Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

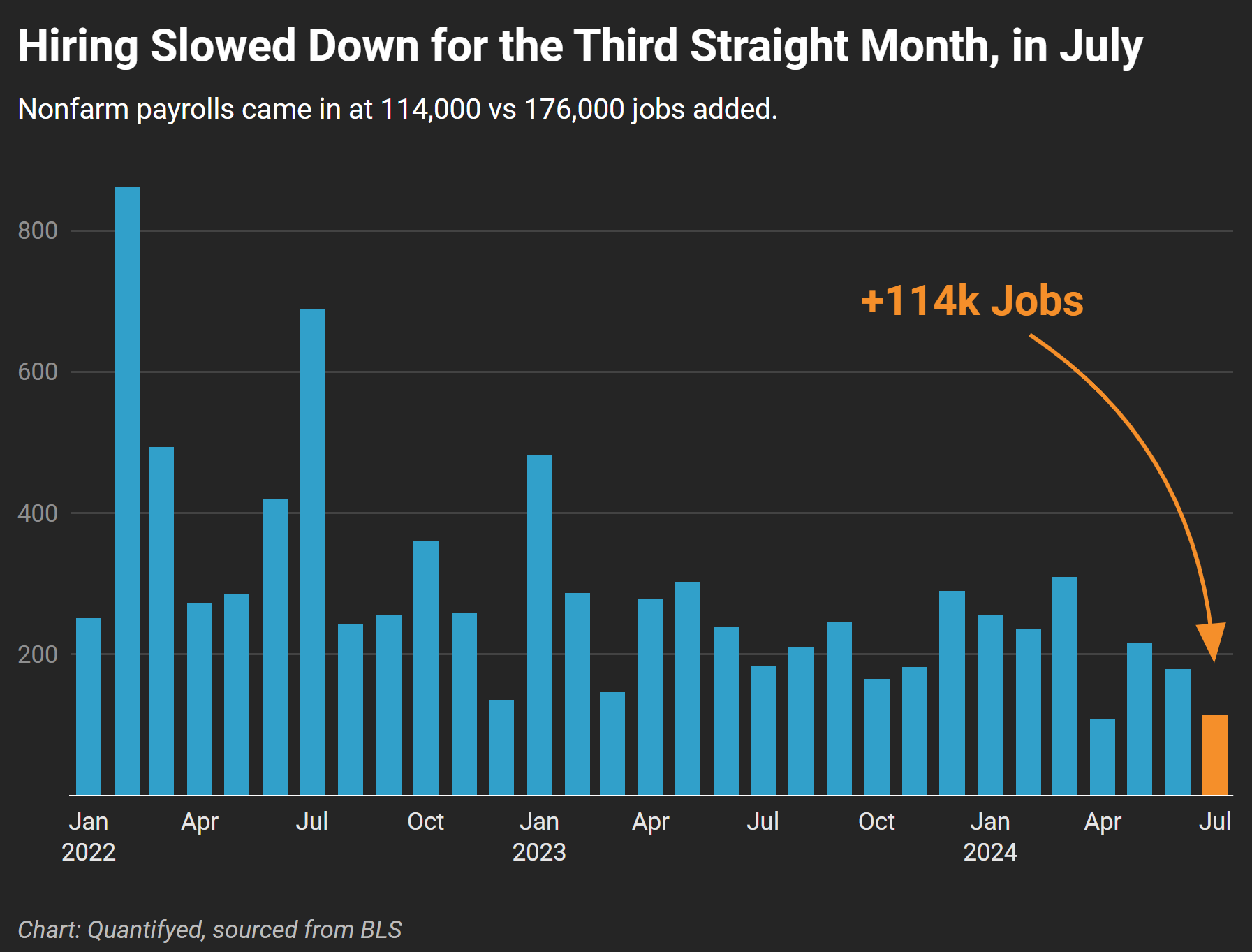

The stock market’s got jitters. Fears of slowing growth are pushing investors to bail on big tech and other high-ticket stocks. It’s been a wild week, and last Friday didn’t help—stocks and bond yields took a nosedive after a weaker-than-expected July payrolls report showed job growth slowed at 114,000 vs the original 176,000 expected.

Oil prices also slid as traders bet on slowing demand, despite rising geopolitical tensions.

Let’s rewind a bit. The trouble really started last Thursday when weak manufacturing and construction data spooked the market. This came right after the Fed decided to hold short-term rates steady at its July policy meeting.

