Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

The used-car market offers a huge opportunity with its fast growth and stability. As buying and selling cars are transitioning online, this sector is becoming more attractive.

The car industry has always been cyclical, since owning a car can be the biggest purchase a consumer can make aside from a home; which, frankly, isn't happening that often nowadays! Just like choosing to keep an old iPhone instead of buying a new one, consumers are purchasing more used-cars. They simply can't afford to get the hottest and fanciest cars

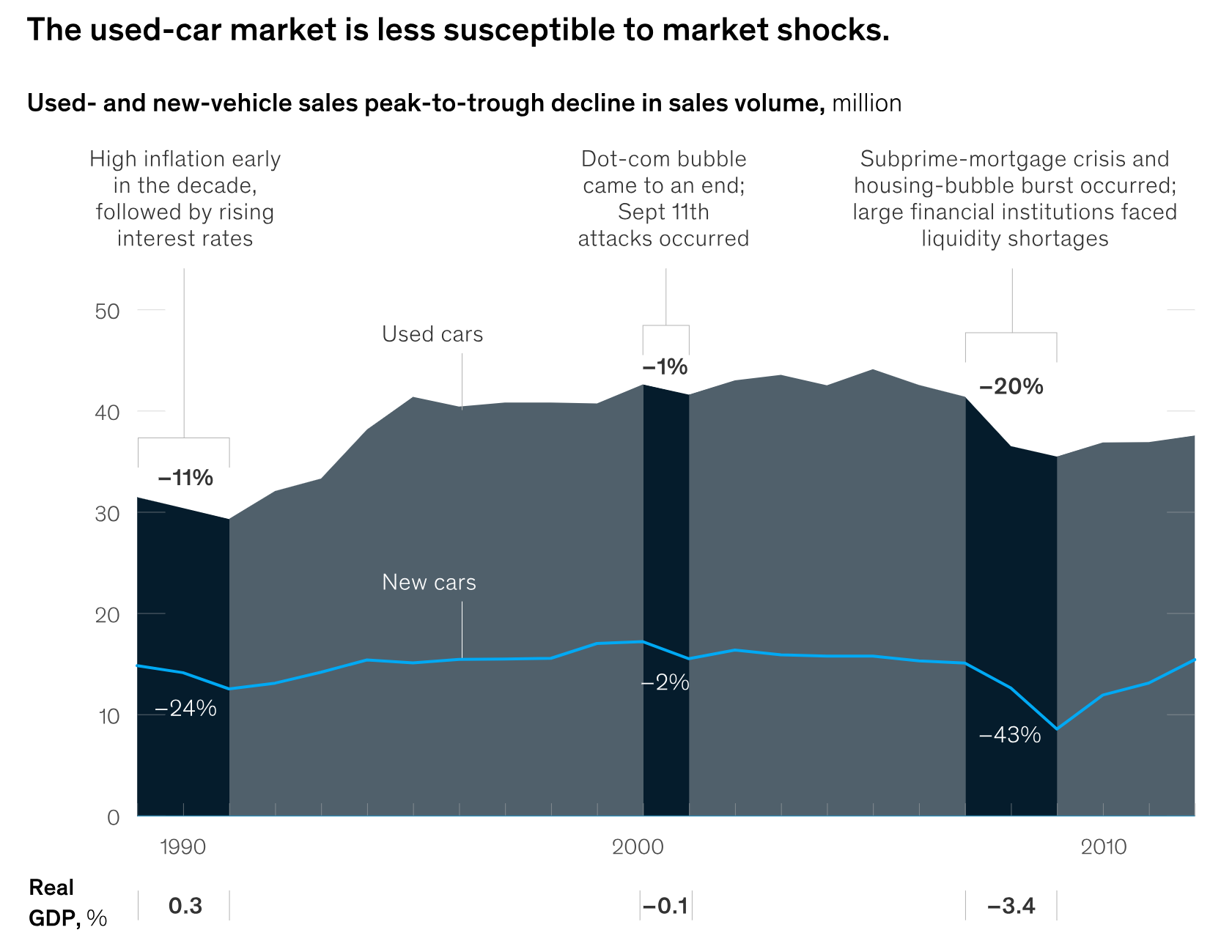

To understand this effect, McKinsey ran a report in 2019 learning about the sales volume between the new and used-car segment. They found three things:

Shown below is McKinsey's illustration of how car sales volumes were impacted during each recession, comparing new and used cars 👇

The takeaway is clear: Used cars offer a countercyclical safe space from the dramatic sales highs and lows seen among new vehicles, with peak-to-trough declines averaging about 11 percent over the past two decades, compared with 23 percent for new cars.

