Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

Nasdaq 100 jumped 1.4% this morning, capping the strongest week since November 2024.

Markets are rallying, and the Fed President Chris Waller had this to say during a talk yesterday, per Bloomberg:

“The inflation data we got yesterday was very good”

Equities are surging, bond yields are cooling, and crypto is recovering.

Is this rally sustainable? Let’s break it down

Small Caps Steal the Show

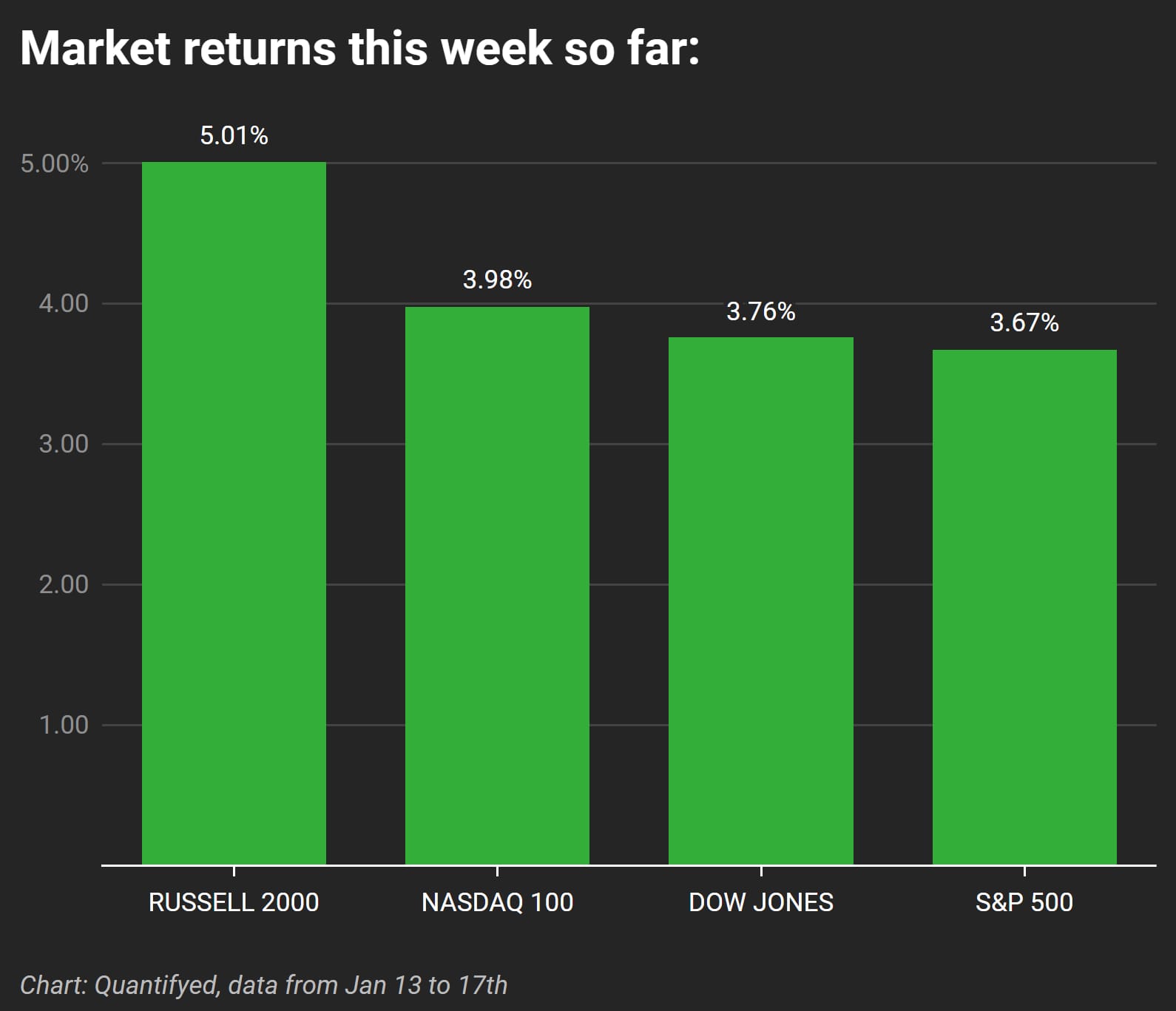

US stocks rallied across the board this week:

