Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Major investment firm Blackstone is becoming a king-pin in the real estate industry. In a recent interview from WSJ, the firm indicated the real estate market may be hitting bottom— a unique opportunity for investors.

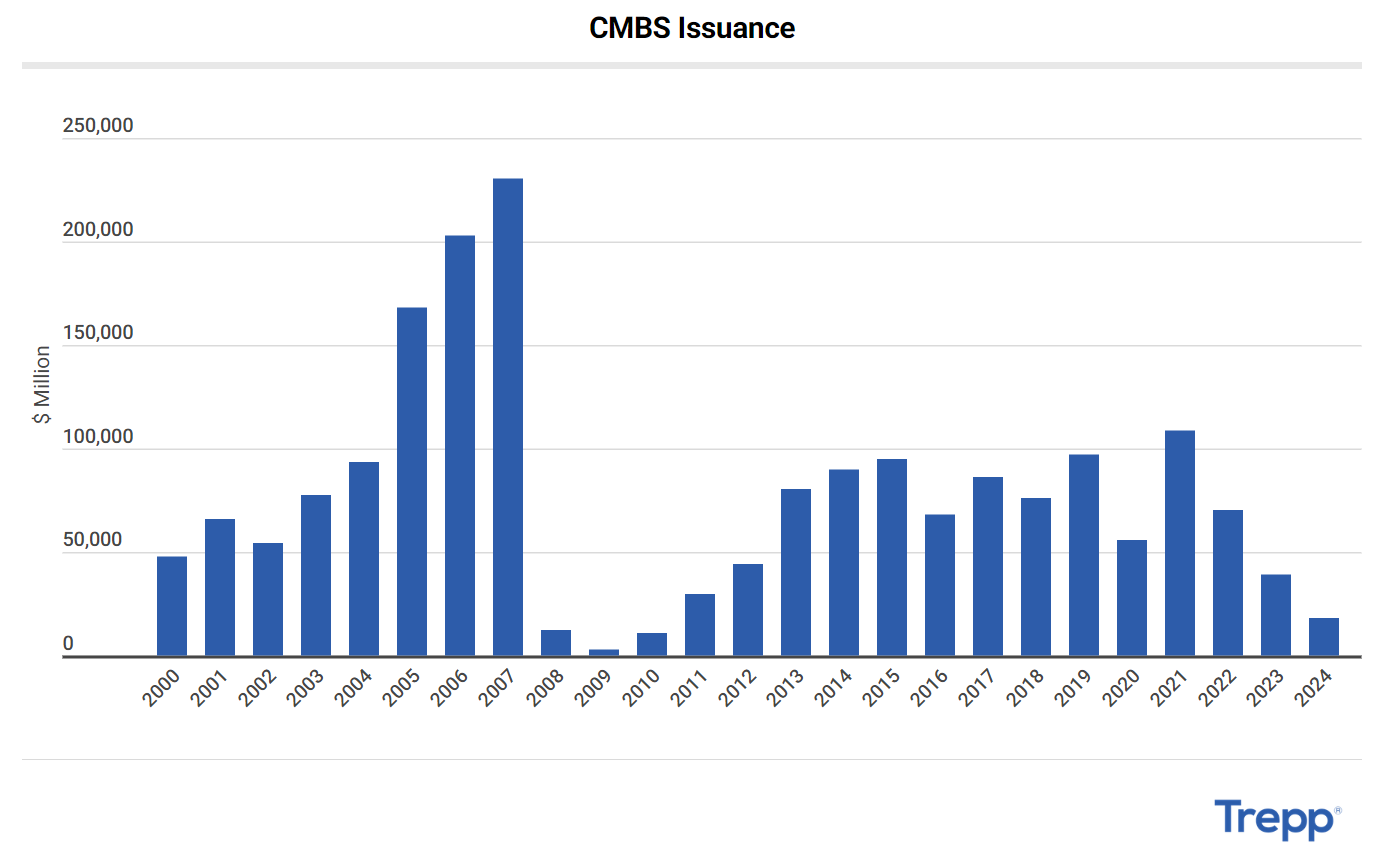

Surge in Commercial Mortgage-Backed Securities

Commercial mortgage-backed securities (aka 'CMBS') are investments that let investors to purchase shares in commercial property, just like a REIT.

In the 1st quarter of 2024, there has been a notable increase in the issuance of CMBS. This surge tells us investor confidence is growing and that commercial real estate is stabilizing.

Increased CMBS issuance means that lenders and investors are more willing to finance commercial properties → which supports prices.

Slower Construction Activity

Construction on many properties has slowed, which is a crucial factor in easing the pressure on rents. With fewer new buildings entering the market, the existing supply becomes more valuable, helping us stabilize and potentially increase rental rates.

