Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

If you’re like me, you’ve probably checked your stock app more times than you’d like to admit. Well, brace yourself for another round of notifications because Apple and Microsoft are set to report their earnings this week.

In this post, I'm going to dive into what investors should expect from Apple and Microsoft’s earnings reports, why these results matter, and what they mean for the broader market.

Apple’s Drivers of Growth

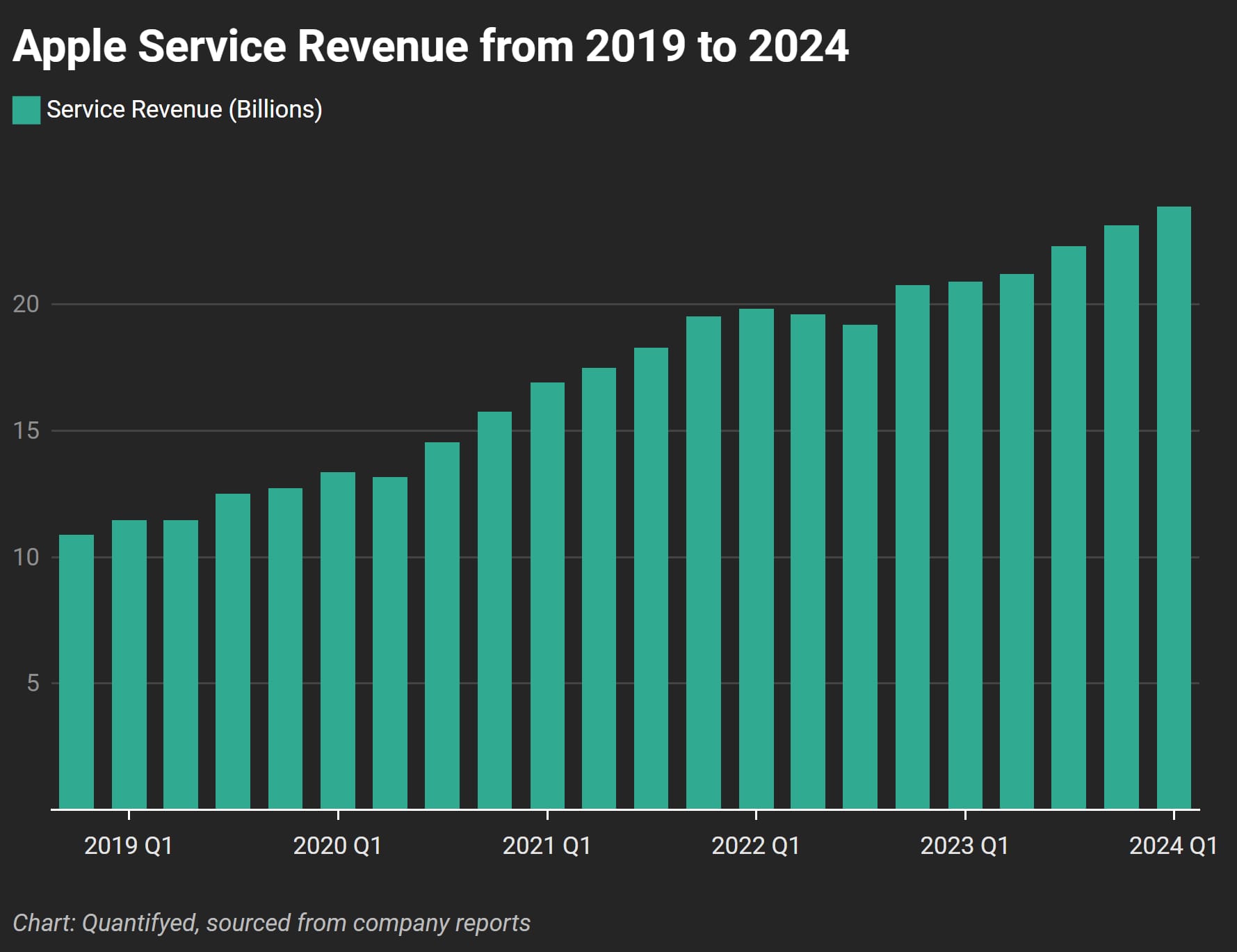

Apple’s earnings report on August 1st are going to shake markets. The most attention will likely focus on a few key areas: AI developments in iPhone, gross margins, and service revenue (aka subscription) growth. Future iPhone sales are crucial, and AI enhancements to Siri and other features could spur more sales down the road.