Now, there’s a growing concern that the Fed might have waited too long to start cutting rates, and the economy could end up paying for it. By Friday, traders were already betting heavily on a half-point rate cut in September.

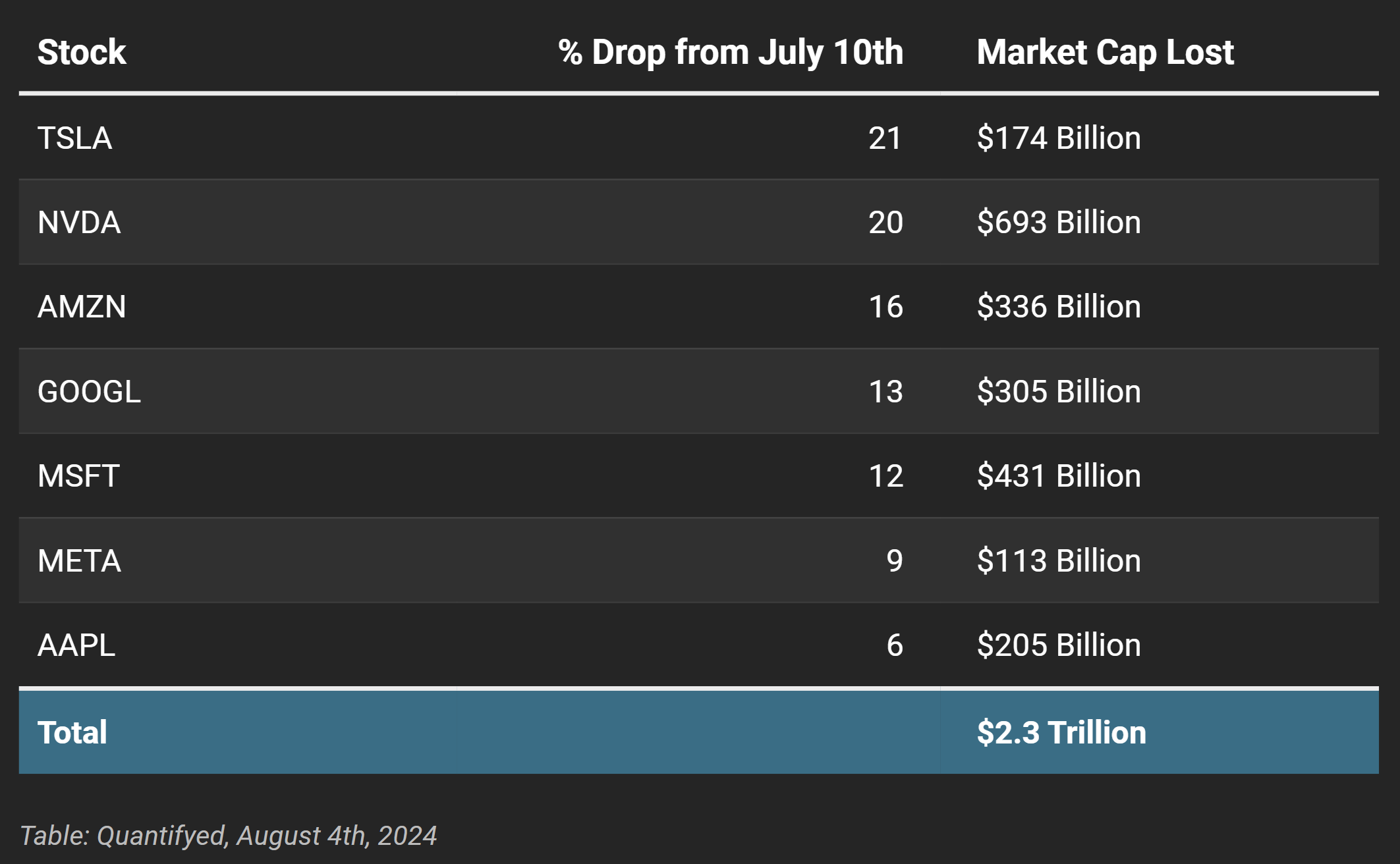

But the real pain? That’s been in big tech. The Mag Seven (Apple, Microsoft, Amazon, Google, Meta, Nvidia, Tesla)—the giants driving this year’s stock gains—have lost over $2.3 trillion in market value from their high in July. Ouch.

Microsoft and Alphabet were among the biggest losers, thanks to earnings reports that fell short of sky-high expectations. Investors were hoping for big things, especially with their AI investments, but both stocks sold off after the results.