This slowdown in construction is particularly helpful in markets, like commercial real estate, that were experiencing oversupply.

US Building Permits, an indicator of new housing construction, haven't grown since the start of 2023, in part because of increased mortgage rates slowing new home sales.

Secret Acquisitions by Blackstone

Despite today's negative sentiment, Blackstone has been the most active buyer in the real estate this year 🤫

Through its Blackstone Real Estate Income Trust (BREIT), aimed for individual investors, the firm snapped up $10 billion in assets from Apartments Income REIT, which owns 76 rental housing communities.

Also, Blackstone acquired Tricon Residential for $3.5 billion, which focuses on single-family rental homes. These acquisitions demonstrate Blackstone's confidence in the long-term value of the real estate market.

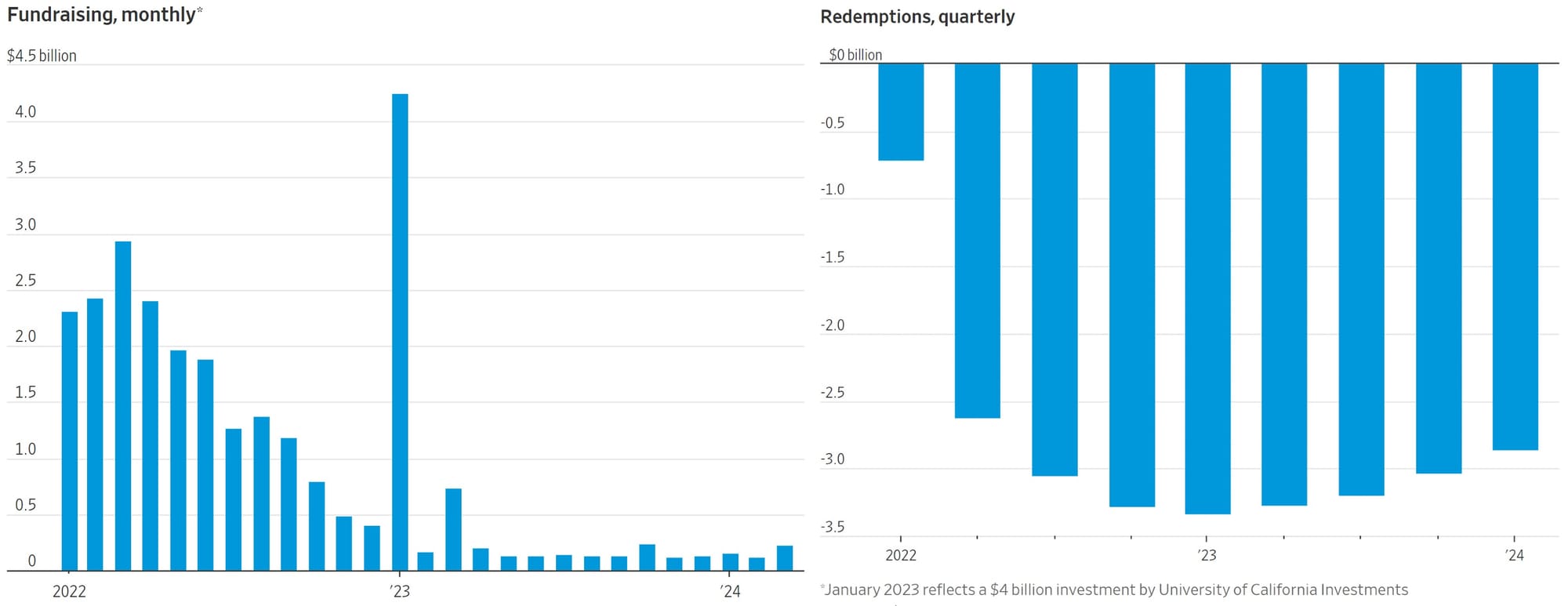

Shifting Investor Sentiment

During 2022 and 2023, the real estate market was hit hard as mortgage rates spiked. Many real estate funds, including those managed by Blackstone, had to limit redemptions (aka 'withdrawals') to prevent forced sales of real estate at discounted prices.

But there's good news: this trend is starting to reverse. Fundraising for BREIT has been reaching higher highs, and redemptions are decreasing, showing a shift in investor sentiment.

Less money is flowing out of real estate investment trusts (REITs), suggesting investors are becoming more optimistic.

Blackstone's perspective on the real estate market is useful to know. The combination of increased CMBS issuance, slowing construction, growing acquisitions, and improving investor sentiment all point to a potential market bottom.