- Russell 2000: +5.01%

- Nasdaq 100: +3.98%

- S&P 500/Dow Jones: Both climbed around 3.7%

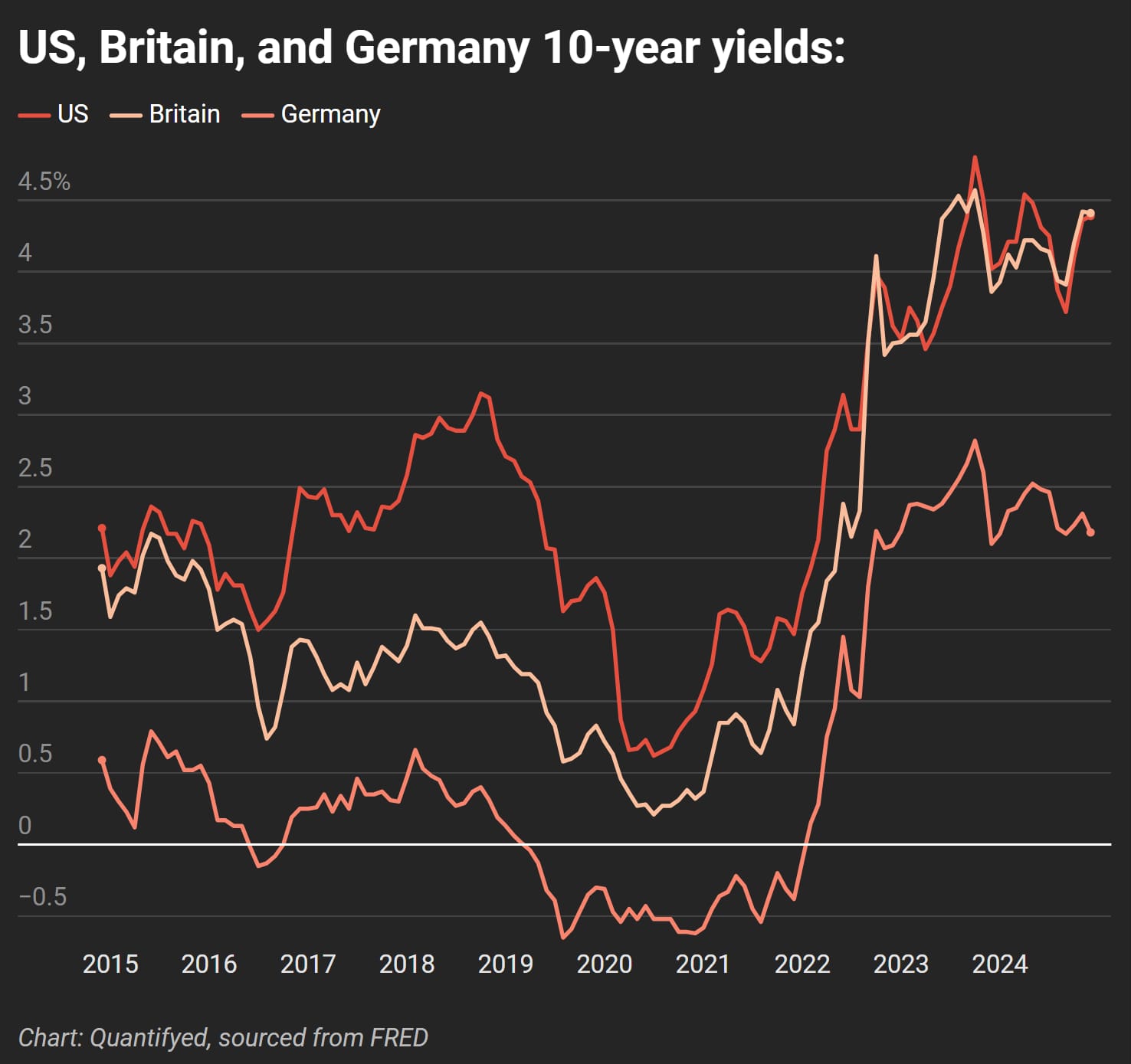

Bonds Finally Fall

Bond markets welcomed the Fed’s softer tone:

- US: Fell to 4.57%

- UK: Down to 4.62%

- Germany: Dropped to 2.51%

Dollar Won’t Budge

The US dollar still holding its ground as a leader:

- US Dollar Index: Rose slightly (+0.1%)

- British Pound: Fell 0.4% to $1.21

- Japanese Yen: Down 0.3%

Crypto Makes a Comeback

Bitcoin and Ethereum also jumped as confidence in risk assets returned:

- Bitcoin: +3.9%, breaking above $104K for the first time since December

- Ethereum: +3.3%, trading at $3,416

Commodities Stay Quiet

Commodities saw slower moves this week:

- WTI Crude Oil: Fell 0.2% to $78.54 per barrel

- Gold: Down 0.2% to $2,708 per ounce