Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Wholesale prices decided to take a breather in September, thanks to a much-needed drop in gas prices. If only our grocery bills could flatline the way wholesale prices did last month, right?

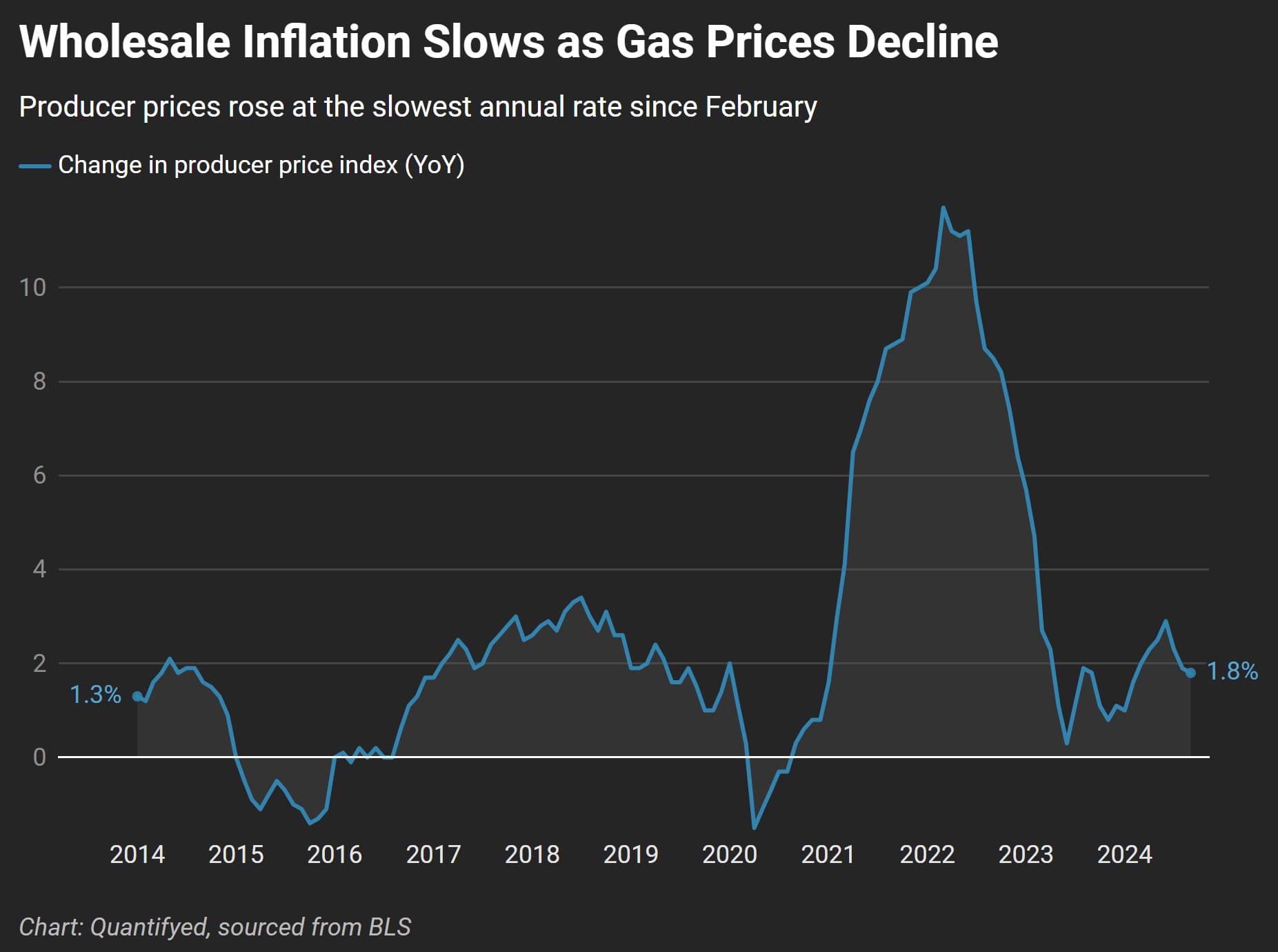

According to the Bureau of Labor Statistics, the producer price index (PPI) for final demand showed no change from August, holding at 0%. This is a notable pause following the 0.2% increase we saw in August, with the annual PPI increase landing at 1.8%—the slowest rate of inflation since February. If you’re wondering what kept inflation in check, it was mostly falling energy prices, particularly gasoline. Let’s dive into the details.

Gas Prices as the Inflation Coolant

The biggest factor behind the flat PPI was the sharp decline in energy prices, particularly gasoline. Gasoline prices fell by a significant 5.6%, and overall energy costs dropped by 2.7%. Diesel fuel, in particular, plunged by a whopping 17.6%, playing a major role in holding down inflationary pressures in the broader economy.

Here’s a snapshot of the change in producer prices over the past decade to give you some perspective:

As the chart illustrates, inflation has eased significantly from its pandemic-era peak. While the steady drop in energy prices is helping, other sectors—like services and healthcare—are still putting pressure on overall inflation.

Core Inflation Still Lingers

While the headline PPI stayed flat, core inflation is still a headache. The PPI that strips out volatile categories like food and energy actually rose 0.2% in September, bringing the year-over-year core inflation rate to 2.8%. This indicates that while energy prices are offering relief, the rest of the economy isn’t playing along quite as nicely. Service sector costs, in particular, are sticking around like a bad cold.

That means inflation still isn’t fully under control, and the Federal Reserve will have to keep an eye on these mixed signals. They may hold off on aggressive rate cuts, considering the underlying inflation pressures in non-energy sectors.

A Few Key Takeaways

- Energy costs, especially gasoline, helped keep wholesale prices flat in September.

- Core inflation still rose, signaling ongoing price pressures in non-energy sectors.

- Fed officials will take these mixed signals into account as they consider future rate cuts.