Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

I used to think I could outsmart the market by buying at rock-bottom and selling at the peak.

I’d try to pinpoint those perfect days when stocks were at their lowest, and then cash out before the next downturn. But over time I learned that chasing those 'magic' days isn’t just stressful—it can seriously cost you in the long run.

The Timing Trap

Market timing sounds simple: buy low, sell high. It’s an easy idea, promising huge gains if you can predict when the market will bottom out or take off. I once believed that if I could catch those low points, I’d beat the market every time. The truth is, though, that even missing just a handful of days in the market can wreck your returns.

Data Doesn’t Lie

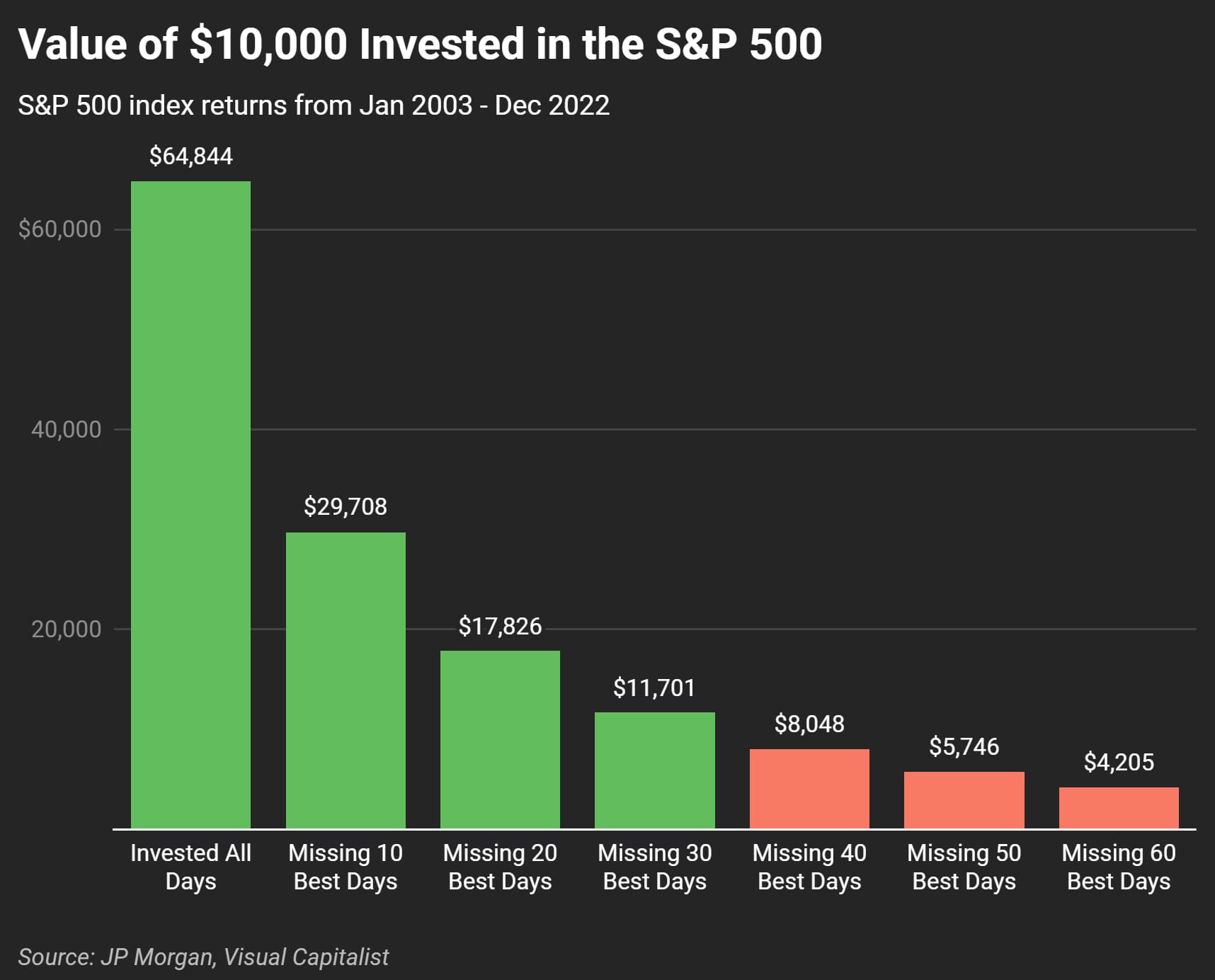

Research tells a brutal story. If you miss just the 10 best trading days over a 20-year period, your average annual return drops from roughly 9.8% to around 5.6%—that’s a loss of nearly 50%.

Imagine investing $10,000; with full market participation, historical returns say it might grow to over $65,000 in 20 years, but if you miss those critical days, you could end up with far less.

It’s not just about numbers, though. Our behavior makes it difficult to stay invested.

When you see a drop, fear kicks in and you sell, only to miss the rebound that often follows the worst days. That emotional roller coaster can add up over time.

The Power of Staying Invested

Here’s the silver lining: even if you’re in the market on a few bad days, the long-term trend of the market is upward. The S&P 500 has averaged about a 10% return per year over the long haul. The power of compounding works best when you let your money sit and grow.

Think of it this way: missing those few best days isn’t just a small hiccup—it can cut your returns drastically.

And while no one can reliably predict when those days will hit, the steady, disciplined approach of buying and holding lets you capture almost all of the market’s growth without the stress of trying to outsmart it.

"Time in the market” beats “timing the market” by a mile. Consistency is key.