open up.

Betting on Treasury Bills

With all that cash, you’d think Buffett would be throwing it around. But no—he’s playing it safe with U.S. Treasury bills.

Why? Liquidity. Treasury bills keep Berkshire’s cash easily accessible, so Buffett can pounce on the right deal when it comes.

Then there’s stability. Treasury bills are low-risk, which fits perfectly with Buffett’s cautious vibe in today’s unpredictable market.

A Few Key Takeaways

- Big Cash, Big Plans: Berkshire’s cash stack is at $325 billion, boosted by Apple sales.

- More Cash Than Big Tech: Compared to tech giants, Berkshire’s cash pile is next-level.

- Playing It Safe: Buffett’s sticking to Treasury bills, holding out for the right moment to strike