Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Have you ever glanced at your stock portfolio during a busy workday and felt totally clueless? Maybe you read market news during lunch and found it hard to make sense of all the volatility.

But what if there was a simple, proven strategy to cut through all that noise? Enter Warren Buffett, the Oracle of Omaha, whose wealth-building secrets can actually make sense.

In this article, I’m going to share Warren Buffett’s strategies to help you navigate the stock market and grow your wealth, even when the news is a hot mess.

Choosing Quality Companies: Finding and investing in strong, undervalued companies is the goal. Buffett focuses on companies with solid fundamentals, future cash flows, and growth potential. Investing in something worth it is key. Cheap companies are priced low for a reason, like poor management or weak business models—avoid falling into that value trap.

Buffett's method involves determining a company's real worth by looking at financial statements, understanding business models, and checking management quality.

Focus on businesses with high returns on equity, healthy profit margins, and strong competitive advantages (economic moats). Buying stocks at prices below their real worth reduces risk and ensures potential for profit. Holding investments for the long term helps ride out market ups and downs and benefits from growth.

Investing regularly, especially in low-cost index funds, no matter the market conditions, is essential. This method uses dollar-cost averaging, buying more shares when prices are low and fewer when prices are high. Consistency is key.

Why Dollar-Cost Averaging (DCA) is a Good Practice: Dollar-cost averaging basically removes the impact of market volatility by spreading out your investing over time. Instead of trying to time the market (which is difficult), you invest a fixed amount regularly. DCA lets you buy more shares when prices are low and fewer when prices are high, leading to a lower overall average cost. This approach takes the emotion out of investing and promotes discipline.

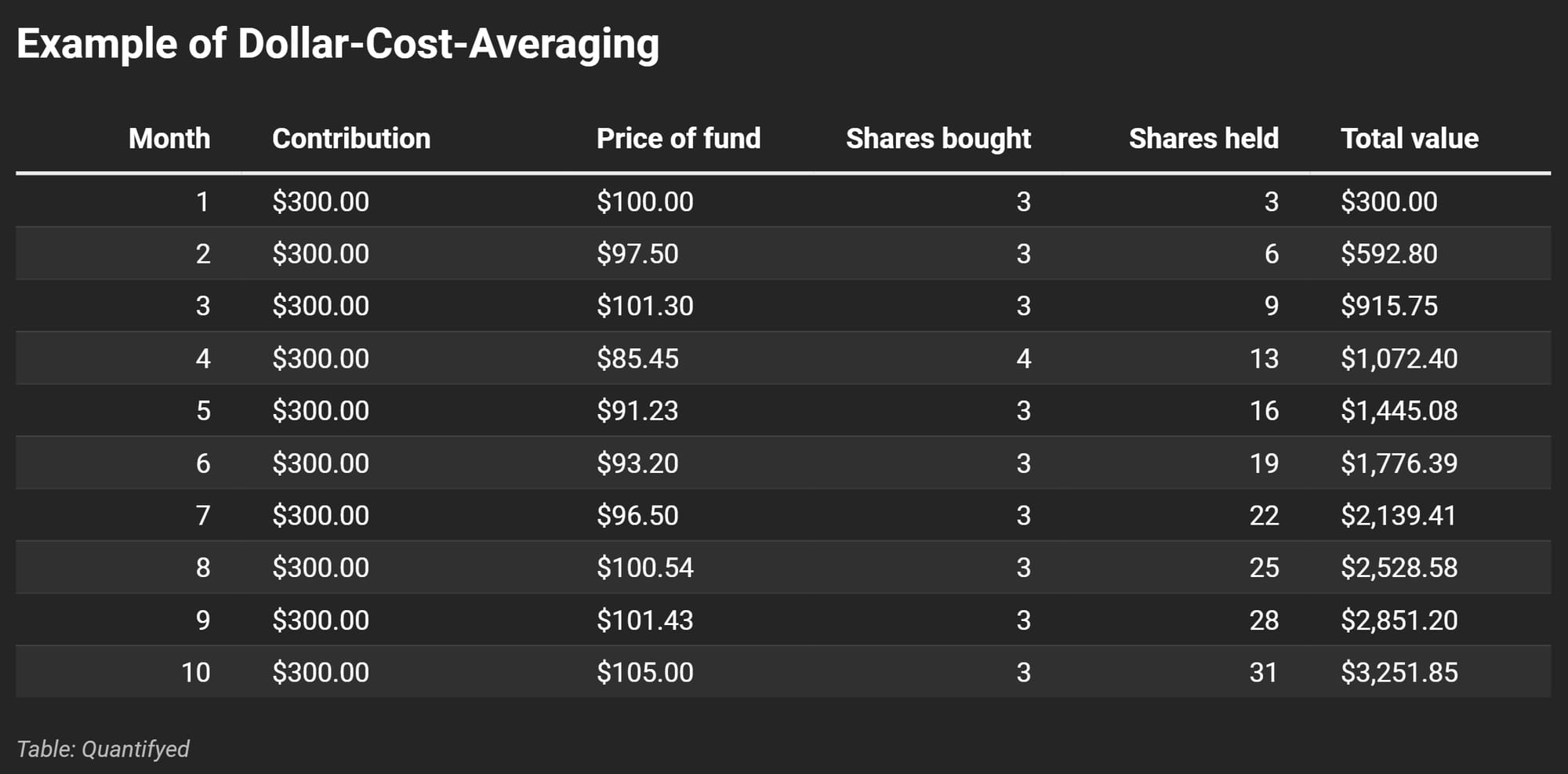

Let's look at an example using this table:

Month 1: Invest $300 at $100 per share, buying 3 shares.

Month 2: Market dips a bit, shares are now $97.50, but you invest another $300, buying 3 more shares.

Month 4: Market takes a bigger dip to $85.45. You buy 4 shares with your $300.

Month 10: Price goes up to $105, but you’re still investing $300, buying 3 shares. Over time, you’ve accumulated 31 shares worth $3,251.85 from consistent investing.

Also, holding your investments for the long term is important. Starting early significantly boosts the benefits of compounding. For example, if you start investing $6,000 annually at age 25 and earn an average annual return of 7%, you could have almost $1.5 million by age 67.

Starting at age 30, with the same annual contributions and return rate, would result in just over $1 million by age 67. That’s a difference of about $450,000 for starting just five years earlier.

By following some of these principles, you can do a lot better with investing. The key is to focus on quality, be consistent, and leverage compounding.