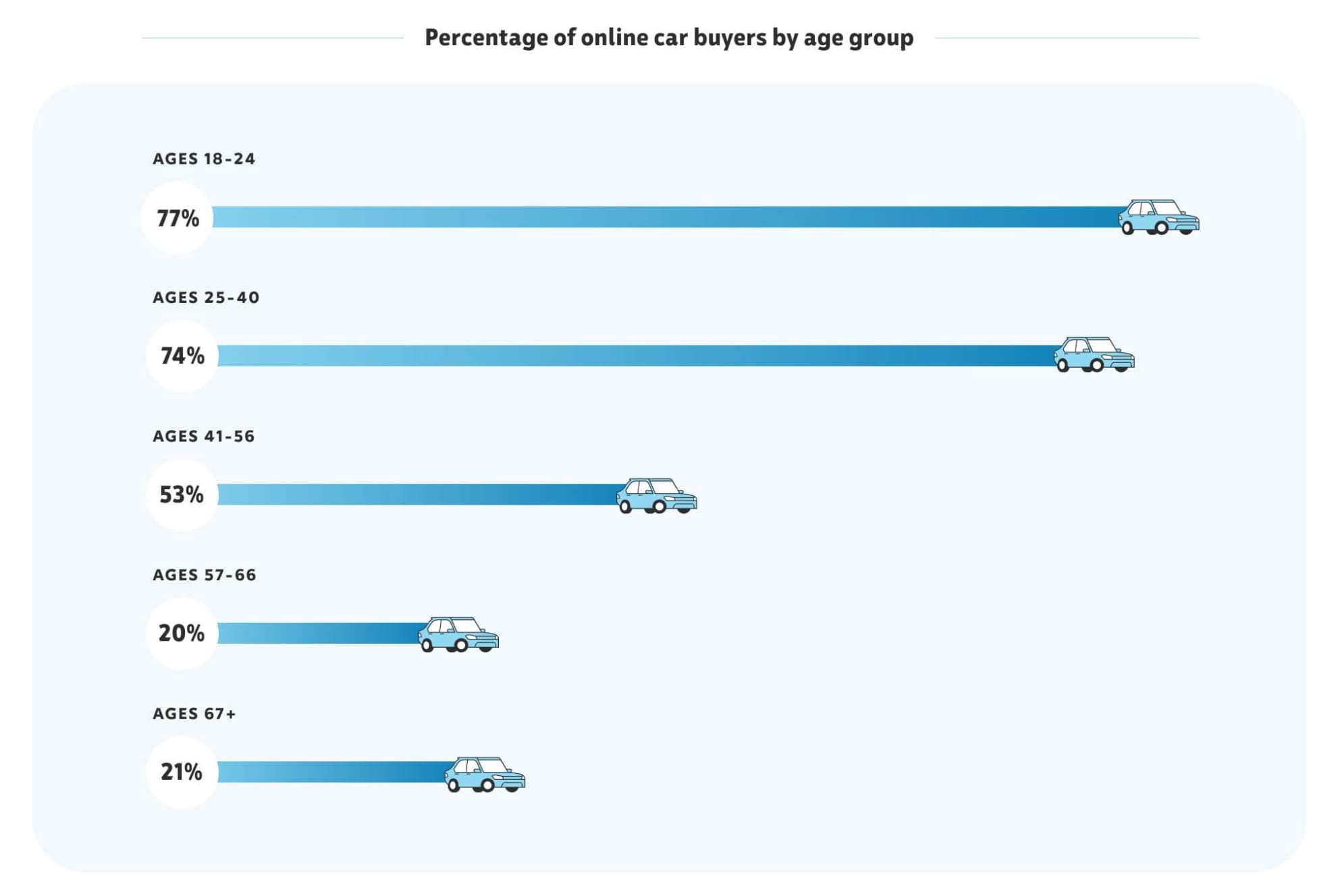

"But Zach, what about online car sales?" Well, that's where things get really interesting. The used-car market is not just growing; it's evolving. More frequently, consumers are buying cars online, offering extreme convenience.

Online car-selling platforms (like Carvana or CarMax) are giants in the used-car market. They're offering a seamless buying experience, from browsing inventory, getting quick financing, and arranging delivery—all from your couch.

Consumers today are more tech-savvy and frugal than ever before. They're looking for reliable, affordable vehicles and are willing to forego the latest models for better value. This shift in consumer behavior is a tailwind for the used-car market, as more people buy pre-owned vehicles.

The used-car market's resilience during economic downturns, combined with the growth driven by digital platforms, makes it an attractive option for both consumers and investors.

For investors, the stability and growth of the used-car market is compelling. Investing in companies with less volatility and higher growth rates could be a smart move. Just like shopping on Amazon, only time will tell if consumers transition to online car shopping.