Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

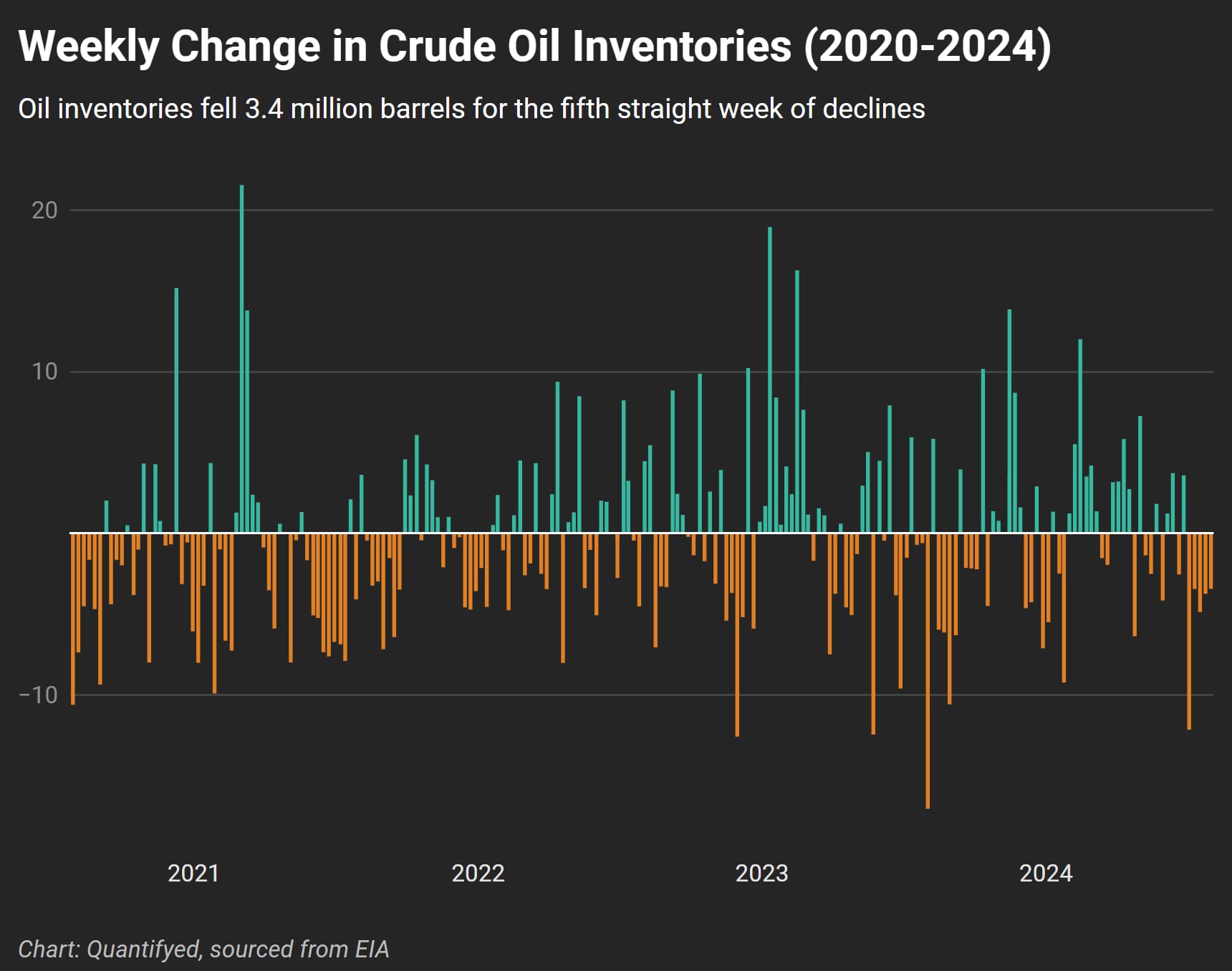

Seems like oil is the new gold rush these days. The U.S. Energy Information Administration just reported that crude oil inventories fell for the fifth week in a row! That’s more consistent than my work routine.

Oil reserves dropped by over 3.4 million barrels, bringing the total down to 433 million last week, which is about 4% below our 5-year average for this time of year. And it’s not just oil—gasoline inventories are also 3% below their 5-year average. Looks like energy commodities are feeling the squeeze across the board.

What’s even more surprising? Refineries are running at 90% max production right now, and we’re still falling short of averages. So, what’s changed? Why is it different this time around?

One major culprit is geopolitical tension. Just yesterday morning, Hamas political leader Ismail Haniyeh was killed in Iran. Almost immediately after, crude oil futures jumped about 4%. We’re seeing this fear drive up energy prices, with Brent Crude contracts costing about 3% more than just a few days ago.

