Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Markets are all over the place today: oil is dropping, China’s recovery isn’t convincing anyone, and global stocks are on a rollercoaster. If you’re confused, you’re not alone. Here’s what you need to know about China’s economy, falling oil prices, and rising U.S. election volatility.

China’s Economic Slowdown and Market Impact

China insists it will hit its 5% GDP growth target, but investors aren’t buying it. On October 8, the Hang Seng Index plunged 10% as markets reacted to the lack of robust fiscal stimulus. Here's what that looks like, visualized:

Mainland China’s CSI300 Index also rose 6%, as it played catch-up after the holiday, showing a strange contrast in sentiment. On one hand, we have investors selling; on the other, we have investors buying.

The difference in reactions between Hong Kong and mainland China could hint at a growing concern over China’s economy. Making matters worse, trade tensions with the EU are rising after they opened tariffs on Chinese EV imports.

Oil Prices: A Temporary Relief?

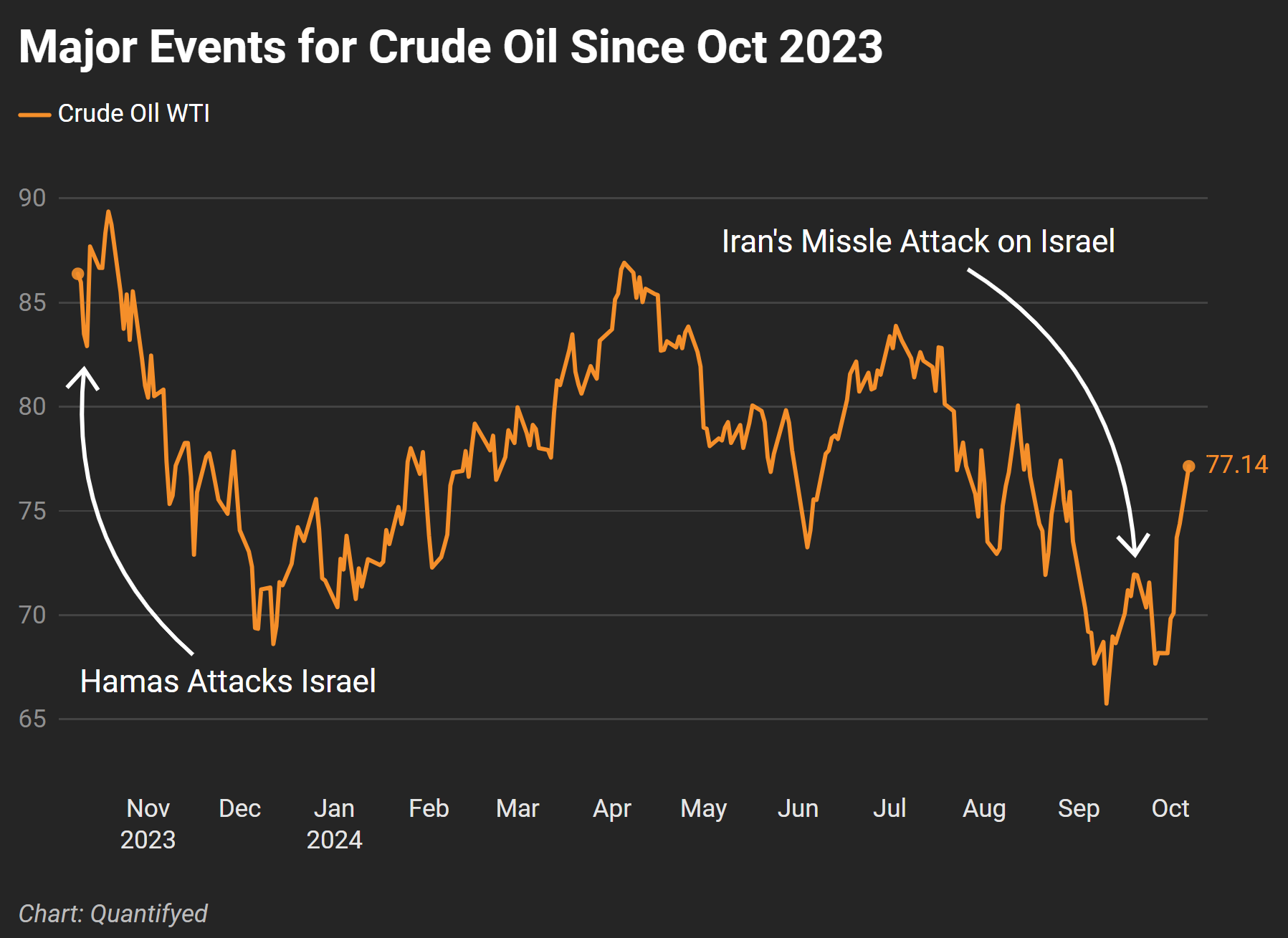

Oil prices have also been on a wild ride lately, bouncing up and down in response to global events. Recently, U.S. crude oil prices fell back to $75 per barrel, marking a 9% drop for the year. Earlier, we saw oil prices spike due to rising tensions in the Middle East. The surge came after Iran’s missile strike on Israel. Suprisingly, prices have started to retreat again.

