Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

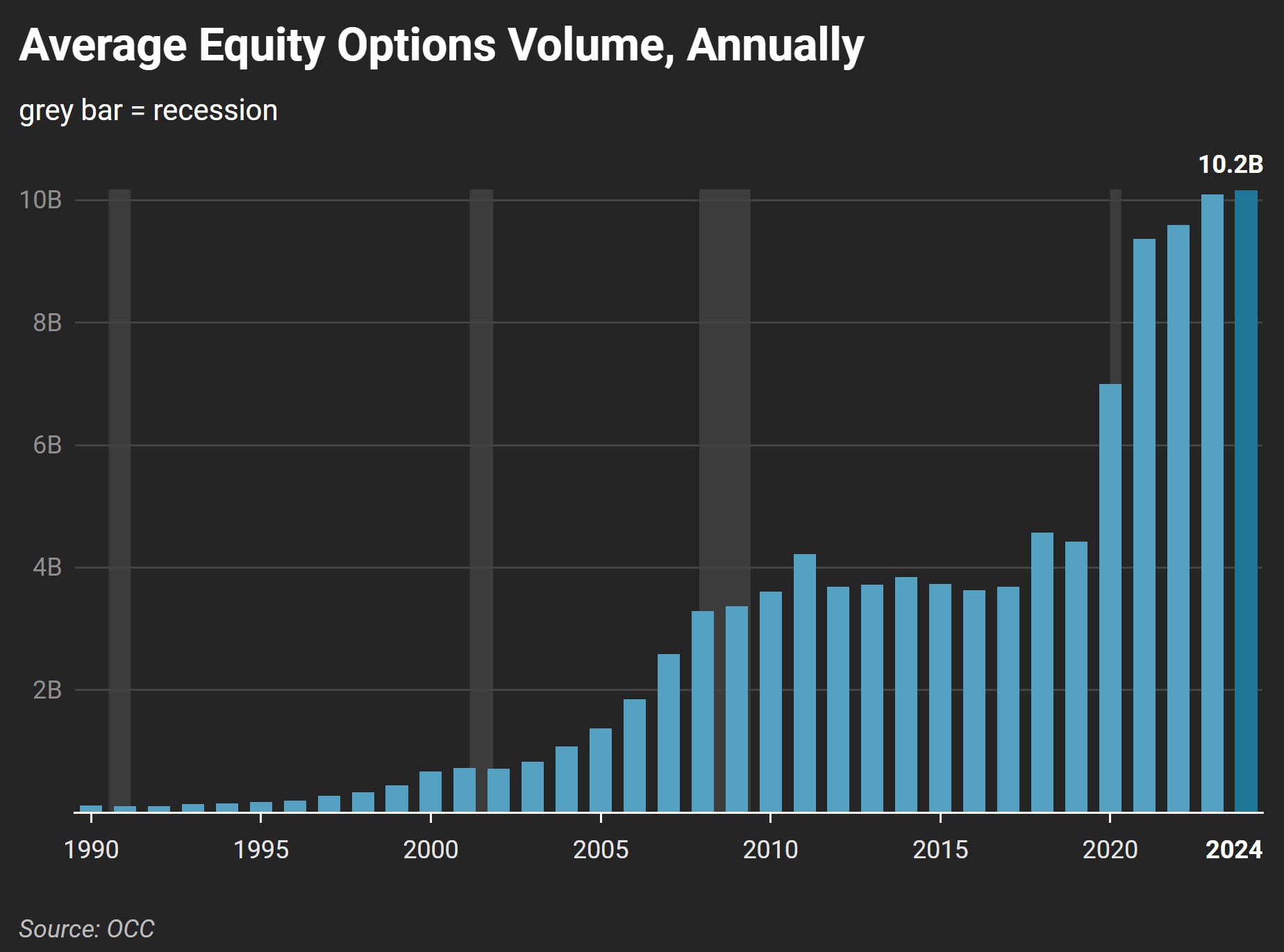

Zero-day-to-expire options (0DTE) are taking over the market. These contracts, which expire the same day they’re traded, now make up 50% of all S&P 500 options activity — a huge jump from just 17% in 2020, per WSJ.

These options could cause extreme volatility for markets.

Zero-day options are taking over:

- 10.2 billion contracts were traded in 2024 .. a new record

- Retail traders make up 29% of all options activity, wayy more than just a few years ago

These short-term bets are exciting but dangerous. The more traders pile in, the easier it is for small price moves to cause chaos:

Why Zero-Day Options Are Risky

Here’s the issue with 0DTE options: they thrive on short-term market moves. That makes them super volatile. When traders pile into the same bets, it can push prices up or down fast, creating huge market swings.

The bigger problem? A sudden shift in market sentiment—like bad news or a market drop—could cause a chain reaction. That means a big sell-off might hit faster and harder than usual.

Could Zero-Day Options Spark a Crash?

History shows us what happens when speculative trading gets out of hand. Think back to the 1987 flash crash or the 2008 financial crisis. Today's surge in risky options trading might create a similar bubble.

The 25% rally in the S&P 500 this year could be a warning sign. If markets take a sudden downturn, zero-day options could be the domino that tips things over.

Key Takeaways:

- Zero-day options now account for 50% of all S&P 500 options trading, showing how big this trend has become.

- Retail traders are driving record options volumes, making markets more unpredictable.