What’s crazier is that after the assassination, Iran’s leader Ayatollah Ali Khamenei stated it’s Iran’s duty to punish Israel for this action, from a report by the state-run Islamic news agency.

It seems like oil traders are still mispricing the risks in the Middle East. Before the Israel-Hamas war, there was Russia's war in Ukraine. Many traders expected a disruption of barrels, but it never materialized.

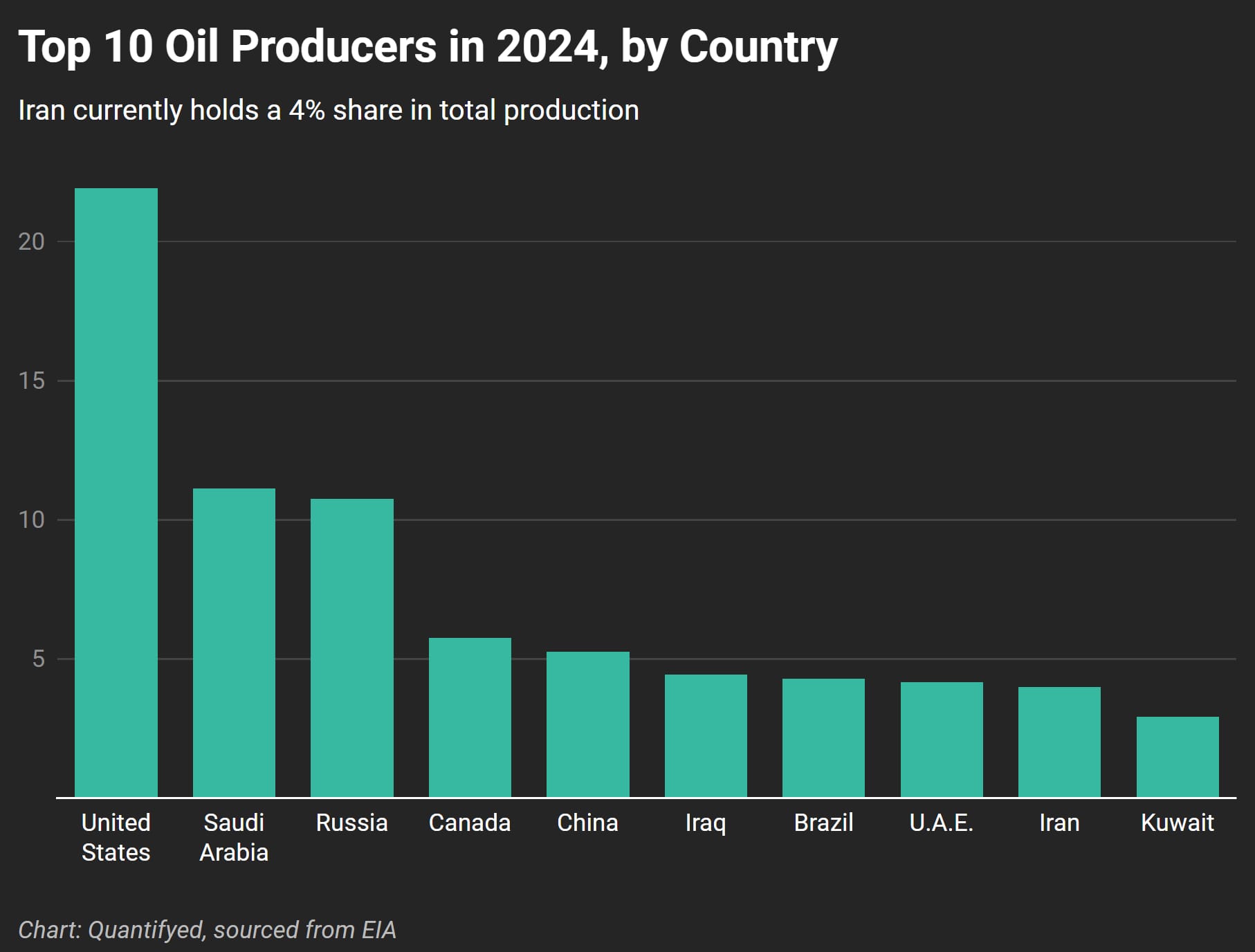

This time, though, it could be different. Since Iran is the ninth-largest producer of oil in the world, any damaged infrastructure could have an effect on oil and gas markets.

I’d keep an eye on energy prices since the risk premium in oil only tends to last if there’s a real supply constraint. our recent reaction of oil prices has been modest, but so far, there hasn’t been any major disruption to supply.

These events are also happening in the same week that earnings reports from major oil companies like Shell and BP are being released. Will the markets start pricing in the real risks, or are we in for another surprise?