Even natural disasters like Hurricane Milton, which reached Category 5 and shut down some oil platforms in the Gulf of Mexico, didn’t push prices back up as much as anticipated. Instead, the real weight dragging oil prices lower has been weaker-than-expected demand from China. As one of the world’s biggest oil consumers, China’s slow recovery is having a bigger impact on oil prices than possible supply disruptions from either hurricanes or the middle east war.

U.S. Election Uncertainty and Market Volatility

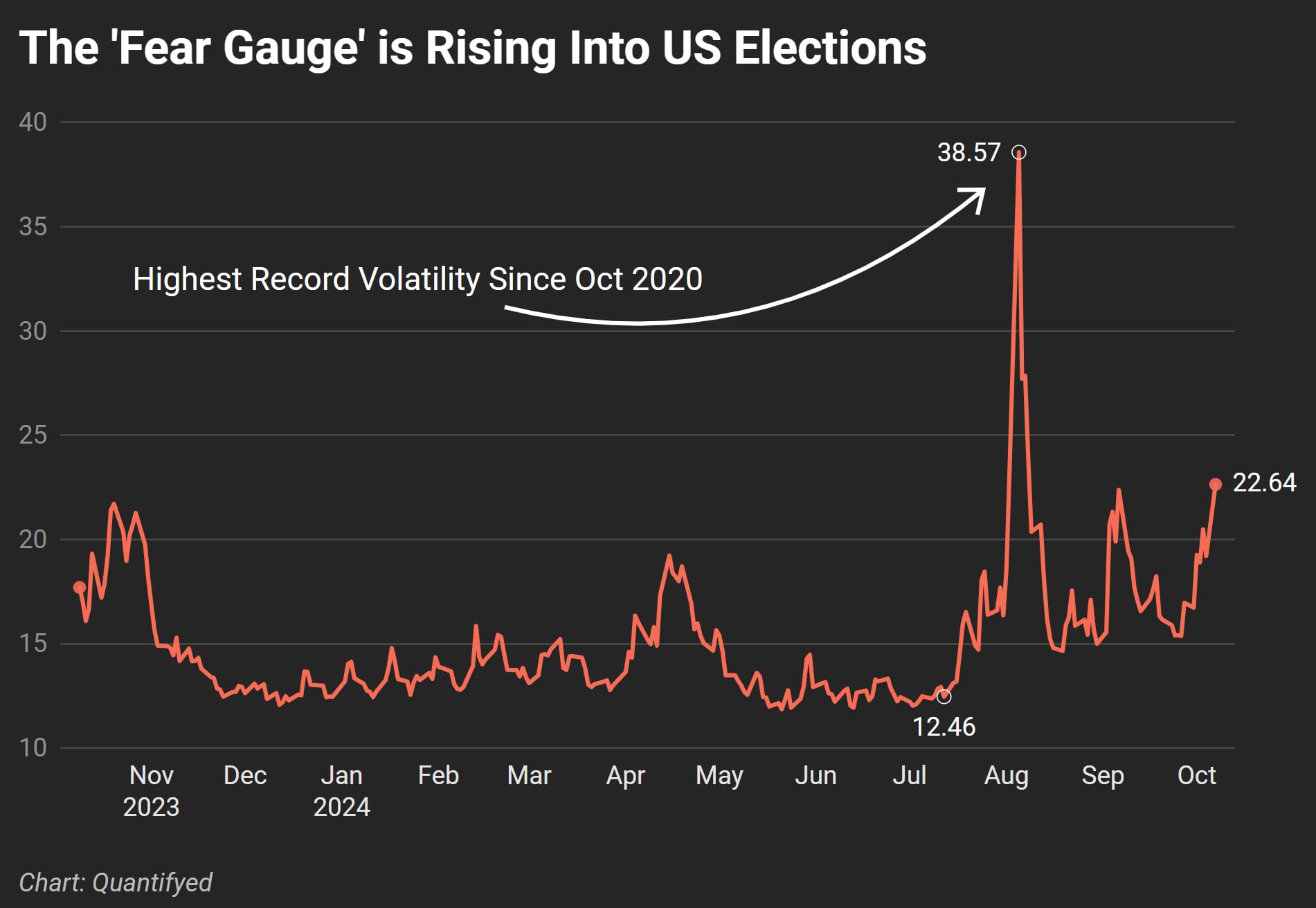

As we get closer to the U.S. election, market volatility is ramping up. With just under a month to go, traders are nervous about how the outcome could affect the economy. The VIX index, often referred to as the “fear gauge,” recently spiked to 22.64 — for reference, a calm market hovers around a level of 15.

Some of this anxiety could come from the uncertainty around the fiscal policies depending on who wins the election—whether it’s Donald Trump or Kamala Harris.

A Few Takeaways

- The Hang Seng’s 10% drop reflects deeper concerns about China’s economic recovery. The CSI300's 6% rise hints at cautious optimism, but it’s clear investors need more fiscal support to feel confident.

- Oil prices, after surging due to Middle East tensions, are down again as China’s weak demand becomes the dominant factor.

- U.S. election volatility is climbing. With the VIX index spiking, markets are preparing for a wild month as election day approaches.