Gross margins are expected to continue their upward trajectory, thanks to Apple's in-house supply chain and its high-margin services segment. The services segment, which makes up about 1/4th Apple's total revenues, is growing fast. This includes revenue from the App Store, Apple Music, iCloud, and other subscription services.

Microsoft’s Earnings Expectations

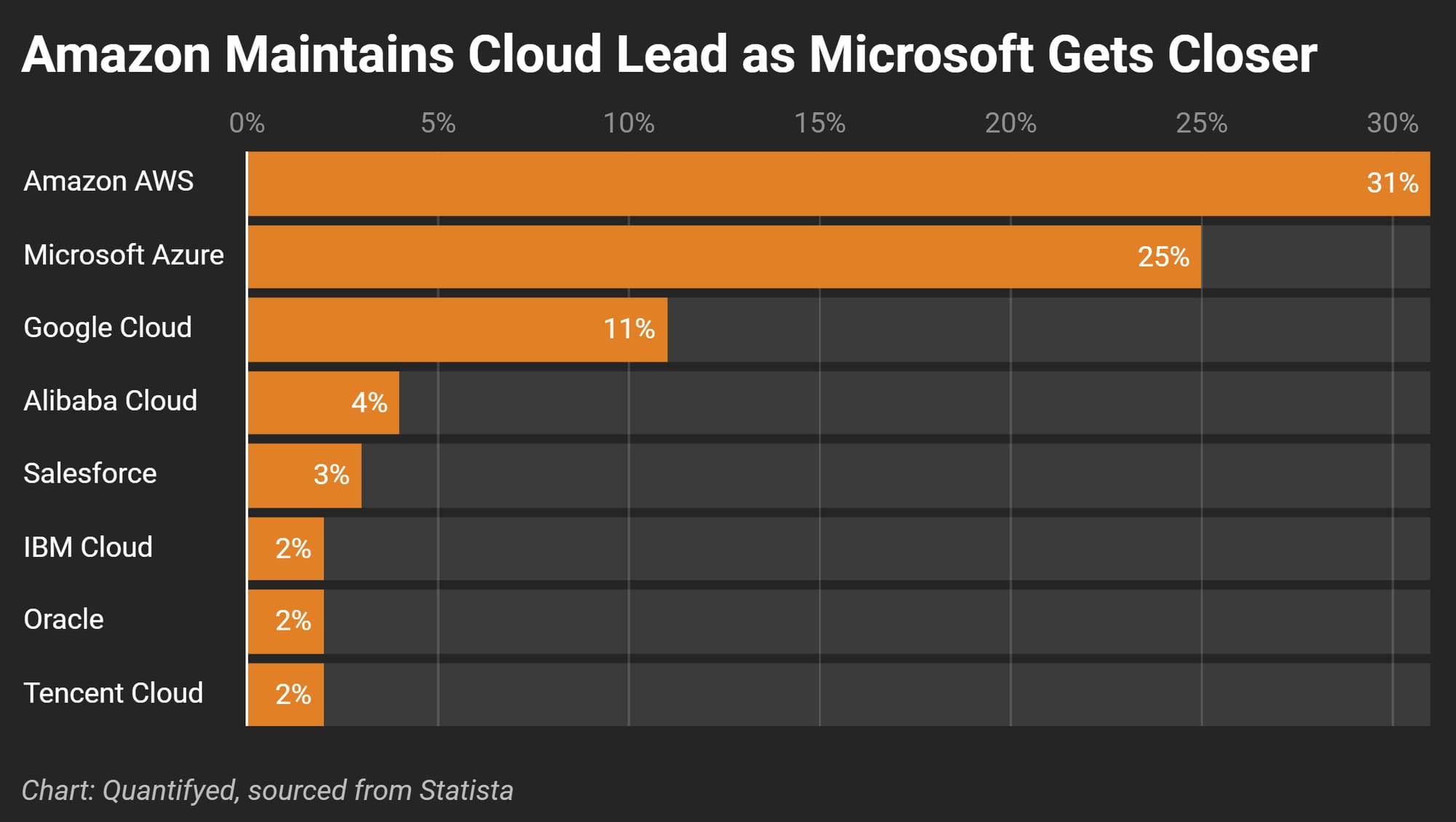

Microsoft’s upcoming earnings report on July 30th will likely focus on the performance of its cloud services, particularly Azure. Despite a slower customer base growth compared to competitors Amazon Web Services (AWS) and Google Cloud Platform (GCP), Microsoft Azure has expanded its market share by 14.2% from 2023. In contrast, AWS and GCP grew by 24.6% and 23.2%.