Amazon didn’t escape the carnage either. They lowered their forward guidance, pointing to slowing revenue growth in their retail business. Consumers aren’t spending like investors hoped, and that sent Amazon’s stock down 9% for the week.

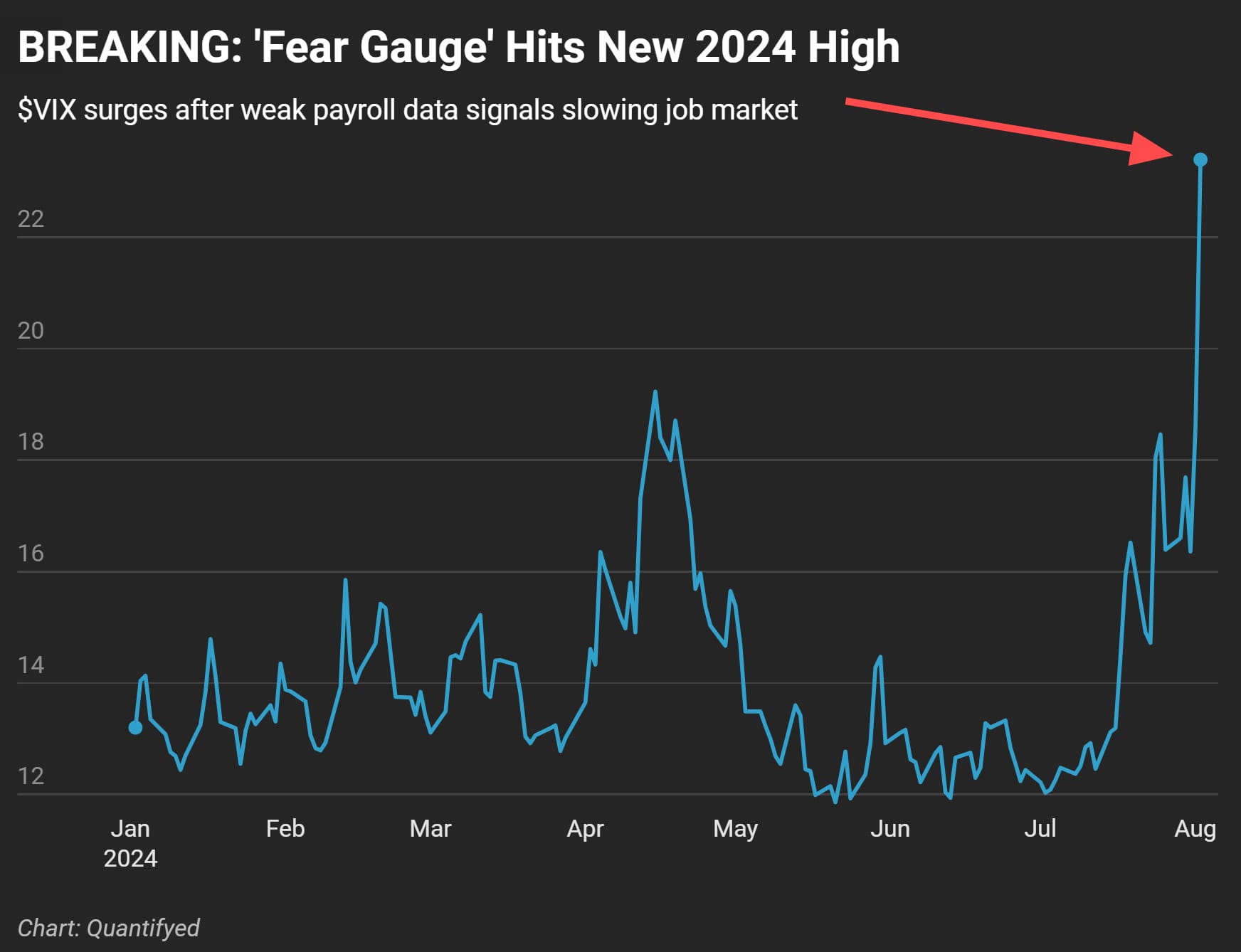

To top it off, our volatility index (I call it the fear gauge) hit its highest level of 2024 on Friday.

It's was a wild week for the stock market! So.. what’s the takeaway?

With the Fed likely to cut rates soon, we might be looking at a shift in market dynamics. Big tech’s taking a beating, but this could be a good time to look at sectors that have been down over the past year—like utilities, real estate, or even beaten-down consumer stocks. These areas could benefit from lower rates, making them a potential bright spot in a shaky market