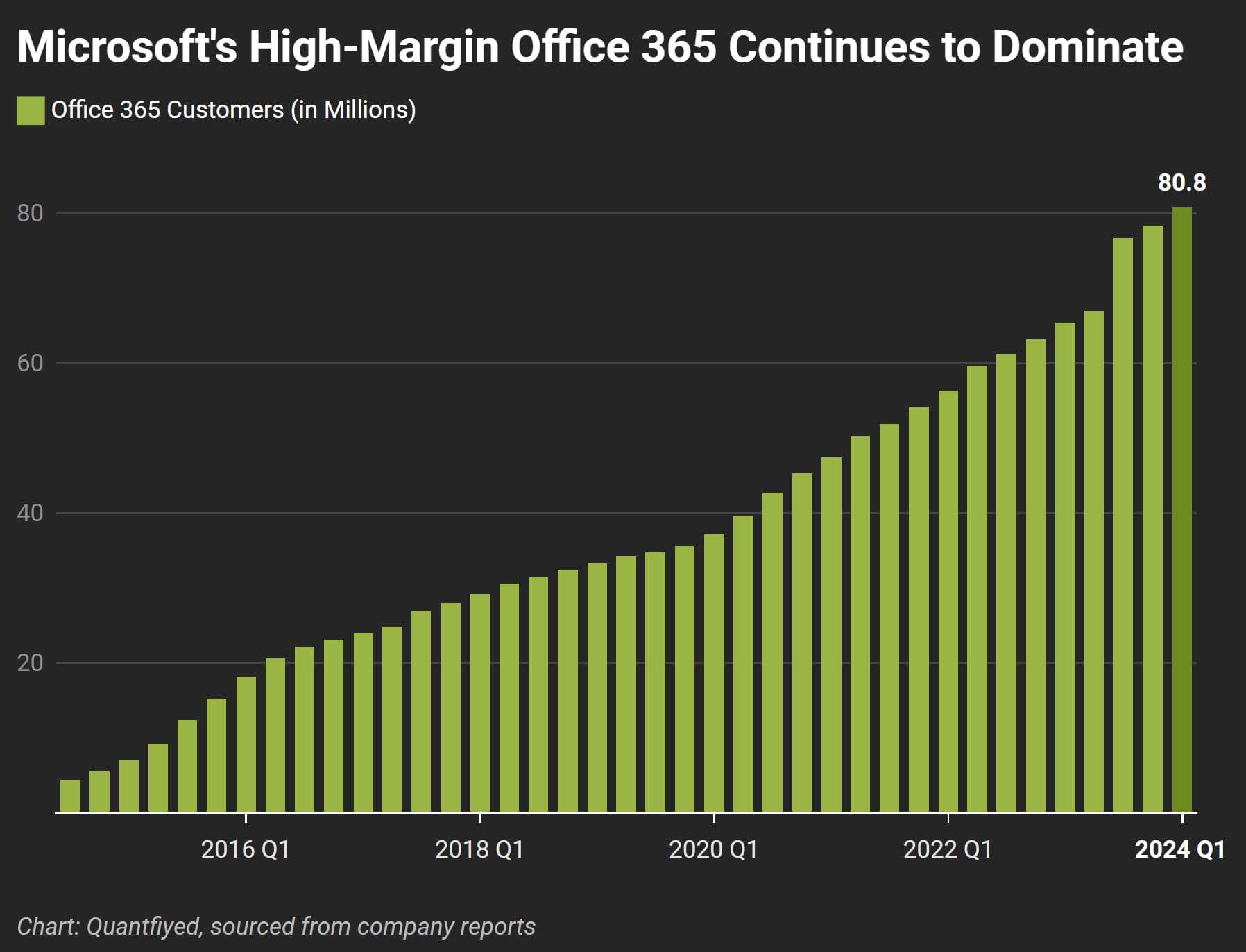

Another interesting metric of Microsoft is their Office 365 product, that continues to benefit their margins and profits. The Office 365 subscriber base has had an average annual growth of 33.78% over the past ten years. It's a pretty remarkable figure that will support the network effect Microsoft has over it's other SAAS competitors.

Broader Market Trends

Shift to Small Caps: Last week was a game changer for markets. We saw a huge swing away from big tech to small caps, driven by expectations of lower interest rates in September.

CAPEX Spending on AI: Investors could get concerned about the tangible returns on massive capital expenditures (CAPEX) in artificial intelligence (AI). While the spending to build infrastructure around AI is useful, the immediate return on these investments could be uncertain.

How do you think investors will react to these company reports this week?